- Major western pre-market equity index futures were stronger.

- The dollar index was on a back foot while United States 10-year treasury yields were firmer, suggesting risk-on.

Base metals

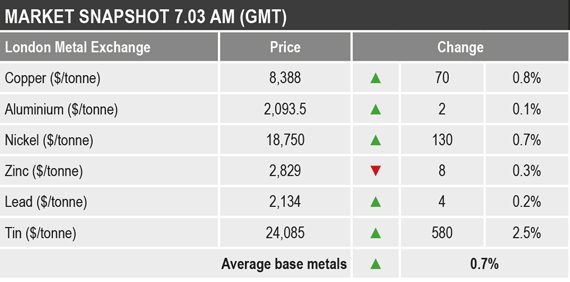

The three-month zinc price was down by 0.3% at $2,829 per tonne, while the rest of the base metals prices were up by an average of 0.9%, led by a 2.5% rise in tin ($24,085 per tonne), while copper was up by 0.8% at $8,388 per tonne.

Precious metals

Precious metals were mixed, with spot gold down by 0.3% at $1,819.46 per oz, while the rest were up, led by a 2.7% rise in platinum ($1,286.30 per oz). followed by silver ($27.50 per oz) and palladium ($2.394.50 per oz) up by 0.6% and 0.3% respectively.

Wider markets

The yield on United States 10-year treasuries was firmer this morning and was recently quoted at 1.21%, up from 1.16% at a similar time on Friday.

Those Asian-Pacific equities that were open, and that we follow, were firmer: the ASX 200 (+0.91%), the Nikkei (+1.91%) and the Kospi (+1.5%).

Currencies

The dollar index remains on the back foot and was recently quoted at 90.28, down from its recent high of 91.60 on February 5.

The other major currencies were mixed this morning: the euro (1.2143) and the Australian dollar (0.7786) were firmer, sterling (1.3907) was strong and at levels not seen since April 2018, but the yen (105.15) was weaker.

Key data

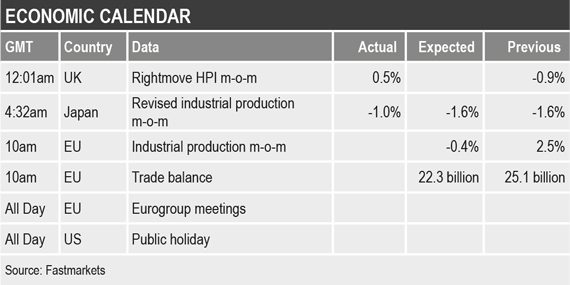

Data already out on Monday showed United Kingdom house prices were up by 0.5% in February, and Japan’s industrial production fell 1% in December, after a 1.6% decline in November.

Out later, there is EU data on industrial production and the trade balance. In addition there is a Eurogroup meeting.

Today’s key themes and views

The metals continue to look strong especially since they are pushing higher without the help of China. Lead, tin, nickel and copper all set fresh multi-month/year highs.

Expectations for stronger demand on the back of economic recovery and infrastructure spending are driving prices and the potential headwind brought about by the shortage of semiconductors, has not proved too strong yet.

Gold prices remain within their sideways-to-down channel; silver and palladium prices are working higher; and platinum prices continue to surge and are the highest they have been since October 2014.