- Asian-Pacific equities were generally stronger this morning

- The US Dollar Index was strong too

Base metals

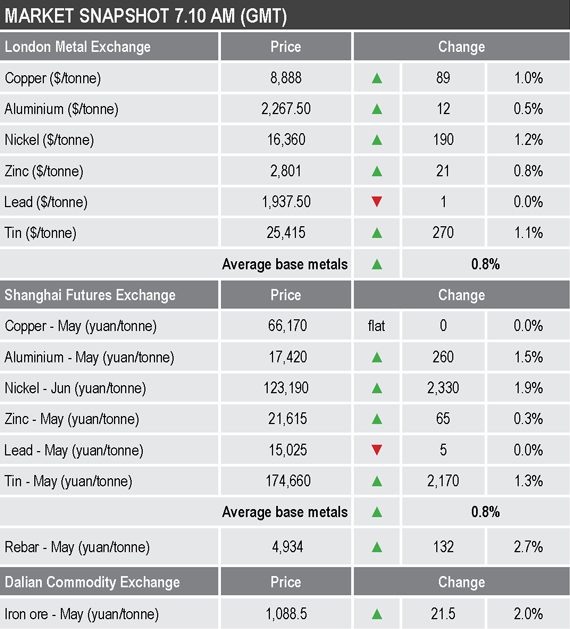

LME three-month base metals prices were up across the board this morning by an average of 0.8%. Lead was the laggard with prices little changed at $21,937.50 per tonne, while the rest were up by between 0.5% for aluminium ($2.267.50 per tonne) and 1.2% for nickel ($16,360 per tonne). Copper was up by 1% at $8,888 per tonne – this after a low on Thursday of $8,702 per tonne.

The most-active base metals contracts on the SHFE were for the most part stronger this morning; with the exception of May lead that was down slightly, with a dip of 5 yuan per tonne, the rest were up by an average of 1%, led by a 1.9% rise in June nickel. May copper was unchanged at 66,170 yuan ($10,114) per tonne.

Precious metals

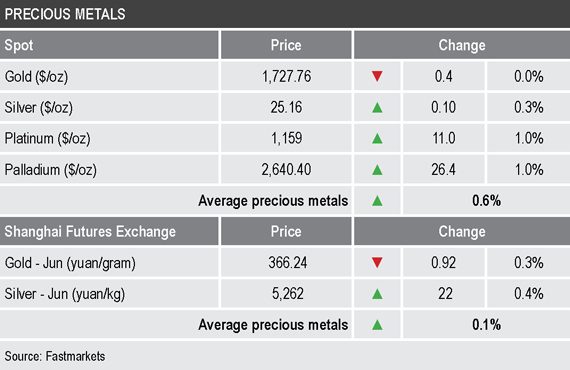

Precious metals prices were firmer this morning with gains averaging 0.6%, with spot gold prices up by $0.40 per oz at $1,727.76 per oz.

Wider markets

The yield on US 10-year treasuries was firmer at 1.64% this morning. The recent high was 1.75%.

Asian-Pacific equities were firmer on Friday: the CSI 300 (2.27%), the Nikkei (1.56%), the Kospi (1.09%), the Hang Seng (1.57%) and the ASX 200 (+0.5%).

Currencies

The US Dollar Index remains bullish and was recently at 92.80, the previous high being 92.51.

The other major currencies were mixed: the euro (1.1776) and the yen (109.44) were weaker, while sterling (1.3772) and the Australian dollar (0.7618) were firmer.

Key data

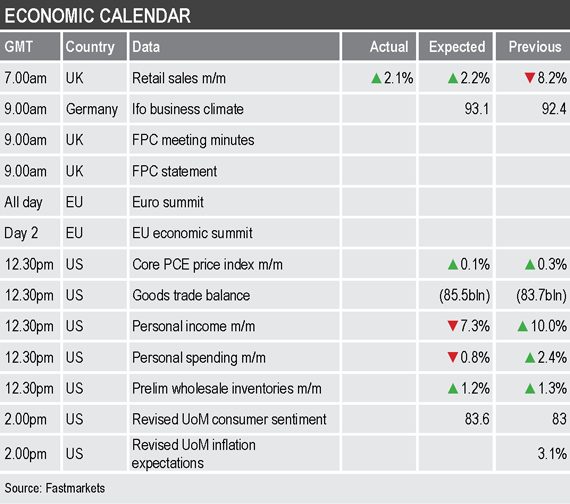

Data already out on Friday shows retail sales in the United Kingdom climbed by 2.1% month on month in February, after an 8.2% fall in January.

Later there is data on German Ifo business climate, along with data from the United States on personal spending, personal income, personal consumption expenditures consumer price index, goods trade balance, wholesale inventories and the revised University of Michigan consumer sentiment and inflation expectations readings.

In addition, the Bank of England’s Financial Policy Committee will release a statement and the minutes of their latest meeting and there is a European Union economic summit.

Today’s key themes and views

Once again weakness in base metals prices has run into dip-buying, suggesting underlying sentiment remains bullish.

The underlying themes remain bullish and while prices have already performed surprisingly well over the past 12 months, suggesting a lot of the recovery news may be in the prices, dips are still finding support. This is a sign of robustness.

Gold prices got some lift in recent weeks, but seem to be lacking follow-through buying – the stronger dollar no doubt not helping. Out of all the precious metals, palladium looks the strongest.