- In his speech to Senate Banking Committee, US Federal Reserve Chairman Jerome Powell maintain a dovish stance and stated that the US economy is in a very good place but faced external uncertainties. As such, he added that the central bank is open to more accommodation and will use tools to keep economic expansion going.

- With the weekend fast approaching, market attention turn to haven-assets again as geo-political tensions in the Middle East remain unsettling. Spot gold is trading higher again this morning amid dip-buying interest near the psychological price level of $1,400 per oz.

Base metals

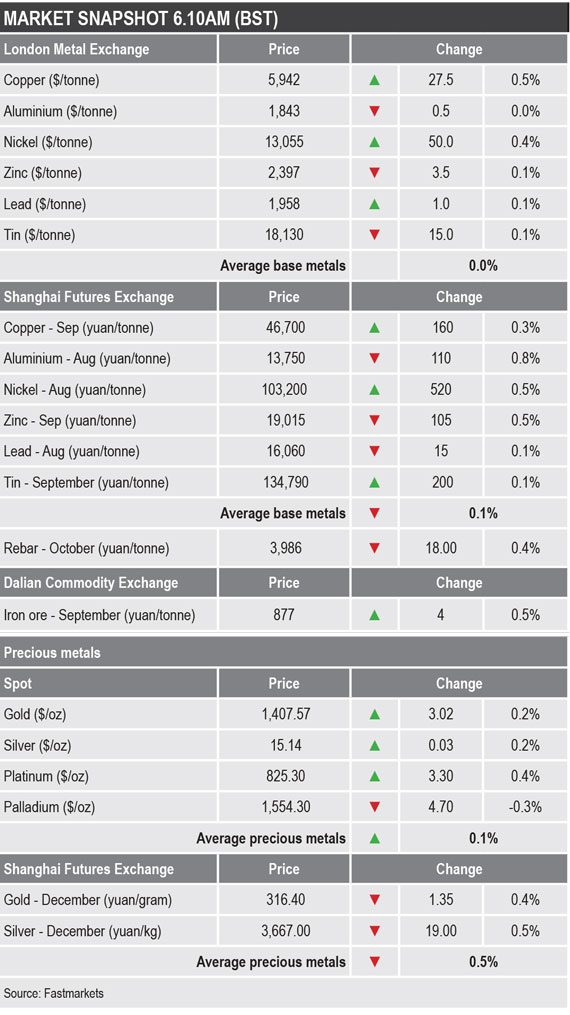

With 2,664 lots already traded as of 06:09am London time, the trading volume in the morning of Friday July 12 is considerably lower than the weekly average of 4,747 lots. The London Metal Exchange base metals complex was mixed, with buying pressure seen on LME copper and lead only, up 0.5% and 0.1% respectively. The rest of the complex struggles to attract bids, with nickel down 0.4%, zinc and tin down on 0.1% while aluminium unchanged.

The base metals prices on the Shanghai Futures Exchange were weak, down 0.1% on average. The most-traded August aluminium contract run into selling pressure, down 0.8%, followed by September zinc 0.5%, while August lead was down 0.1%. September copper and tin along with the August nickel contract helped offset the decline, up 0.3%, 0.1% and 0.5% respectively.

Spot copper prices in Changjiang is up 0.2% to 46,590-46,700 yuan per tonne while the LME/Shanghai copper arbitrage ratio has edged higher to 7.85.

Precious metals

Although the precious metals complex ran into fresh selling pressure on Thursday July 11, dip-buying interest saw spot gold and silver prices edging higher this morning, up 0.2%. Haven-demand remains strong amid the continued uncertainty over the US-China trade talks and deteriorating conditions in the Middle-East.

Overall, the precious metals complex is up by an average of 0.1%. Platinum is up 0.4% while sister-metal palladium ran into selling pressure following from recent retest of $1,600 per oz level, down 0.3% this morning.

The precious metals complex on the SHFE was off by 0.5% with the most-traded December gold contract down 0.4% while silver was off by 0.5%.

Wider markets

Geo-political tensions in the Middle-East remains high and thus supporting the spot Brent crude oil price, which was trading at $67.04 at the time of writing, up 0.31%.

Benchmark US 10-year treasuries are under fresh downside pressure again, down 0.88% but higher than yesterday’s 2.0379% and was last trading at 2.1237%. The German 10-year bund yield has improved too even though it still trades at record negative territory. It was last at -0.2600%, coming off the -0.3000%.

Major Asian indices saw mixed performance in the early Asian trading session on Friday July 12. Leading the complex is China’s CSI300 index up (+0.62%), the Nikkei (+0.20%) and the Hang Seng Index (+0.11%). However, the Topix was off by 0.15% and ASX200 index was down by 0.29%.

US equity index managed to close positively, with the Dow Jones industrial average up 0.85%, S&P500 index knocking on the 3,000 mark, up (+0.23%) but the Nasdaq was slightly weaker (-0.08%).

Currencies

The weaker dollar was visibly weaker in the early Asian trading session, down 0.14% at 96.92 at the time of writing. The Japanese yen is hovering comfortably above 108.00.

The other major currencies we follow were stronger, with the euro up 0.12% at 1.1269. A third-party survey reported that there are already enough votes for Boris Johnson to be elected the next Prime Minister to success Theresa May over his main rival Jeremy Hunt. This has given the pound sterling some grounds on the upside to 1.2548.

The Australian dollar has edged higher to 0.6999, up 0.35%, while the Chinese yuan was last at 6.8725, up 0.05% this morning.

Key data

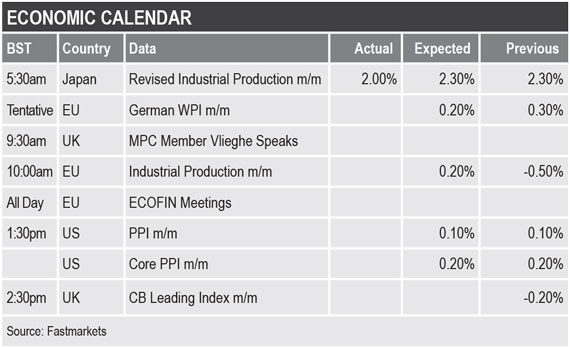

Japanese revised industrial production number came in disappointingly at 2%, well below the market expectation of 2.3%.

In notable data today, the latest Producer Price Index reading from the US and industrial output numbers from Europe are set to be released.

Today’s key themes and views

The mixed performance in the London Metal Exchange base metals complex suggest a somewhat cautious tone in the market. That said, more buying interest has emerged at the time of writing, with LME copper and nickel being the outright best performer this week. However, demand for gold and silver remains fairly healthy too and there is still an element of fear among global investors that has encouraged some form of diversification away from risky assets. Fresh rhetoric from the Middle East or a presidential tweet could change the landscape again today.