Meanwhile in Asia, protests in Hong Kong over a controversial extradition bill have started to subside but calls for the territory’s leader, Carrie Lam, to resign are growing.

Despite this, three-month base metals prices on the London Metal Exchange were firmer at the start of a new trading week. But gains have been fairly limited, indicating that market participants remain cautious ahead of this week’s US Federal Open Market Committee (FOMC) meeting.

- According to CME Group’s FedWatch tool, market participants assign a 21.7% probability of a cut at this week’s meeting, while expectations of a cut at the July meeting were above 80%.

- Further clarifications on what the US central bank wants to do next will determine global investors’ risk appetite.

- But there is a strong expectation for the Fed to start easing its monetary policy to weather the current negative macroeconomic climate.

Base metals

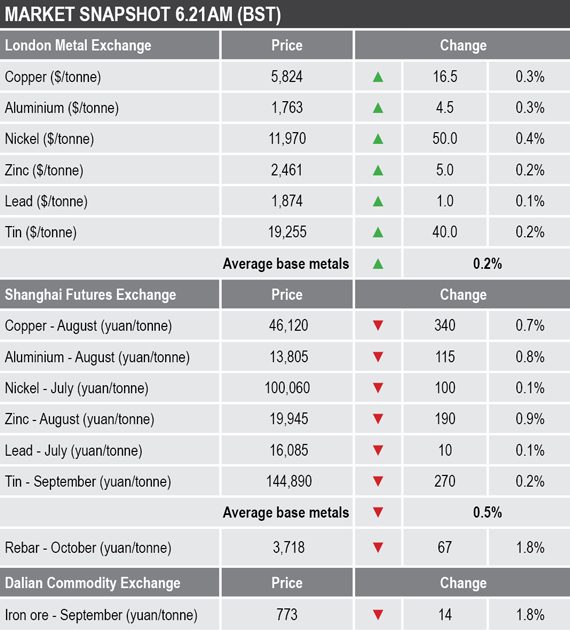

The LME three-month base metals were firmer this morning, with prices up by an average of 0.2% as at 6.21am London time. Nickel (+0.4%) was the outperformer, followed by copper (+0.3%) and aluminium (+0.3%), while zinc and tin were both up by 0.2% and lead managed to eke out a 0.1% gain.

In China, base metals prices on the Shanghai Futures Exchange were under selling pressure at the time of writing, down by an average of 0.5%. The most-traded August zinc contract was down by 0.9%, while the August aluminium and copper contracts followed fairly closely with declines of 0.8% and 0.9% respectively. The latter was recently at 46,120 yuan ($6,657) per tonne. The most-traded September tin contract was down by 0.2%, while the July contracts for nickel and lead were both down by 0.1%.

Spot copper prices in Changjiang were down 0.7% at 46,070-46,200 yuan per tonne and the LME/Shanghai copper arbitrage ratio dipped lower to 7.94.

Precious metals

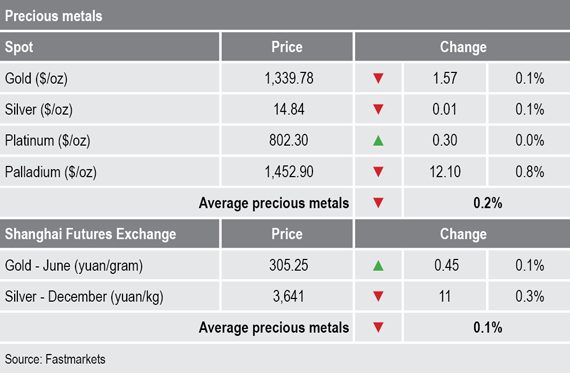

Spot gold and silver prices failed to hold on to recent gains on Friday and both metals are under selling pressure this morning. The spot gold price was recently down by 0.19% at $1,339 per oz, while spot silver price was down by 0.03% and was recently trading at $14.85 per oz.

The platinum price is threatening to break below the psychological level of $800 per oz as selling pressure grows. Meanwhile, sister-metal palladium is consolidating from recent gains, down by 0.2%. It was last trading at $1,465 per oz and judging by the rebound momentum, more gains in the coming days cannot be ruled out just yet.

On the SHFE, the June gold contract was up by 0.1% at 301.95 yuan per gram, while the December silver contract was down by 0.3%.

Wider markets

The spot Brent crude oil price remains well supported by the recent attacks on oil tankers in the Gulf of Oman and was last trading at $62.16 per barrel.

Risk-on sentiment has allowed global bond yields to recover too, with the yield on benchmark US 10-year treasuries up at 2.1000%. Meanwhile, the German 10-year bund yield still trades in negative territory and was recently quoted at -0.2500%.

In Asia, equities were mixed on Monday: Hang Seng (+0.60%), CSI300 (+0.08%), Nikkei (+0.03%), Topix (-0.45%) and the ASX 200 (-0.35%).

This follows negative closes for major US indices on Friday, with the Dow Jones Industrial Average down by 0.07%, the S&P500 off by 0.16% and the Nasdaq down by 0.52%.

Currencies

The recovery in the dollar index continues to gain traction while the expectations of a Fed rate cut at this week’s FOMC meeting remains low. The US currency was recently at 97.56, up from June 12’s low of 96.58.

With the dollar firmer the other major currencies we follow were weaker: the Japanese yen (108.60), the euro (1.1205) and sterling (1.2579). The Australian dollar is up marginally however at 0.6875.

The yuan has weakened to 6.9250, down by 0.02% at the time of writing.

Key data

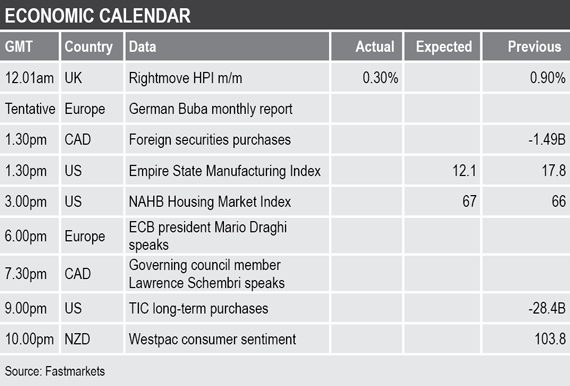

It is a light day for data on Monday with the UK’s Rightmove house price index rising by 0.3% month on month in May. Later there is the Empire State Manufacturing Index from the US and a speech from European Central Bank president Mario Draghi of note.

Today’s key themes and views

Despite the positive start to the week by the LME base metals, global risk sentiment remains fairly fragile, highly sensitive to any sudden developments in the simmering US-China trade war or escalated tensions in the Middle East.

While the resilient dollar index is likely to cap rebound gains in the base metals in the short term, market participants are seemingly hopeful that the US central bank could deliver an interest rate cut as early as July to alleviate some of the negative pressure on global economic growth.

Global investors were rather happy to switch from holding risk assets to haven assets on a whim and this may well be the nature of how things pan out as market volatility continues to force market participants to adapt quickly.