This saw the three-month base metals prices on the London Metal Exchange rise by an average of 2.4% on Wednesday September 4.

The rally has been widespread across risk markets so far on Thursday, and for the base metals the combination of rising prices and a pick-up in volume bodes well. A total 8,335 lots had been traded as of 5.36am London time, compared with 4,453 lots as at 6.55am on Wednesday.

- US total vehicle sales came in at an annualized rate of 17 million units in August, up from 16.6 million units in July

- Asian equity markets were upbeat on Thursday

- US Federal Reserve’s Beige Book showed overall economy was expanding at a “moderate pace”

Base metals

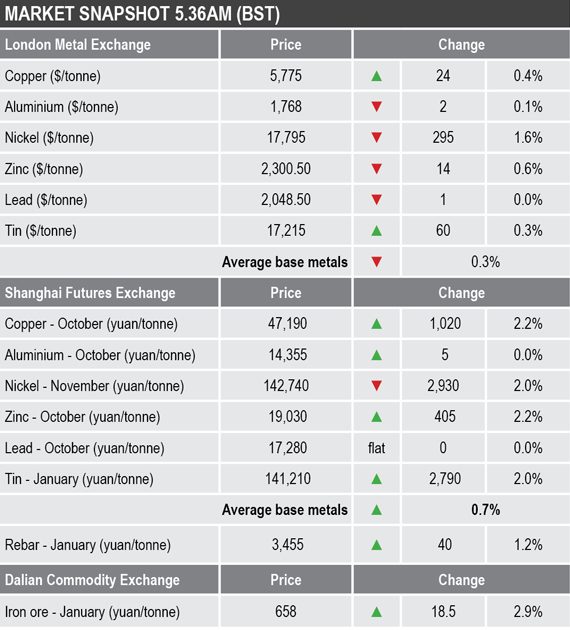

Three-month base metals prices on the LME were mixed this morning, with copper and tin showing gains of 0.4% and 0.3% respectively, lead and aluminium were little changed and nickel and zinc were weaker by 1.6% and 0.6% respectively, but it should be noted that zinc rallied 4.7% on Wednesday, so some pullback is unsurprising and nickel has been rallying of late.

Copper was recently quoted at $5,775 per tonne, up by around $113 per tonne compared with a similar time on Wednesday, this after setting a 27-month low at $5,518 per tonne on Tuesday.

In China, the base metals traded on the Shanghai Futures Exchange were for the most part firmer this morning, the exception was November nickel that was down by 2%. October aluminium and lead were little changed, while October copper and January tin were up by 2.2% and 2% respectively, with the former at 47,190 yuan ($6,593) per tonne.

The spot copper price in Changjiang was up by 1.7% at 46,880-47,240 yuan per tonne and the LME/Shanghai copper arbitrage ratio dipped to 8.17, compared with 8.23 on Wednesday.

Precious metals

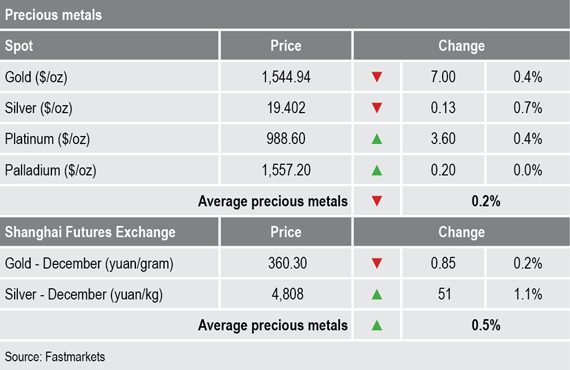

Spot gold prices are consolidating at around $1,545 per oz, after setting a fresh multi-year high at $1,557.20 on Wednesday. Silver has been on an extremely bullish run, rising to a new multi-year high at $19.65 per oz on Wednesday, it was recently quoted at $19.40 per oz. Platinum has been following silver’s lead, it was recently quoted at $988.60 per oz, having been as high as $997 earlier this morning, while palladium prices continue to rebound and were last at $1,558 per oz.

Wider markets

The spot Brent crude oil price has become caught-up in the return of risk-on, with prices rising to $60.75 per barrel, compared with $58.50 per barrel at a similar time on Wednesday – for now the price remains rangebound between $57.22 and $61.48 per barrel.

The yield on benchmark US 10-year treasuries is showing some relief too, it was recently quoted at 1.5103%, compared with 1.4773% at a similar time on Wednesday. The German 10-year bund yield is firmer at -0.6665%, compared with -0.6920% at a similar time on Wednesday.

Asian equities are upbeat on Thursday: The Hang Seng (+0.12%), the CSI 300 (+1.68%), the ASX200 (+1.05%), the Kospi (+0.99%), and the Nikkei (+2.32%).

This follows a stronger performance in Western markets on Wednesday: in the United States, the Dow Jones Industrial Average closed up by 0.91% at 26,355.47 and in Europe the Euro Stoxx50 closed up by 0.88% at 3,450.83.

Currencies

The dollar index is correcting lower and was recently quoted at 98.50, this after Tuesday’s multi-year peak at 99.38. A pullback in the dollar may well help underpin the metals.

As the dollar slips, the euro (1.1021), sterling (1.2238) and the Australian dollar (0.6814) are rebounding, but the yen (106.54) is weaker, suggesting money is coming out of havens – we wait to see if this flows into the precious metals too.

Key data

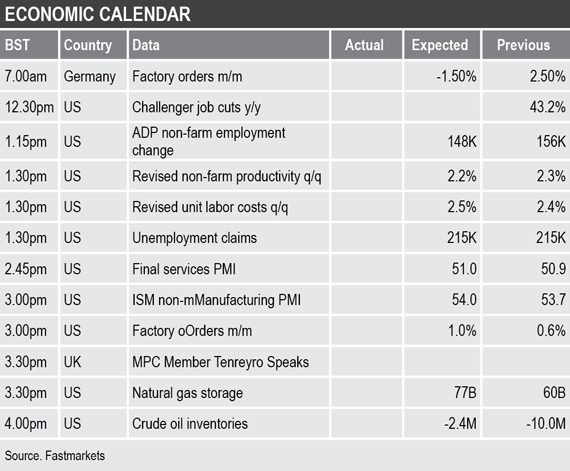

Thursday’s economic agenda contains data on German factory orders and a mass of key US data including Challenger job cuts, ADP non-farm employment change, revised non-farm productivity and initial labor costs, initial jobless claims, services purchasing managers index (PMI), Institute for Supply Management (ISM) non-manufacturing PMI, factory orders, natural gas storage and crude oil inventories.

In addition, UK Monetary Policy Committee member Silvana Tenreyro is speaking.

Today’s key themes and views

The relief rally seems appropriate given there has been some good news on Chinese economic data, more stimulus seems to be flowing and stress over Hong Kong as abated. But, overall little has changed and while the trade talks have a habit of breaking up, which ends up kicking a trade deal further down the road, we would expect the rally to be short-lived. We think the market will want to see a deal signed before getting outright bullish.

While we think nickel’s fundamentals have changed significantly, the $7,200-per-tonne price rally, a move of 62% since the June low, probably means the market has adjusted enough for now. The market may well tighten further down the road that could justify further gains, but short term it is looking overbought.

Gold has managed to run higher because the dollar has weakened, but given some easing in geopolitical tension and following risk-on moves in broader markets we would not be surprised to see bullion prices ease on profit-taking.