That said, US economic data out on Thursday was generally robust with strong data on housing starts, the Philadelphia Fed manufacturing index and initial jobless claims, which somewhat countered the poor data from Wednesday, so there are still cross winds blowing through the global economy.

- Asian equities mixed, but China’s CSI 300 is down by 2.38%

- EU passenger car registrations down by 0.4% in April and down by 2.6% in first four months of the year

Base metals

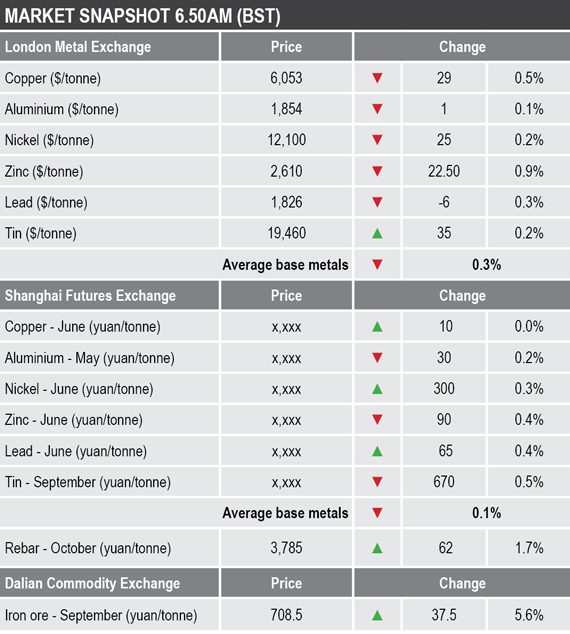

Three-month base metals prices on the London Metal Exchange were for the most part weaker on Friday morning, the exception being tin that is up by 0.2% – although tin was the one metal showing weakness on Thursday when it closed down by 1.4%.

The rest of the three-month LME base metals prices were down by an average of 0.4% this morning, led by a 0.9% drop in zinc prices to $1,826 per tonne. Copper was recently quoted at $6,053 per tonne, compared with Thursday’s close of $6,081.50.

On the charts, the rebounds in the metals over the past three days are now consolidating, so we wait to see how strong underlying support is. Half the metals – zinc, nickel and tin – are still backwardated so if downward momentum has been lost then the chances of short-covering may increase.

In China, base metals prices on the Shanghai Futures Exchange were mixed on Friday, with July copper little changed at 47,760 yuan ($6,940) per tonne, while the July contracts for aluminium and zinc were off by 0.2% and 0.4% respectively and the September tin contract was down by 0.5%. The July nickel and June lead contracts were up by 0.3% and 0.4% respectively.

Spot copper prices in Changjiang were down by 0.2% at 47,760-47,890 yuan per tonne and the LME/Shanghai copper arbitrage ratio was slightly firmer at 7.89, compared with 7.87 at a similar time on Thursday.

Precious metals

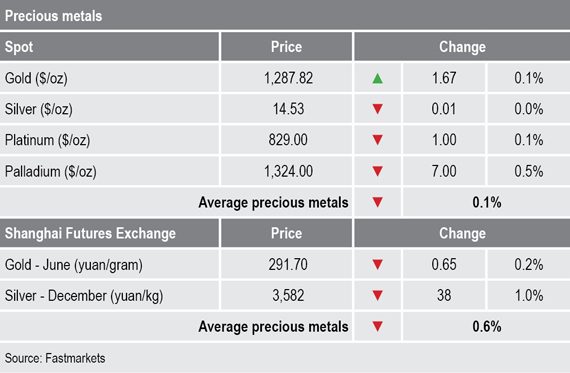

Precious metals were for the most part little changed this morning while the markets consolidate after Thursday’s show of weakness that saw spot prices close down by an average of 1.2%. The spot gold price was up by 0.1% at $1,287.82 per oz, compared with $1,286.15 at Thursday’s close, with silver at $14.53 per oz, platinum at $829 per oz and palladium off by 0.5% at $1,324 per oz, compared with $1,331 per oz on Thursday’s close.

On the SHFE, the December gold contract was down by 0.2% from Thursday’s close, while the December silver contract was off by 1%.

Wider markets

In wider markets, the spot Brent crude oil price continues is trending higher again and was recently quoted at $72.57 per barrel, up from $71.90 per barrel at a similar time on Thursday.

The yield on benchmark US 10-year treasuries has rebounded slightly and was recently quoted at 2.3851%, compared with 2.3565% at a similar time on Thursday. The yields on the US two-year and five-year treasuries remain inverted and were recently quoted at 2.1830% and 2.1609% respectively.

The German 10-year bund yield remains negative, it was recently quoted at -0.1085%, compared with -0.12002% at a similar time on Thursday.

Asian equity markets were mixed this morning: Nikkei (+0.89%), Hang Seng (-1.08%), CSI 300 (-2.38%), the Kospi (-0.58%) and the ASX 200 (+0.59%).

This follows a stronger performance in western markets on Thursday. In the United States, the Dow Jones Industrial Average closed up by 0.84% at 25,862.68, while in Europe the Euro Stoxx 50 was up by 1.56% at 3,438.56.

Currencies

The dollar index is edging higher and was recently quoted at 97.76, this after a low on Monday of 97.03.

Sterling continues to weaken (1.2785), as do the Australian dollar (0.6890) and the Japanese yen (109.63), while the euro (1.1183) consolidates.

The yuan continues to weaken, it was recently quoted at 6.9014, compared with around 6.7100 in mid-April before the escalation in the US-China trade dispute.

Key data

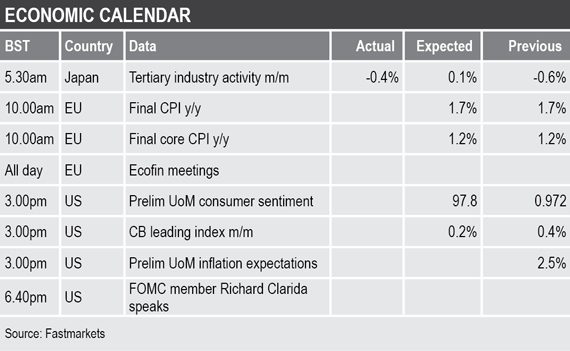

Data out already on Friday showed Japan’s tertiary industry activity fall by 0.4%, this after a 0.6% fall previously. Key data out later includes the EU’s consumer price index along with US releases that include the University of Michigan’s preliminary consumer sentiment and inflationary expectations and leading indicators.

In addition, there is an EU Economic and Financial Affairs Council meeting and US Federal Open Market Committee member Richard Clarida is speaking.

Today’s key themes and views

Against the background of mixed economic data and uncertainty on the US-China trade front there is little to be bullish about. That said, with prices already down and with the funds short, prices may get some support from short-covering. If and when a trade deal is made, then we would expect business confidence to recover and that could then lead to a restocking rally, but until then the path of least resistance is likely to be sideways-to-lower.

Gold found some support last week on the back of the turmoil in trade talks but Thursday’s price retreat suggests there is little appetite to chase prices higher above $1,300 per oz.