That said, US equities went on to brush off the news with markets closing at record highs again on Friday November 8.

- Gold prices break below support as US equities rally.

- Unrest in Hong Kong weighs on market sentiment in Asia this morning.

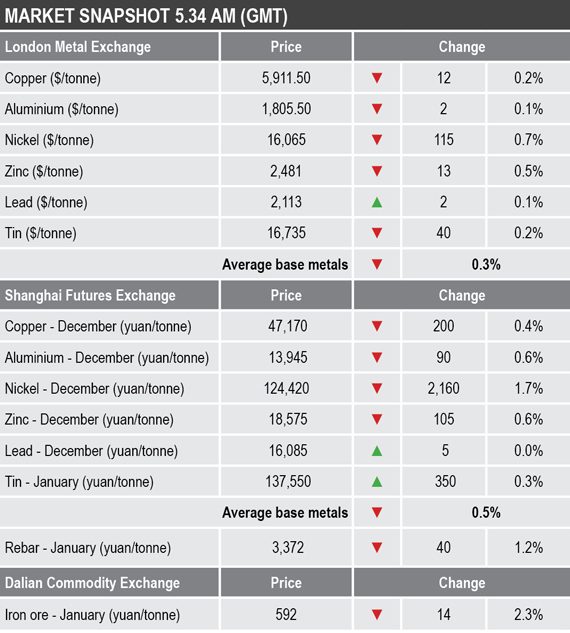

Base metals

Three-month base metals prices on the London Metal Exchange have for the most part seen follow-through weakness this morning, with the complex down by an average of 0.3%. Nickel led the decline with a 0.7% drop to $16,065 per tonne, lead was bucking the trend with a 0.2% rise to $2,113 per tonne and copper was down by 0.2% at $5,911.50 per tonne.

Traded volume remains light with 3,061 lots traded as at 5.34am London time.

In China, the most-traded base metals contracts on the Shanghai Futures Exchange were for the most part weaker, with December nickel leading on the downside with a 1.7% decline, December copper, aluminium and zinc were down by an average of 0.5%, with December copper off by 0.4% at 47,170 yuan ($6,741) per tonne. December lead was little changed and January tin was up by 0.3%.

The spot copper price in Changjiang was down by 0.4% at 47,080-47,170 yuan per tonne and the LME/Shanghai copper arbitrage ratio was slightly firmer at 7.98, compared with 7.96 at a similar time on Friday.

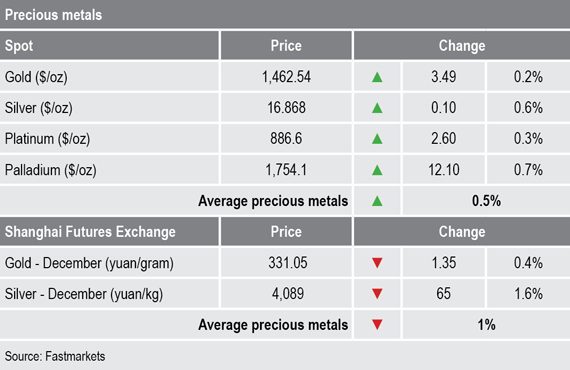

Precious metals

Spot gold prices are consolidating this morning and were recently quoted at $1,462.54 per oz, with the precious metals complex, including gold, up by an average of 0.5%, but this is after losses averaging 2.1% on Friday. The low in spot gold on Friday was $1,456.30 per oz, which means prices have so far corrected 6.5% from the early-September highs of $1,557.20 per oz.

Wider markets

Spot Brent crude oil prices were weaker this morning, with prices down by 1.3% from Friday’s close and recently quoted at $61.85 per barrel. Prices did set a fresh one-and-a-half month high at $63.26 per barrel last Thursday.

Despite cool water been poured on talk that a trade deal was in the making last week, haven products are weaker with the yield on benchmark US 10-year treasuries strengthening further. It was recently quoted at 1.9407%, compared with around 1.9023% at a similar time on Friday morning. The German 10-year bund yield was weaker, however, recently quoted at -0.2637%, compared with -0.2472% at a similar time on Friday.

Asian equities were mixed this morning: the Hang Seng (-2.85%) led on the downside, followed by China’s CSI 300 (-1.76%), the Nikkei (-0.26%) and the Kospi (-0.61%), but the ASX 200 (+0.72%) was stronger.

This follows a mixed performance in Western markets on Friday, where in the US, the Dow Jones Industrial Average closed up by 0.02% at 27,681.24, which was a fresh record high, along with record high closes on the S&P 500 and Nasdaq Composite, while in Europe, the Euro Stoxx50 closed down by 0.19% at 3,699.65.

Currencies

The dollar index is consolidating this morning and was recently quoted at 98.31, this after a strong run last week that had seen it rise from a low of 97.16 on November 4. This rebound follows the index’s fall to 97.12 from the October 1 high at 99.67.

The other major currencies we follow are for the most part weaker: the euro (1.1024), sterling (1.2794) and the Australian dollar (0.6852), while the yen, having weakened last week, is edging higher this morning and was recently quoted at 108.95.

Key data

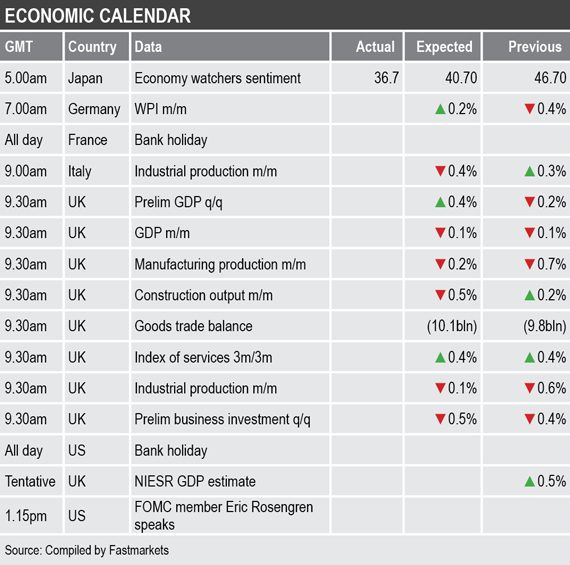

Data already out on Monday shows Japan’s economy watchers sentiment for October drop to 36.7 from 46.7 in September and Germany’s wholesale price index drop by 0.1% for October, after a 0.4% drop in September.

Key data out later includes Italian industrial production and a host of releases from the United Kingdom including preliminary gross domestic product, industrial and manufacturing production, construction output, goods trade balance, index of services and preliminary business investment.

US Federal Open Market Committee member Eric Rosengen is scheduled to speak this afternoon.

Today’s key themes and views

While progress, or lack thereof, in trade negotiations between China and the US is setting the mood in the base metals, nickel and lead are reacting to their own individual circumstances.

Nickel is correcting the mismatch between the tightness on the LME and the general situation in the physical market where there is good availability of nickel units and lead is reaching to a combination of a weaker outlook for next year and the pick-up in stocks in Shanghai monitored warehouses, where stocks rose by 34.6% last week to 28,850 tonnes – not that that is a high level of stocks.

We still expect developments in US-China trade negotiations to set the overall direction, and even lead and nickel are likely to follow that direction once they have consolidated/adjusted for recent gains.

Gold prices, along with other havens seem to be reacting to the rally in US equities and the overall notion that a partial trade deal is still more likely now than it has been for a long time.