Instead, relations between the world’s two largest economies remain frosty following a report that China will sanction US firms that sell weapons to Taiwan. In addition, US President Donald Trump has threatened additional tariffs on China after it failed to increase purchases of US agriculture products.

- Looming interest rate cut by US Federal Reserve supports risk appetite, especially for US equities.

- Conversely, haven demand has cooled on growing expectations of an interest rate cut at the end of the month, with profit-taking featuring across the precious metals complex.

Base metals

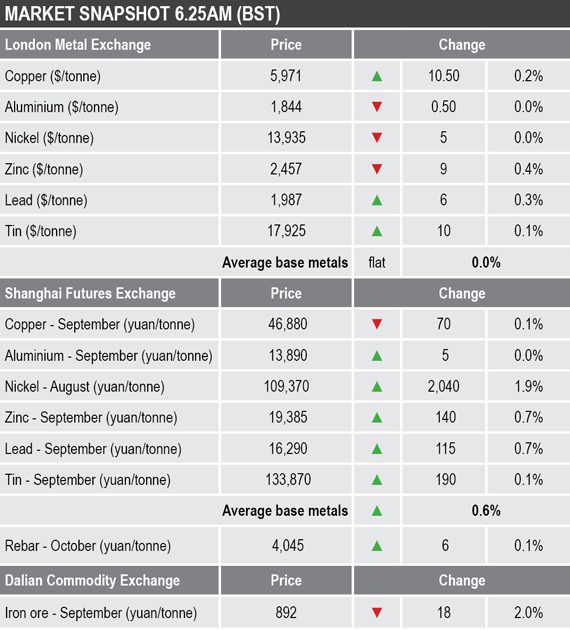

The London Metal Exchange three-month base metals prices were mixed during the early Asian trading session on Wednesday July 17. Mild buying pressure was witnessed in lead (+0.3%), copper (+0.2%) and tin (+0.1%), while nickel and aluminium were little changed and zinc slid by 0.4%.

Although aluminium was little changed this morning, the light metal has managed to retain most of its recent gains despite sizeable inflows over the past two days. Nickel has retreated after climbing to a high of $14,200 per tonne on Tuesday, it was recently trading at $13,935 per tonne. Long-term supply concerns seem to have fueled the sharp move higher in nickel, which is not surprising given the metal’s propensity to overreact in either direction to supply news.

In China, base metals prices on the Shanghai Futures Exchange were up by an average of 0.6% this morning. Leading the gains was the most-traded August nickel contract that was up by 1.9% and showing little sign of slowing. This was followed by gains of 0.7% in the September zinc and lead contracts, while September tin could only manage a gain of 0.1%. September aluminium was unchanged while September copper dipped by 0.1% to 46,880 yuan ($6,816) per tonne.

Spot copper prices in Changjiang were unchanged at 46,810-46,920 yuan per tonne, while the LME/Shanghai copper arbitrage ratio was at 7.88 compared with 7.89 at a similar time on Monday.

Precious metals

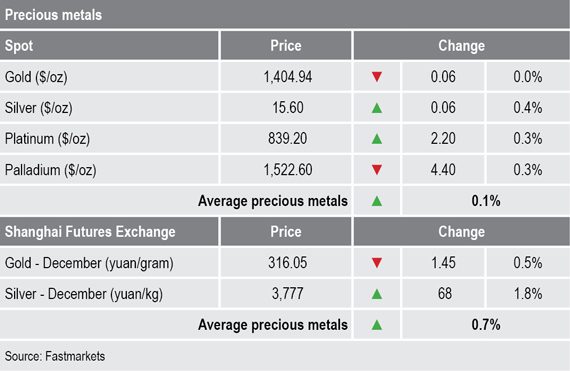

The spot silver price outperformed its peers this morning after it surged above $15.60 per oz. Silver’s improved technical development – sporting a potential bullish inverse-head-and-shoulders formation – has encouraged more technical buyers to enter the complex. Additionally, with gold looking a tad expensive, more and more investors have turned to silver instead. That said, the spot gold price was marginally weaker this morning and was recently trading at $1,404.94 per oz.

Platinum producer Anglo American Platinum recently reported a jump in interim profits due to higher metal prices. This is likely to make wage negotiations with South Africa’s largest trade union, Association of Mineworkers and Construction Union, a lot more difficult. Platinum was up by 0.3% this morning and was recently at $839.20 per oz, while palladium has run into short-term profit-taking as it dips by 0.3% to $1,522.60 per oz.

On the SHFE, the most-traded December gold contract fell by 0.5%, while the most-traded December silver contract rose by 1.8%.

Wider markets

With no sign of geopolitical tensions in the Middle East escalating further, the spot Brent crude oil price has run into profit-taking, edging down to $64.63 per barrel after being as high as $66.70 per barrel at the start of the week.

The yield on benchmark US 10-year treasuries edged up to 2.1332% on Monday but has come under pressure again this morning, dropping to 2.0973% at the time of writing. The German 10-year bund yield fared better, edging to -0.2487% from Monday’s open of -0.2600%.

In equities, major Asian indices were mixed on Wednesday: Nikkei (-0.26%), Hang Seng (-0.26%), Topix (-0.07%), ASX200 (+0.44%) and CSI300 (+0.28%).

This follows weakness in US markets overnight with Dow Jones Industrial Average down by 0.09%, the S&P500 Index down by 0.34% and the Nasdaq Composite off by 0.43%.

Currencies

The dollar index was a tad firmer this morning at 97.33, up from 96.80 at a similar time on Monday, after US Federal Reserve Jerome Powell said that the central bank would “act as appropriate” in regard to interest rate cuts amid increased uncertainty. Much of the expectations for a 25-basis-point cut at the end of the have been priced in already, however, leaving the market much less excited unless hints of a 50-basis-point cut emerge.

Against the firm US currency, the Japanese yen has weakened to 108.23, while the euro (1.1213) and the pound sterling (1.2415) were little changed. Having said that, both of the latter currencies are down since the start of the trading week when the euro and the pound sterling opened at 1.1272 and 1.2574 respectively. The Australian dollar was off by 0.06% this morning at 0.7006 while the Chinese yuan has weakened to 6.8819.

Key data

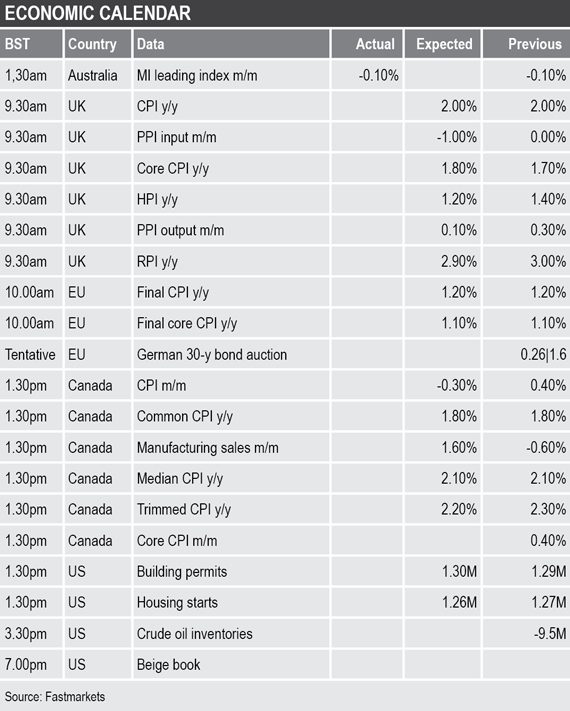

Data of note includes the consumer price index (CPI) from the United Kingdom and Europe. US releases including building permits, housing starts, crude oil inventories and the Federal Reserve’s Beige Book are also noteworthy.

Today’s key themes and views

In general, the LME base metals have had mixed performances of late.

Tin has struggled amid persistent selling pressure that has kept its price below the psychological price level of $18,000 per tonne. In zinc, uncertainty surrounding demand and rising global supply has suppressed the rebound momentum in the metal’s price. Copper continues to attempt a break above $6,000 per tonne but fresh overhead supply continues to thwart the move. Lead and aluminium are fairly resilient while nickel remains the strongest performer of the complex.

Silver has reacted higher on the back of its positive technical configuration while gold looks a tad weaker due to the firmer dollar.