The London Metal Exchange three-month base metals prices were weaker on Friday morning and it is worth noting that the strongest performer this week, nickel, has started to pull back too.

- Geopolitical tensions in the Middle East show no signs of easing and the risk of a prolonged standoff has increased.

- Haven demand has strengthened with the spot gold price trading as high as $1,424 per oz.

- Given that it is month-end and the macroeconomic backdrop remains highly uncertain, most investors are likely to move to the sidelines to reduce their risk exposure.

Base metals

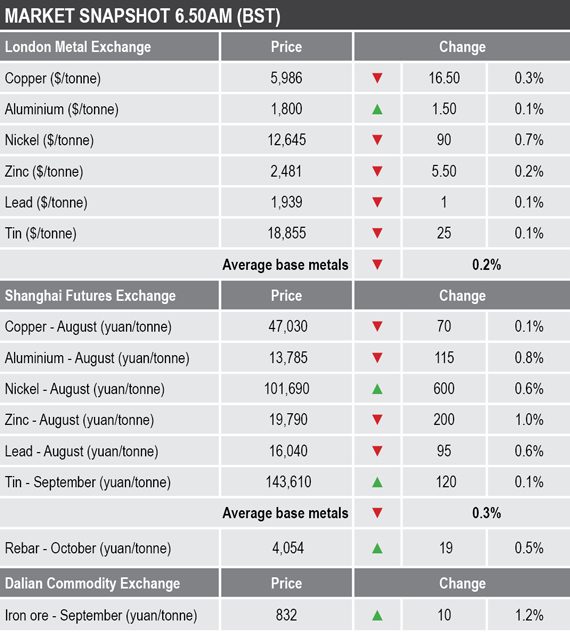

The LME three-month base metals prices were broadly weaker this morning, down by an average of 0.2% as at 06.50am London time. Aluminium was the exception with a gain of 0.1% to $1,800 per tonne.

The rest were down between 0.1% for lead and tin and 0.7% for nickel.

In China, base metals prices on the Shanghai Futures Exchange were similarly weaker, down by 0.3% on average. That said, higher iron ore prices continue to fuel strong buying in nickel, with the metal’s most-traded contract on the SHFE up by 0.6% at 101,690 yuan ($14,814) per tonne. September tin managed to eke out a 0.1% gain, while the August contracts for zinc (-1%), aluminium (-0.8%), lead (-0.6%) and copper (-0.1%) were all down.

Spot copper prices in Changjiang were down by 0.4% at 46,970-47,140 yuan per tonne and the LME/Shanghai copper arbitrage ratio has edged lower to 7.91 – slightly down from 7.93 at a similar time on Thursday.

Precious metals

On average, the precious metals complex was up 0.4% at the time of writing amid signs simmering geo-political tensions in the Middle East as well as the high risk G20 summit event.

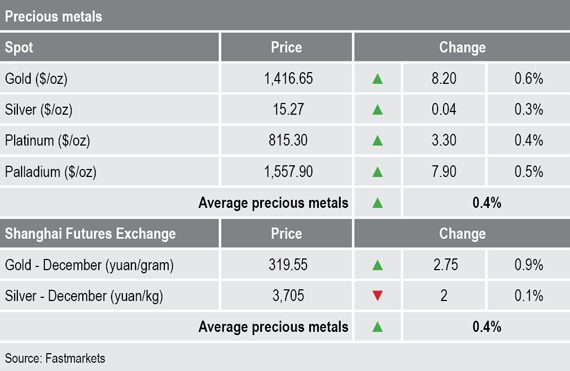

The precious metals complex is firmer this morning, up by an average of 0.4%, while geopolitical tensions simmer and world leaders meet in Osaka for the G20 meeting. Spot gold and silver prices have edged higher by 0.6% and 0.3% respectively, with gold recently trading at $1,416.65 per oz and silver at $15.27 per oz.

Meanwhile, the platinum price is firmer this morning, up by 0.4% and was recently $815.30 per oz. Sister-metal palladium continues to rally with a 0.5% gain to $1,557.90 per oz.

The December gold contract on the SHFE was up by 0.9%, while the December silver contract slid by 0.1%.

Wider markets

The spot Brent crude oil price remains well supported and traded as high as $66.71 per barrel in the early Asian trading session but has since stabilized at $66.12 per barrel.

The yield on benchmark US 10-year treasuries continues to hover above the 2% mark and was recently up by 0.36% at 2.0213%. But the German 10-year bund yield still trades in negative territory and was last seen at -0.3200%.

In equities, broad-based selling pressure emerged in Asian markets, with the ASX (-0.71%), Hang Seng (-0.51%), Nikkei (-0.29%) and CSI300 (-0.24%) and Topix (-0.14%) all down.

This follows the mixed closes in major US indices on Thursday, with the Dow Jones Industrial Average down by 0.04% while the S&P500 was up by 0.38% and the Nasdaq continued to recover with a decent gain of 0.73% to close at 7,967.

Currencies

The rebound momentum in the dollar index proved short-lived after fresh downside pressure has emerged. The index was down by 0.11% at 96.11 at the time of writing. As demand for haven assets returns, so has the recent strength in the Japanese yen, last at 107.69.

The other major currencies have edged higher on the back of the weaker dollar, with the euro up by 0.13% at 1.1385 while sterling was marginally higher at 1.2674. The Australian dollar continues to go strong and has broken above the 0.7000 level.

The yuan strengthened over the three days but was a tad weaker this morning at 6.8656, down by 0.17% at the time of writing.

Key data

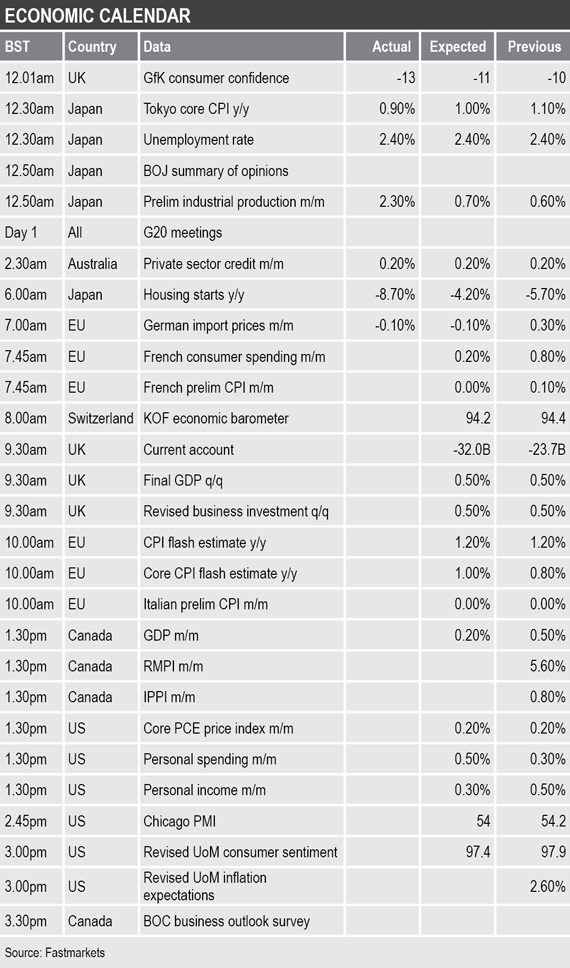

Data out in the early Asian trading session saw Japanese releases such as the Tokyo core consumer price index (CPI) coming in below expectations at 0.9%, versus the forecast 1%, and the unemployment rate flat with analysts’ forecasts at 2.4%. The country’s preliminary industrial production figure surprised to the upside at 2.4%, exceeding the expected 0.7%.

It is a busy day for data on Friday with the United Kingdom’s current account and final revision of first-quarter GDP, the European Union’s CPI flash estimate and US releases that include the PCE price index, personal spending, Chicago purchasing managers’ index (PMI) and the University of Michigan’s consumer sentiment and inflation expectations of note.

Today’s key themes and views

The meeting between US president Donald Trump and China’s Xi Jinping scheduled for Saturday is a high-risk macro event. Market participants expect both sides will opt to ease tensions and potentially restart trade talks. But we do not think that both sides are willing to back away from their demands and the G20 summit is merely another act to calm a jittery global market.

We maintain our view that another bout of buying in haven assets could emerge if geopolitical tensions in the Middle East escalate further or the G20 summit fails to produce any clear picture on the simmering trade war between the United States and China.