- Gold prices and US treasuries rise while demand for havens rebounds.

- Asian equities are under pressure, led by a 2% fall in the Hang Seng.

Base metals

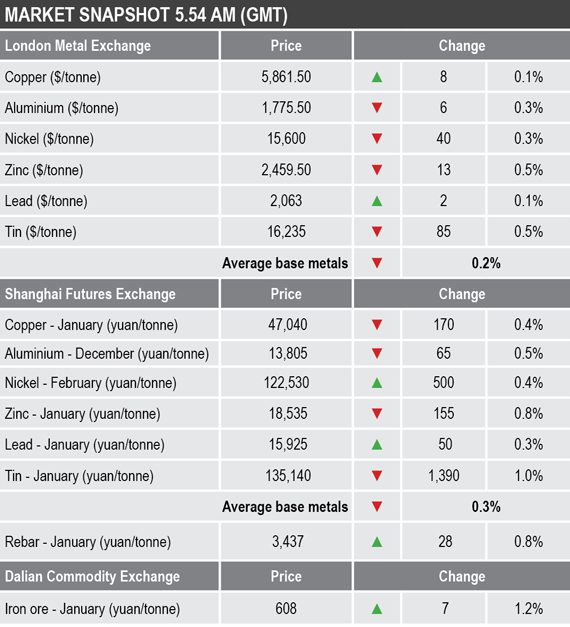

Three-month base metals prices on the London Metal Exchange were for the most part weaker on Wednesday morning, with the complex off by an average of 0.3% from their closes on Tuesday. Copper and lead bucked the trend with gains of 0.1%, while zinc led on the downside with a 0.5% fall to $2,459.50 per tonne. Copper was recently quoted at $5,861.50 per tonne.

Traded volume has been average with 5,191 lots traded as at 5.54am London time.

In China, the most-traded base metals contracts on the Shanghai Futures Exchange were mixed, with February nickel and January lead up by 0.4% and 0.3% respectively, while the rest of the complex were down by an average of 0.7%. January copper was off by 0.4% at 47,040 yuan ($6,713) per tonne.

The spot copper price in Changjiang was down by 0.2% at 46,930-47,080 yuan per tonne and the LME/Shanghai copper arbitrage ratio was slightly firmer at 8.03, compared with 8 at a similar time on Tuesday.

Precious metals

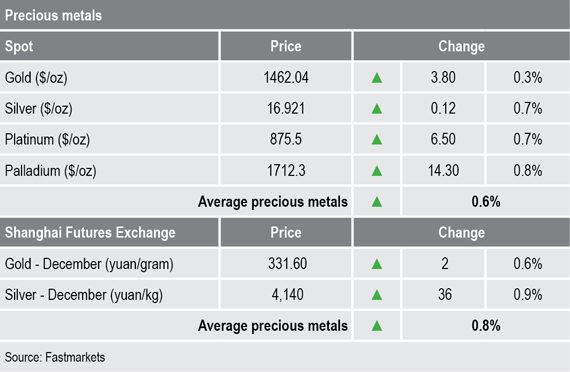

Spot gold prices were rebounding in what appears to be a combination of rebounding off support and buying on the back of a slight pick-up in investor concern over the US-China trade talks and the situation in Hong Kong.

Silver and palladium prices have followed gold’s lead, while platinum prices were consolidating.

Wider markets

The yield on benchmark US 10-year treasuries has fallen back and was recently quoted at 1.9209%, compared with around 1.9404% at a similar time on Tuesday morning. The German 10-year bund yield was also weaker and was recently quoted at -0.2523%, compared with -0.2322% at a similar time on Tuesday.

Asian equities were weaker this morning: the Hang Seng (-2.06%), the Nikkei (-0.85%), the Kospi (-0.86%), China’s CSI 300 (-0.14%) and the ASX 200 (-0.81%).

This follows a mixed performance in Western markets on Tuesday, where in the US, the Dow Jones Industrial Average closed unchanged at 27,691.49, while in Europe, the Euro Stoxx50 closed up by 0.42% at 3,712.20.

Currencies

The dollar index is consolidating this morning and was recently quoted at 98.34, this after a strong run last week that had seen it rise from a low of 97.16 on November 4 to 98.40.

The other major currencies we follow are consolidating: the euro (1.1011), the Australian dollar (0.6846), the yen (109.08) and sterling (1.2851) is firmer.

The yuan (7.0167) is weaker, which highlights the negativity of Trump’s speech, we think.

Key data

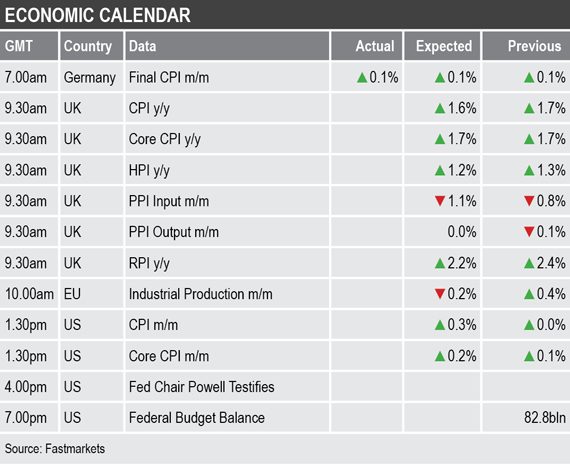

Data already out on Wednesday showed Germany’s consumer price index (CPI) rose 0.1%, which was unchanged. Later there is price data out from the United Kingdom, industrial production data out from the European Union and CPI and the Federal budget balance data out from the US.

US Federal Reserve chair Jerome Powell is scheduled to testify on the economy before the Joint Economic Committee.

Today’s key themes and views

News about trade negotiations between China and the US needless to say remains all important for the market as can be seen by the markets’ reaction to Trump’s speech on Tuesday afternoon. Today the base metals are looking weaker across the board, so we expect further consolidation until the news improves.

Gold prices, along with other havens, are firmer, which highlights the increased uncertainty over the US-China trade talks, especially as a failure to reach an agreement is likely to see the trade escalate further.