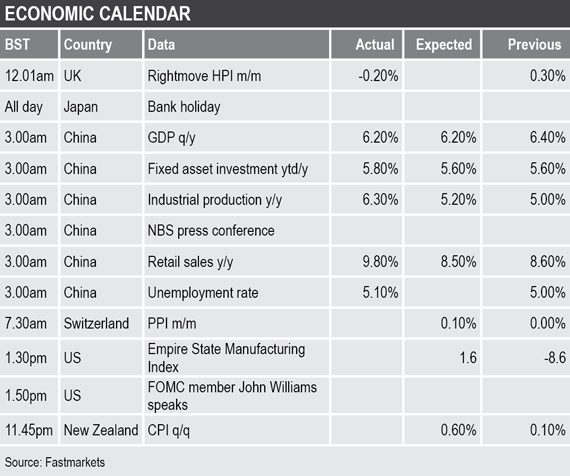

The record low GDP growth comes as the world’s second-largest economy continues to feel the effects of a protracted trade war with the United States. That said, other Chinese data out earlier this morning showed activity in June was considerably stronger, with growth in fixed asset investment, industrial production and retail sales – an indication that Chinese easing programs are at work.

- Global risk sentiment should remain robust following recent record closes in major US equity indices – the S&P 500 Index ended last week at a record high of 3,013.

- In addition, recent dialogue from Iranian President Hassan Rouhani suggests that his country is ready to negotiate if the US lifts sanctions and returns to the 2015 nuclear deal.

Base metals

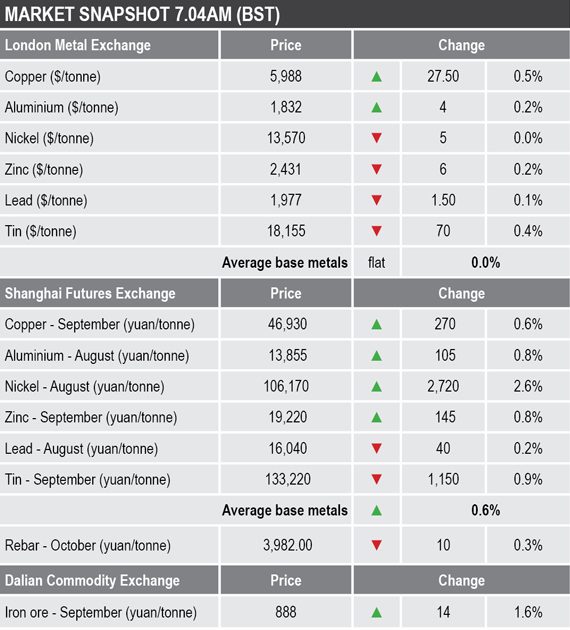

Three-month base metals prices on the London Metal Exchange were unimpressed with the more positive developments, however, to give a mixed start to a new trading week.

There was mild buying in copper (+0.5%) and aluminium (+0.2%) during the early session on Monday July 15, but the rest of the complex struggled to attract bids with tin down by 0.4%, zinc off by 0.2%, lead down by 0.1% and nickel unchanged.

But nickel remains in high ground following last week’s price gain of 7.9%. Long-term supply concerns seemed to fuel the sharp move higher, which is not surprising given nickel’s propensity to overreact in either direction to such news.

Stronger-than-expected readings on June activity in China has buoyed base metals prices on the Shanghai Futures Exchange this morning. The complex was up by an average of 0.6% at the time of writing, with the most-traded August nickel contract leading the charge higher with a gain of 2.6%.

This was followed by gains of 0.8% in both the September aluminium and zinc contracts, while September copper was up by 0.6% at 46,930 yuan ($6,819) per tonne compared with its close on Friday. September tin and August lead bucked the firmer showing of its peers to decline by 0.9% and 0.2% respectively.

Spot copper prices in Changjiang were up by 0.2% to 46,570-46,900 yuan per tonne while the LME/Shanghai copper arbitrage ratio has edged higher to 7.89 after a reading of 7.85 at a similar time on Friday.

Precious metals

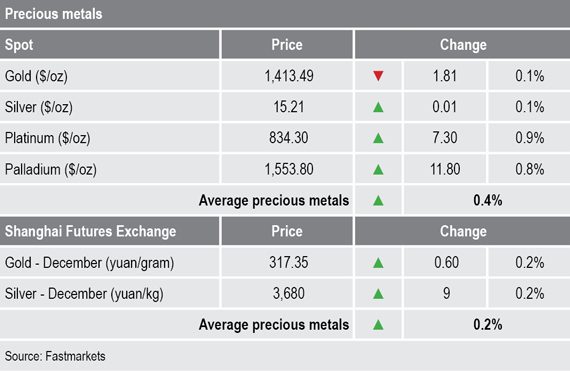

The spot gold price was a tad weaker this morning, down by 0.1% and was last trading at $1,413.49 per oz. Silver, meanwhile, managed to attract bids with an increase of 0.1% to trade at $15.21 per oz. The platinum group metals were much firmer than their bullion peers with platinum and palladium up by 0.9% and 0.8% at the time of writing.

Persisting uncertainty surrounding wage negotiations between South Africa’s Association of Mineworkers and Construction Union (AMCU) and the country’s top platinum miners have kept platinum and palladium prices well supported.

On the SHFE, the December gold and silver contracts were both up by 0.2%.

Wider markets

Although there has been talk that Iran is considering starting negotiations with the US, the likelihood of this happening is not too great. As such, we expect the spot Brent crude oil price to remain elevated – the price was recently at $66.70 per barrel, slightly down from $67.04 per barrel at a similar time on Friday.

The yield on benchmark US 10-year treasuries has edged higher to 2.1332%, slightly higher than Friday’s 2.1237%. The German 10-year bund yield has also improved, though it still trades in record negative territory – it was last at -0.2600%.

Major Asian indices gave mixed performances in the early trading session on Monday: Nikkei (+0.20%), Hang Seng (+0.17%), CSI300 (+0.16%) but Topix and the ASX200 were off by 0.15% and 0.65% respectively.

US equities closed strongly on Friday with the Dow Jones Industrial Average leading the gains with an increase of 0.9%, the S&P500 closing above 3,000 with a gain of 0.46% and the Nasdaq up by 0.59%.

Currencies

The dollar index was slightly weaker in the early Asian trading session, down by 0.02%, and was recently trading at 96.80. The Japanese yen has strengthened and is trading just below 108.00.

There was mixed movements in the other major currencies we follow: the euro was up by 0.04% to 1.1274, the pound sterling was down by 0.06% at 1.2567, while the Australian dollar edged up by 0.25% on the back of firmer Chinese data to 0.7035. The yuan was similarly stronger – recently at 6.8730.

Key data

In data already out on Monday, China’s fixed asset investment, industrial production and retail sales were all better than expected with year-on-year increases of 5.8%, 6.3% and 9.8% respectively in June.

Later, the Empire State Manufacturing Index and a speech by US Federal Open Market Committee member John Williams are of note.

Today’s key themes and views

LME base metals prices are off to a mixed start to the new trading week. With China’s second-quarter GDP coming in line with expectations and other data showing more positive signs of growth – which should be supportive of demand in the coming months – the base metals’ softer price action suggests that the market requires more convincing to overcome the negative sentiment.

The precious metals remain elevated and this suggests an element of uncertainty remains among global investors.