This risk-on move has seen gold, the Japanese yen and outright benchmark United States 10-year treasuries, the havens, all weakening. This bodes well, it suggests a combination of relief rally, oversold markets that are seeing short-covering and a reaction to some positive geopolitical developments, with reference to Hong Kong and the US-China trade deal.

- The Dow Jones Industrial Average, at 26,728, is just 2.4% below record highs

- The Chinese yuan (7.1475) has strengthened – a sign of confidence in developments

Base metals

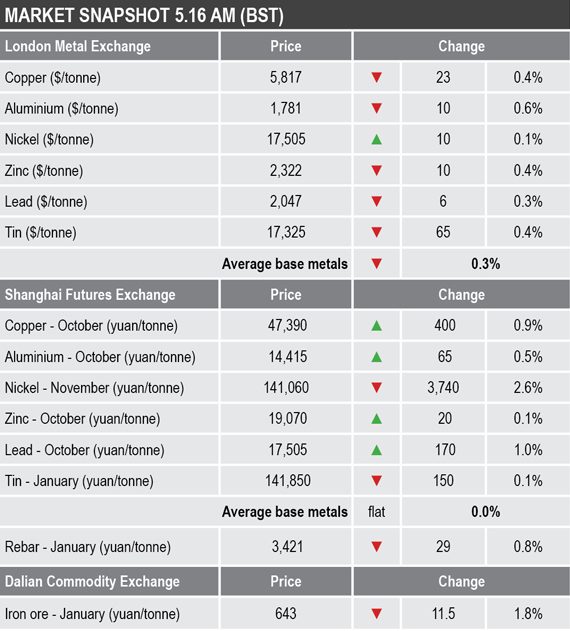

Three-month base metals prices on the London Metal Exchange were for the most part weaker this morning, with prices down by an average of 0.3% while the metals consolidate after gains, excluding nickel, of 1% on Thursday. We exclude nickel because it has been shooting higher in recent months and more particularly in recent days following the reintroduction of Indonesia’s export ban on nickel ores, so it is been trading its own fundamentals for a while.

The metal bucking the slightly weaker trend this morning is nickel that was up 0.1%, but it did drop 3.3% on Thursday, while the rest were down between 0.3% for lead and 0.6% for aluminium. Copper was recently quoted at $5,817 per tonne, up by around 5.4% from the 27-month low at $5,518 per tonne on Tuesday.

In China, the base metals traded on the Shanghai Futures Exchange were for the most part firmer this morning, the exception was November nickel and January tin, with the former off by 2.6% as it corrects after becoming overbought in the short term, while tin was off by just 0.1%. October zinc was little changed with a slight increase of 0.1%, while the rest of the October contracts were up between 0.5% for aluminium and 1% for lead. October copper was up by 0.9% at 47,390 yuan ($6,632) per tonne.

The spot copper price in Changjiang was up by 0.9% at 47,360-47,570 yuan per tonne and the LME/Shanghai copper arbitrage ratio dipped to 8.14, compared with 8.23 on Wednesday. This suggests LME copper prices is where the strength is coming from.

Precious metals

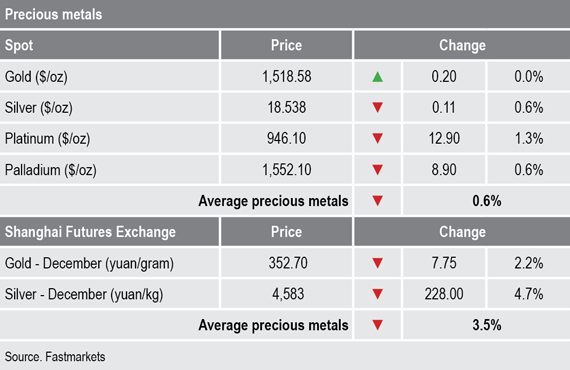

We said in Thursday’s Morning View that “given some easing in geopolitical tension and following risk-on moves in broader markets we would not be surprised to see bullion prices ease on profit-taking” and that is unfolding now with spot gold recently quoted at $1,518.58 per oz, this after setting a fresh multi-year high at $1,557.20 on Wednesday. Silver has followed suit with prices recently quoted at $18.54 per oz, this after a multi-year high at $19.65 per oz on Wednesday.

Platinum and palladium prices are retreating too, and were recently quoted at $941 per oz and $1,547 per oz.

Wider markets

The spot Brent crude oil price has become caught up in the return of risk-on, with prices rebounding to $62.35 per barrel on Thursday, but they are now consolidating around $61 per barrel, compared with $58.50 per barrel at a similar time on Wednesday.

The yield on benchmark US 10-year treasuries continues to show a more relieved market, it was recently quoted at 1.5739%, compared with 1.5103% at a similar time on Thursday. The German 10-year bund yield at -0.5920%, compared with -0.6665% at a similar time on Thursday, is reacting similarly.

Asian equities were upbeat on Friday: The Hang Seng (+0.59%), the CSI 300 (+0.25%), the ASX200 (+0.54%), the Kospi (+0.18%), and the Nikkei (+0.63%).

This follows a stronger performance in western markets on Thursday: in the US, the Dow Jones Industrial Average closed up by 1.41% at 26,728.15 and in Europe the Euro Stoxx50 closed up by 0.98% at 3,484.70.

Currencies

The dollar index is correcting lower and was recently quoted at 98.36, this after Tuesday’s multi-year peak at 99.38. A pullback in the dollar may well help underpin the metals.

As the dollar slips, the euro (1.1041), sterling (1.2335) and the Australian dollar (0.6821) are rebounding, but the yen (107.00) is weaker, suggesting money is coming out of havens. Sterling is outperforming on the upside as a hard Brexit is looking less likely.

Key data

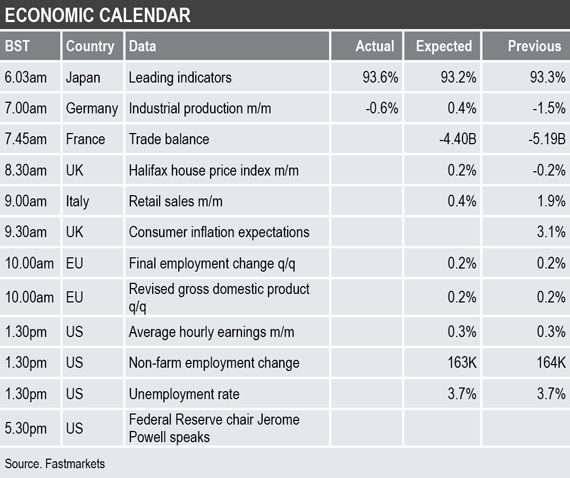

Friday’s economic data showed Japan’s leading indicators edge higher to 93.6% from 93.3%, while German industrial production dropped by 0.6%, having been expected to rebound 0.4%. Later there is data on France’s trade balance, UK house prices, Italian retails sales, UK inflation expectations, EU employment change and revised gross domestic production.

US data is focused on the monthly employment report, but in addition to that, US Federal Reserve chair Jerome Powell is speaking.

Today’s key themes and views

The relief rally seems appropriate given there has been some good news on Chinese economic data, more stimulus seems to be flowing, stress over Hong Kong has abated and some of the recent US data has been encouraging. For the stronger tone to continue the market probably needs more positive rhetoric on trade talks in the run-up to the talks in October. But, October seems a long way off and it may be asking too much for US President Donald Trump not to stir up more tension between now and then – that said with Iran starting up its centrifuges to enrich uranium again, Trump’s attention may divert from trade for a while.

While we think nickel’s fundamentals have changed significantly, the $7,200-per-tonne price rally, a move of 62% since the June low, probably means the market has adjusted enough for now. The market may well tighten further down the road that could justify further gains, but short term it is looking overbought.

Gold is consolidating and given the risk-on sentiment we would not be surprised to see bullion prices ease on profit-taking, but the need for havens has not gone away given all the uncertainty, so once again we do not expect prices will stay down for long.

There will be no Morning View next week due to traveling commitments.