- EU manufacturing PMI drops to 47.7, US equivalent falls 2 points to 50.6

- Investors favor gold and US treasuries as risk-off increases

Base metals

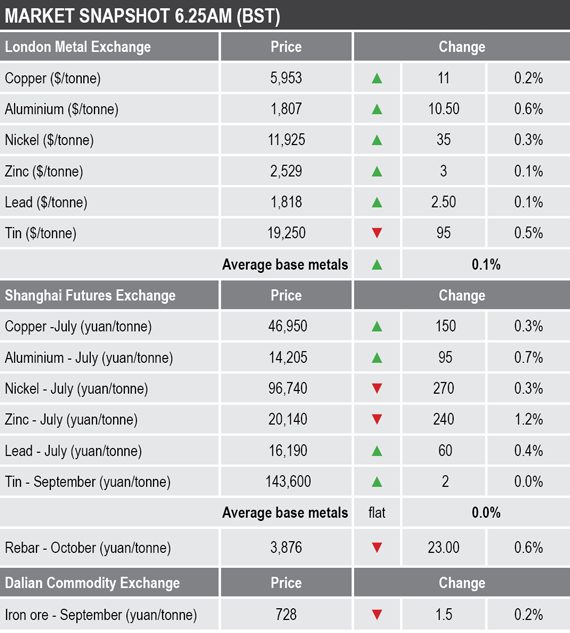

Three-month base metals prices on the London Metal Exchange were for the most part firmer on Friday morning, the exception was tin where prices were off by 0.5%, while the rest were up by an average of 0.3% – led by a 0.6% gain in aluminium. Copper was recently quoted at $5,953 per tonne, compared with Thursday’s close of $5,942.

Copper, aluminium and zinc prices, all extended their second quarter lows this week, while the rest tested underlying support, which so far has held. Those that did set fresh multi-month lows on Thursday, did see buying emerge intraday with all closing well off their lows and establishing hammer-shaped candlesticks – formations that tend to be bullish – on the charts in the process.

In China, base metals prices on the Shanghai Futures Exchange were mixed on Friday, with July nickel and zinc down by 0.3% and 1.2% respectively, September tin was little changed, while the rest of the July contacts were up between 0.3% and 0.7%, with July copper up by 0.3% at 46,950 yuan ($6,790) per tonne, compared with Thursday’s close of 46,800 yuan per tonne.

Spot copper prices in Changjiang were up by 0.4% at 46,890-46,945 yuan per tonne and the LME/Shanghai copper arbitrage ratio was at 7.89.

Precious metals

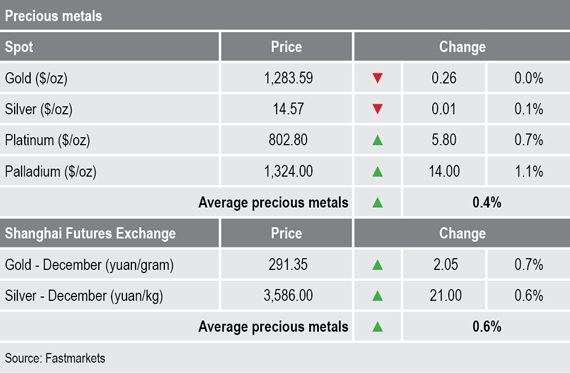

The rise in tension over trade and the deteriorating economic data, as seen by the PMI releases, has led to a shift into haven assets with spot gold prices recently quoted at $1,283.59 per oz, off by 0.26% from Thursday’s close at $1,284.95 per oz, but well up from Tuesday’s low of $1,269.55 per oz.

On the SHFE, the December gold and silver contracts were up by 0.7% and 0.6% respectively from Thursday’s close.

Wider markets

In wider markets, the spot Brent crude oil price has tumbled this week, but started to consolidate this morning and were recently quoted at $68.40 per barrel, up by 0.65% from Thursday’s close at $67.96. At the start of the week, the price was as high as $73.38 per barrel.

The yield on benchmark US 10-year treasuries has fallen further and was recently quoted at 2.3232%, with the yield on Thursday falling to levels last seen in 2017. The yields on the US two-year and five-year treasuries remain inverted.

The German 10-year bund yield remains in negative territory and was recently quoted at -0.1100%.

Asian equity markets were mixed this morning: Nikkei (-0.16%), Hang Seng (+0.33%), CSI 300 (+0.39%), the Kospi (-0.69%) and the ASX 200 (-0.55%).

This follows a weakness in western markets on Thursday. In the United States, the Dow Jones Industrial Average closed down by 1.11% at 25,490.47, while in Europe the Euro Stoxx 50 was down by 1.76% at 3,327.20.

Currencies

The dollar index is consolidating and was recently quoted at 97.74, this after setting a fresh two-year high on Thursday at 98.38.

The other major currencies have been weaker while the dollar has been stronger, but today’s consolidation in the dollar has lifted the others: sterling (1.2681), the Australian dollar (0.6896), the Japanese yen (109.55) and the euro (1.1195) are consolidating.

The yuan has flattened out either side of 6.9000 and was recently quoted at 6.9029, compared with around 6.7100 in mid-April before the escalation in the US-China trade dispute.

Key data

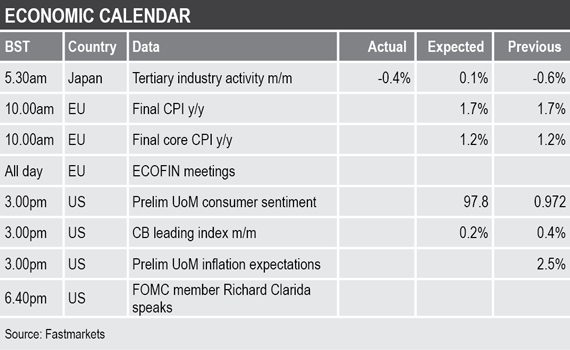

Data out already on Friday showed Japan’s all industries activity fall 0.4%, this after a 0.2% decline previously. Data out later included UK retail sales, the Confederation of British Industry (CBI) realized sales, with US data including durable goods orders and the Treasury currency report.

Today’s key themes and views

With hopes of a trade deal slipping and the economic data deteriorating, it does look as though the race against time for a trade deal to be made before recession unfolds is in danger of being lost and that is being reflected in market sentiment.

Any continued economic slowdown will take pressure off the tightening fundamentals in those metals where the fundamentals remain tight. As we have said for a long time now, if and when a traded deal is agreed then we would expect a significant market reaction once business confidence is allowed to grow and as supply chains restock. But, given how a trade deal between China and the US remains elusive, any lasting bullishness may not appear until a deal has been signed. Until then the sideways-to-lower drift may continue.

The gold price has had another blip higher on the back of the latest risk-off move in markets and with treasury yields low and negative in the case of some European yields, the opportunity cost of holding gold is low. That said, the medium-term trend in gold remains to the downside. Even mighty palladium is now trending lower.