Further evidence of slowing growth with disappointing US data out on Tuesday, which bodes ill for today’s flash manufacturing purchasing managers’ index (PMI) data, are no doubt weighing on sentiment.

- The International Monetary Fund lowered its global growth forecast to 3.2% from 3.3% for 2019, citing weak activity in Asia, trade tensions and Brexit.

- Boris Johnson to become UK Prime Minister – Brexit rhetoric likely to pick up again.

- Senior US trade officials are set to travel to China before the end of the month.

Base metals

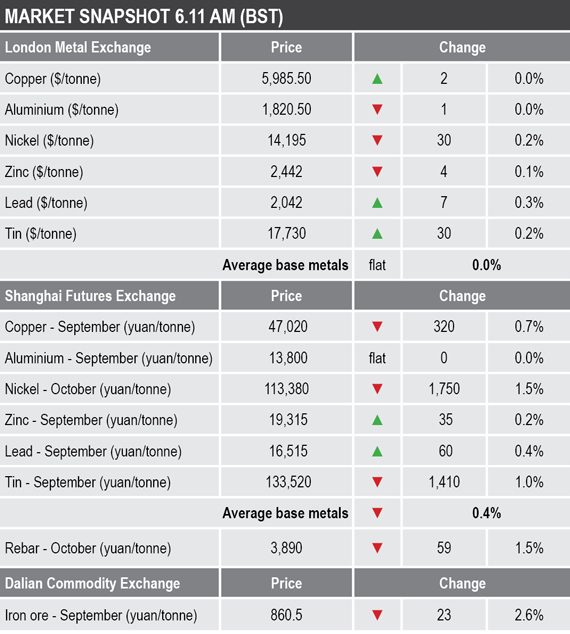

The London Metal Exchange three-month base metals are for the most part little changed with prices ranged from being down by 0.2% in the case of nickel, to being up by 0.3% in the case of lead. Copper is up by just $2 per tonne from Tuesday’s closing price at $5,985.50 per tonne. Lead is looking in the strongest position to shine, with prices set to challenge last week’s highs.

In China, base metals prices on the Shanghai Futures Exchange were mixed, albeit with a downward bias, with October nickel leading on the downside with a 1.5% drop. This was followed by a 1% drop in September tin and a 0.7% drop in September copper to 47,020 yuan ($6,832) per tonne.

Spot copper prices in Changjiang were down by 0.6% at 46,870-46,990 yuan per tonne, compared with 47,170-47,290 on Tuesday. The LME/Shanghai copper arbitrage ratio was recently at 7.85, compared with 7.87 at a similar time on Tuesday.

Precious metals

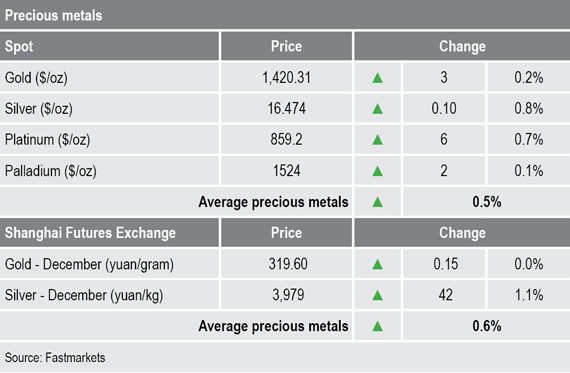

Spot precious metals prices were firmer across the board this morning, up by an average of 0.5% – led by a 0.8% gain in silver to $16.47 per oz. Gold was up by 0.2% at $1,420.31 per oz, but the yellow metal still seems to be consolidating after last week’s run up to $1,453 per oz.

Platinum, at $859.20 per oz, was once again closing in on last week’s high of $861.50, while palladium was consolidating after recent weakness.

December gold prices on the SHFE were little changed, while December silver prices were up by 1.1%.

Wider markets

The spot Brent crude oil price was recently at $63.94 per barrel, compared with $63.33 at a similar time on Tuesday.

The yield on benchmark US 10-year treasuries was firmer this morning at 2.0773%, compared with 2.0518% at a similar time on Tuesday. But the German 10-year bund yield continues to weaken and was recently at -0.3470%, compared with -0.3420% on Tuesday morning.

In equities, Asian indices were generally firmer on Wednesday: Nikkei (0.41%), Hang Seng (0.59%), CSI300 (0.65%) and ASX200 (0.77%) – the exception was the Kospi that was down 0.91%.

This follows positive closes in western markets on Tuesday, where in the United States the Dow Jones Industrial Average close up by 0.65% at 27,349.19 and in Europe, the Euro Stoxx50 closed up by 1.23% at 3,532.87.

Currencies

The dollar index has pushed higher and was recently quoted at 97.68, resistance is now at 97.77.

While the dollar remains firm, the other major currencies we track are flat-to-weaker: Japanese yen (108.13), euro (1.1151), sterling (1.2446), the Australian dollar (0.6983) and the Chinese yuan (6.8807).

Key data

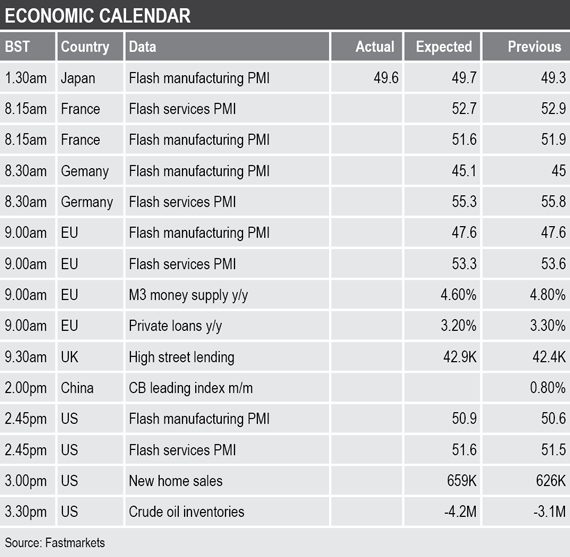

Today’s agenda is focused on flash manufacturing and services PMI data. Japan’s manufacturing index climbed to 49.6 after 49.3 previously. European PMI readings are expected to be flat-to-lower, while US numbers are expected to be higher. Other key data includes Chinese leading indicators, US new home sales and US crude oil inventories.

Today’s key themes and views

The underlying medium-term trends since early-to-mid-June, are upward for copper, aluminium, lead and nickel, but downward for zinc and tin. On balance, we feel the base metals have either found bases, or soon will, and then it will be a case of waiting for the demand outlook to improve and that is likely to take a new trade deal between China and the US.

There is enough uncertainty surrounding trade, Iran, Brexit, global growth and the sustainability of record breaking US equities, to continue fueling demand for gold as a haven. That said, the rising dollar may prove a short-term headwind. Interest in silver is starting to pick up; the gold/silver ratio has fallen to 1:86 from 1:93 earlier in July.