With the market already pricing in a 25-basis-point cut in the central bank’s benchmark interest rate at the Federal Open Market Committee’s (FOMC) July 30-31 meeting, the dovish remarks have fueled expectations of a deeper cut – with the probability of a 50-basis-point cut at the month-end meeting now at 50% from 34% previously.

- Tensions in the Middle East have ratcheted up after US president Donald Trump said the United States destroyed an Iranian drone in the Strait of Hormuz.

- As a result, haven demand has returned with global investors once again re-assessing their risk exposure.

Base metals

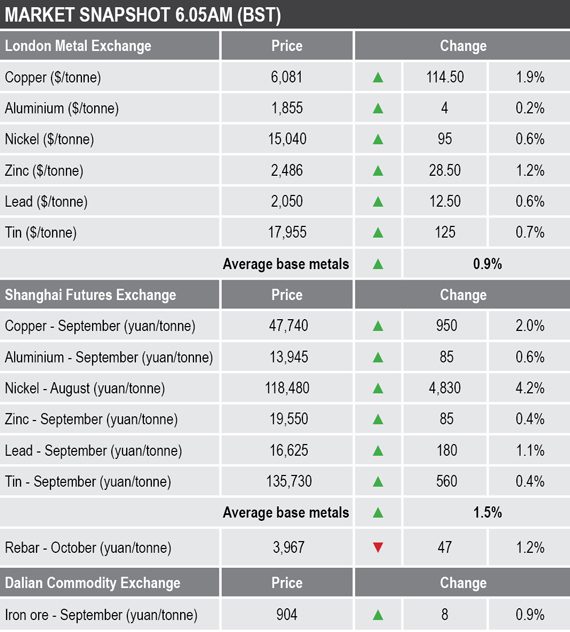

Despite renewed geopolitical tensions, dovish Federal Reserve comments have propelled the London Metal Exchange three-month base metals prices higher on Friday July 19, with the complex up by an average of 0.9% as at 6.05am London time.

It appears that the sharp vertical rally in nickel has also inspired gains in the rest of the base metals; copper was the beneficiary of the bullishness in nickel, with the red metal up by 1.9% and trading as high as $6,102.50 per tonne, while the other LME base metals were up across the board: zinc (+1.2%), tin (+0.7%), lead (+0.6%), nickel (+0.6%) and aluminium (+0.2%).

Buying in copper has been strong this morning with 5,156 lots of the red metal traded as of 06:05am London time, while total volumes have set a new weekly high of 9,286 lots – up from Thursday’s high of 8,093 lots.

In China, investors continue to frantically buy into the August nickel contract on the Shanghai Futures Exchange, with a gain of 4.2% this morning. The rest of the complex were also up, with the September contracts for copper and lead up by 2% and 1.1% respectively, while the September contracts for aluminium, zinc and tin were up between 0.4% and 0.6%.

Spot copper prices in Changjiang were stronger at 47,460-47,780 yuan ($6,898-6,901) per tonne on Friday, by up 1.8% from a day earlier, while the LME/Shanghai copper arbitrage ratio has risen sharply to 8.03 this morning from 7.87 at a similar time on Thursday.

Precious metals

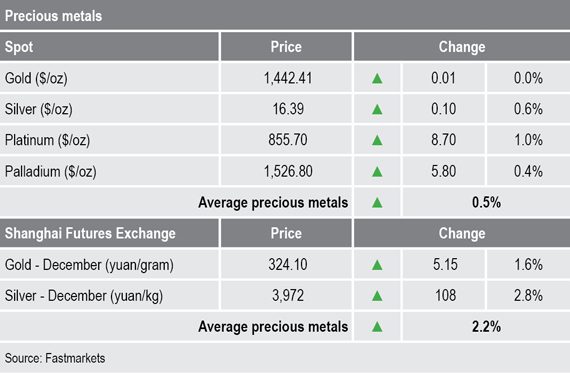

The renewed tensions in the Middle East sparked fresh buying in the spot gold and silver on Thursday, with the former climbing as high as $1,446.60 per oz this morning and silver reaching a high of $16.45 per oz. Both have since retreated with spot gold recently little changed from the previous day’s close at $1,442.41 per oz and spot silver up by 0.6% at $16.39 per oz.

Overall, the precious metals were up by an average of 0.5% this morning. Platinum continues to attract bids and its spot price was up by 1% to $855.70 per oz, while sister-metal palladium recorded a more moderate gain of 0.4% to $1,526.80 per oz.

The precious metals traded on the SHFE were also well bid this morning, with the most-traded December gold and silver contracts up by 1.6% and 2.8% respectively.

Wider markets

The spot Brent crude oil price was recently at $62.90 per barrel this morning, relatively stable after the volatility witnessed on Thursday. The price is still much lower than the $66.70 per barrel seen at the start of the trading week.

The yield on benchmark US 10-year treasuries has recovered some ground this morning, up by 1.03% to trade at 2.0446%. But the German 10-year bund yield dipped lower to -0.3138%, a concerning contrast to Monday’s open of -0.2600%.

In equities, Asian indices were mostly trading higher on Friday: Nikkei (+2.01%), Topix (+1.91%), Hang Seng (+1.04%), CSI300 (+0.94%) and ASX200 (+0.72%).

This follows positive closes in the US on Thursday that saw the S&P500 close 0.36% higher, the Nasdaq up by 0.27% and Dow Jones Industrial Average eke out a 0.01% gain.

Currencies

The dollar dipped in early trading on Friday, down by 0.02% to 96.89 as at 6.05am London time, following the dovish comments from Federal Reserve officials and expectations of a deeper cut in interest rates at the FOMC’s July 30-31 meeting. We expected the central bank will stick with an initial cut of 25 basis points in July, leaving the option for a further cut later in the year.

With the dollar softer, most of the other major currencies we track have strengthened: Japanese yen (107.64), euro (1.1257), the Australian dollar (0.7065) and the Chinese yuan (6.8770). The exception to this was the pound sterling that was unchanged at the time of writing at 1.2530.

Key data

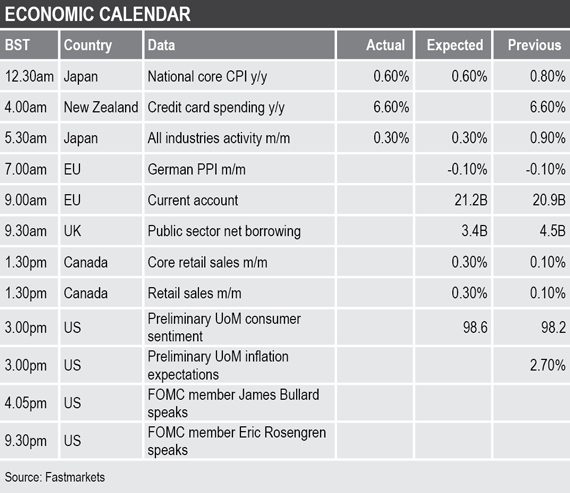

In data on Friday, Japan’s national core consumer price index (CPI) and all industries data was in line with market expectations at 0.6% and 0.3% respectively.

Data out later includes the preliminary readings of the University of Michigan’s consumer sentiment and inflation expectations. In addition, FOMC members James Bullard and Eric Rosengren are speaking.

Today’s key themes and views

The old saying that “the market can stay irrational longer than you can stay solvent” is most apt in the current trading environment for the key assets we follow. It is quite unusual that LME copper, which struggled to attract bids on Thursday, is now outperforming its peers a day later. Yet, one could argue that the fundamental backdrop for the red metal has not changed, and the belated reaction seems to suggest that perhaps Chinese investors are starting to warm to copper as the next best asset to invest in now that nickel is beginning to look a little crowded.

As such, an irrational trading mentality begets irrational prices and the sustainability of the rallies currently underway across the LME base metals should remain a concern. This is especially true in the current macroeconomic climate of weakening government bond yields, central banks rushing to cut interest rates, a simmering trade war between the world’s two largest economies and a spate of anemic global growth – all of which in no way justify the current strength.

That said, we expect more short-term upside to emerge because the market now expects any upcoming bad news – i.e. poor economic data – to be “good” news as it will likely inspire central banks to ease interest rates, which is positive for base and precious metals prices.