- Asian-Pacific equities and major western pre-market equity futures indices were in negative territory this morning.

- Haven assets like gold, US treasuries and the yen are all pointing to a pick-up in investor concern.

Base metals

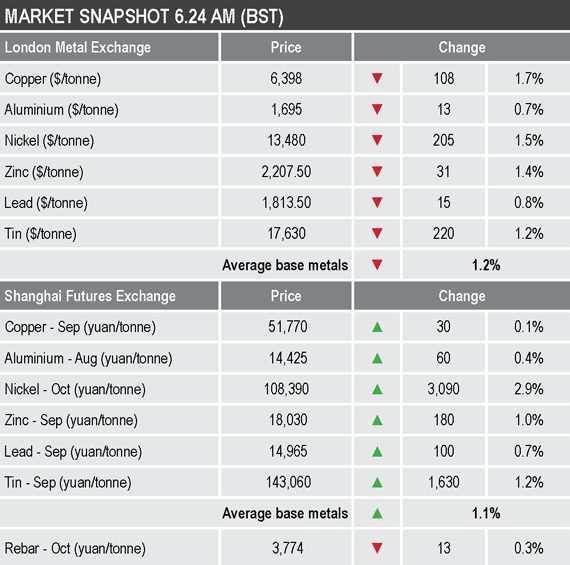

Three-month base metals prices on the LME were down by between 0.7% for aluminium ($1,695 per tonne) and 1.7% for copper ($6,398 per tonne), with the complex down by an average of 1.2%.

Volume has been higher than of late, with 5,916 lots traded as of 6.24am London time.

Oddly, the most-traded base metals contracts on the Shanghai Futures Exchange were up across the board, with gains averaging 1%, and it was not that trading on the LME was overly bullish on Thursday; the LME base metals gave a mixed performance yesterday, with copper, lead and zinc lower, while the rest were firmer.

So why are SHFE prices up and LME down? Maybe this polarization reflects the view that western markets have rallied more than the fundamentals justify, while China’s rebound is gaining momentum.

Precious metals

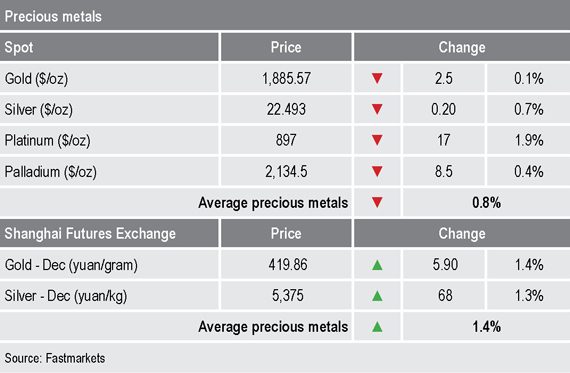

Spot gold prices were down by 0.1% at $1,885.57 per oz this morning, compared with Thursday’s close. The high seen yesterday being $1,898.35 per oz – the 2011 high at $1,921.13 per oz may well now act as a magnet.

Silver ($22.49 per oz) was down by 0.7%, platinum ($897 per oz) was down by 1.9% and palladium ($2,134 per oz) was down by 0.4%, compared with Thursday’s closes. The overall risk-off sentiment seems to have triggered some profit-taking in the precious metals.

Wider markets

The yield on US 10-year treasuries was at 0.57% this morning – this is the lowest it has been for a while and highlights some underlying stress and haven demand, as does of course the strength in gold and with the yen also stronger. Warning lights seem to be flashing that we might see a deeper bout of risk-off, spooked by rising United States-China tension.

Asian-Pacific equities were weaker this morning: the Hang Seng (-2.28%), the CSI 300 (-3.75%), the Nikkei (closed), the ASX 200 (-1.28%) and the Kospi (-0.45%).

Currencies

The US dollar index was trending lower and was recently quoted at 94.66, while the low on Thursday was 94.59, which breached the March low of 94.63, signaling a likely continuation of the downward trend in the dollar.

The euro (1.1607) seems the main beneficiary of the weaker dollar because it has broken higher, while sterling (1.2741) is still within its recent range, the Australian dollar (0.7091) is consolidating after recent strength and the yen (106.37) is starting to challenge recent highs that lie between 106.07 and 105.99.

Key data

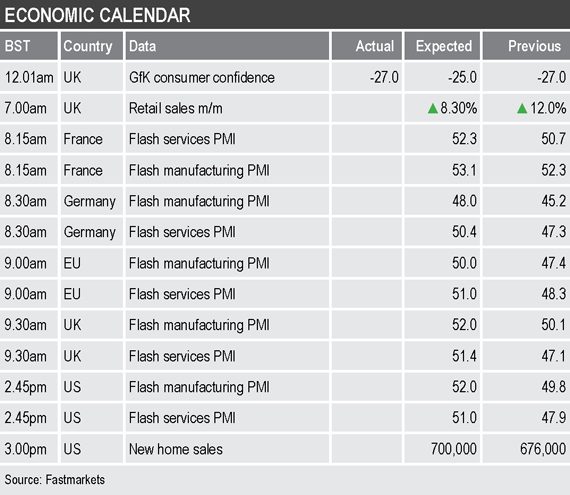

Friday’s economic agenda is busy and is focused on purchasing managers’ index (PMI) data for manufacturing and services with data out across Europe and the US.

Data already out on Friday showed the United Kingdom’s GfK consumer confidence index for July was unchanged at -27, while retail sales in the UK climbed by 13.9% month on month in June, better than the 8.3% rise expected. There is also US data on new home sales.

Today’s key themes and views

A correction is underway in the base metals on the LME, but given the price rebound in recent months that is unsurprising and so far the pullbacks have been limited. We should get a feel for how much froth has been baked into the rally, by seeing how far the pullbacks go.

Overall, we expect dips will be supported because of production disruptions, potential for stockpiling, promises of infrastructure spending and as institutional investors have access to cheap financing so may be looking for long-term buy and hold opportunities.

Gold seems to be adjusting for different financial times ahead, where interest rates remain low for a long time, where there is increased risk due to the uncertainty that comes with the pandemic and the unknown consequences of pumping so much money and debt into the global financial system. The price may not be immune to profit-taking sell-offs along the way should other markets correct, but overall we expect gold’s repositioning to mean higher prices.