- Spot gold price reaches high of $1,411.90 per oz

- US President Donald Trump reportedly ordered an attack on Iran, which was later aborted

- Asian equities weaker across the board

Base metals

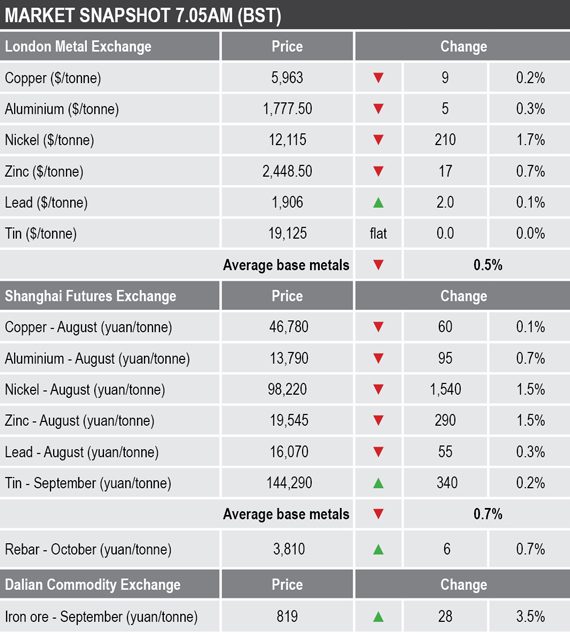

Three-month base metals on the London Metal Exchange were for the most part weaker, with prices down by an average of 0.5% this morning, Friday June 21.

Nickel led the decline with a drop of 1.7% to $12,115 per tonne, copper was off by 0.2% at $5,963 per tonne, aluminium and zinc were down by 0.3% and 0.7% respectively, while lead was little changed and tin was untraded.

In China, base metals prices on the Shanghai Futures Exchange were for the most part weaker this morning. The exception was September tin that was up by 0.2%, while the August contracts for the rest of the base metals were off by an average of 0.8%. August copper was off by 0.1% at 46,780 yuan ($6,810) per tonne.

Spot copper prices in Changjiang were up by 0.1% at 46,760-46,860 yuan per tonne and the LME/Shanghai copper arbitrage ratio has fallen to 7.85, after 7.89 at a similar time on Thursday.

Precious metals

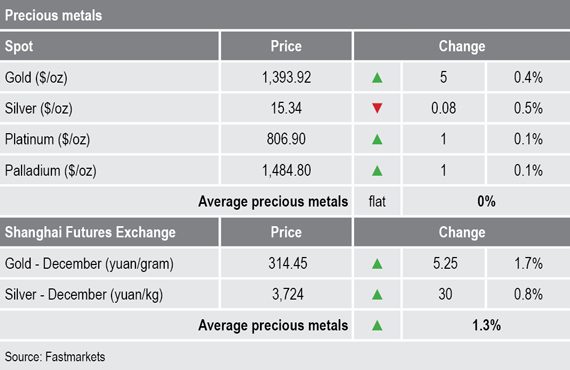

The rise in Middle East tension fueled gold’s rally which is also being supported by the dovish monetary stances in the United States and European Union. This morning’s highs were the highest the gold price had been since September 2013 – the next key resistance being $1,433.95 per oz.

Silver is following gold’s lead, but with the gold/silver ratio at 1:90.7, silver remains relatively weak to the yellow metal. Palladium is consolidating recent gains, while platinum remains rangebound in low ground.

On the SHFE, the December gold and silver contracts were up by 1.7% and 0.8% respectively.

Wider markets

The spot Brent crude oil price surged higher on Thursday and saw additional strength earlier this morning with the price reaching a high of $64.99 per barrel, but the price was more recently at $64.37 per barrel. While increased optimism over a US-China trade deal has helped to lift prices, we expect the conflict in the Middle East is the current main driver.

Demand for US treasuries seems to be easing with the yield on benchmark US 10-year treasuries edging up to 2.0151% after 1.9877% at a similar time on Thursday. The German 10-year bund yield still trades in negative territory but was slightly firmer at -0.3100%, compared with -0.3137% at a similar time on Thursday.

In Asia, equities were mainly weaker on Friday, this after a strong week overall: Nikkei (-0.95%), Hang Seng (-0.35%), Kospi (-0.27%) and the ASX 200 (-0.55%), while China’s CSI300 (+2.90%) is bucking the trend.

This follows strength in western markets on Thursday. In the US, the Dow Jones Industrial Average closed up by 0.94% at 26,753.17, while in Europe, the Euro Stoxx 50 was up by 0.39% at 3,468.08.

Currencies

The dovish stance by the US Federal Open Market Committee (FOMC) has led to dollar weakness with the dollar index dropping to 96.55 this morning, compared with a recent high of 97.77 on Tuesday.

The other major currencies we follow are stronger: the yen (107.29), sterling (1.2707), the euro (1.1309) and the Australian dollar (0.6923).

The yuan is consolidating its recent firmer tone and was recently quoted at 6.8702.

Key data

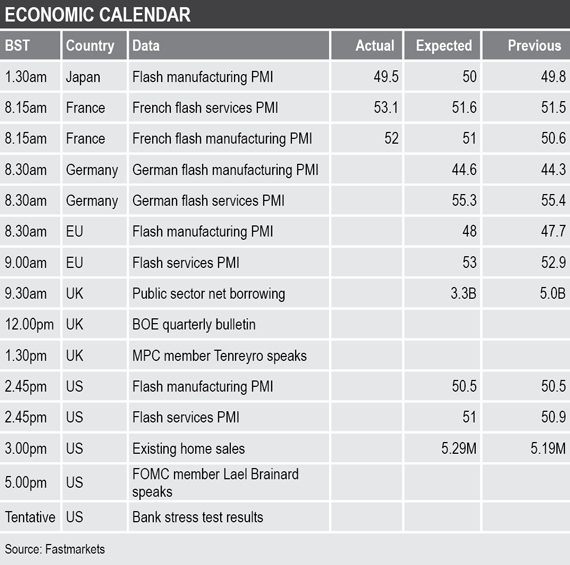

Economic data out today is focused on flash manufacturing and services purchasing managers’ indices (PMI) with data out in most regions. Other key data includes US existing home sales.

UK Monetary Policy Committee member Silvana Tenreyro and FOMC member Lael Brainard are speaking.

Today’s key themes and views

The base metals are looking quite mixed with zinc looking the weakest, this despite the large backwardation has stopped attracting stocks into LME-registered warehouses. Conversely, lead is looking robust on the upside, copper has put in a strong rebound this this week and is now consolidating, as has nickel, and to a lesser extent aluminium, while tin is consolidating after the weakness it has seen in the second quarter.

This mixed performance suggests the individual metals’ supply fundamentals are influencing prices. Any new US-China trade deal would likely see the demand fundamentals take center stage.

The price of gold is looking a bit overbought in the short term, but the backdrop is now bullish. We should get insight into how bullish sentiment is by seeing how the market handles any pullback.