On Monday we had thought poor corporate earnings data had the potential to rattle markets, but it seems that negative oil futures prices were the catalyst that caused traders concern.

The soon-to-expire May contract for West Texas Intermediate (WTI) at one stage dropped to -$40 per barrel on Monday, having been trading around $18 per barrel on April 17. This was a futures market aberration; spot crude oil prices have remained in positive territory and were recently quoted at around $21.60 per barrel, having been down as low at $20.36 per barrel on Monday.

- United States looks to temporarily suspend immigration.

- Fall in oil prices highlights the damage done to demand for commodities, but oil’s price slump is more a storage problem, which is not something that should affect most of the metals.

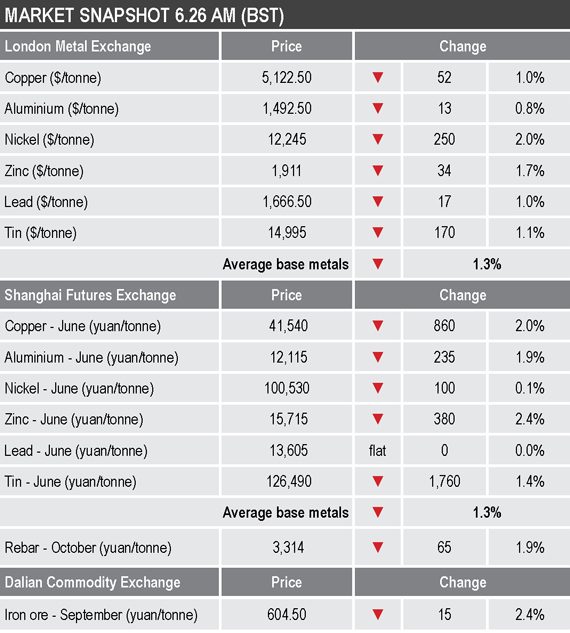

Base metals

Three-month base metals prices on the LME were down by an average of 1.3% this morning, led by a 2% fall in nickel prices to $12,245 per tonne, with the rest of the complex off by between 0.8% for aluminium ($1,492.50 per tonne) and 1.7% for zinc ($1,911 per tonne). Copper was down by 1% at $5,122.50 per tonne, this after a high on Monday of $5,248 per tonne.

Volume on the LME remains high with 10,060 lots traded as at 5.49am London time, compared with an average of 8,308 lots traded at a similar time across last week.

The most-traded base metals contracts on the SHFE were also weaker by an average of 1.3%, led by a 2.3% fall in June zinc prices, with June copper the second worst performer with a 2% decline to 41,540 yuan ($5,871) per tonne.

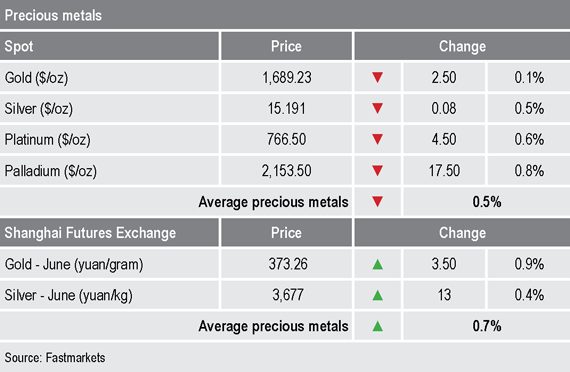

Precious metals

Spot gold prices started to rebound on Monday, and were recently quoted at $1,689.23 per oz, this after a low on Monday of $1,671.70 per oz. The more industrial precious metals are weaker this morning with losses averaging 0.6%. The gold/silver ratio is fairly flat and was recently quoted at around 1:111.

Wider markets

We had noticed in recent days that despite the return of risk-on in broader markets the yield on benchmark US 10-year treasuries was not on the rise, which suggested a degree of caution; the yield is weaker again this morning at 0.6%, compared with 0.63% at a similar time on Monday.

Asian-Pacific equities were weaker this morning: the Nikkei (-1.91%), the Hang Seng (-2.29%), the ASX 200 (-1.64%), the Kospi (-1.67%) and China’s CSI 300 (-1.66%).

Currencies

The dollar index is working higher again, it was recently quoted at 100.12, this after 99.98 at a similar time on Monday and after a low of 98.81 on April 14.

The other major currencies we follow are slightly weaker: sterling (1.2406), the euro (1.0840) and the Australian dollar (0.6309), while the yen (107.47) is firmer.

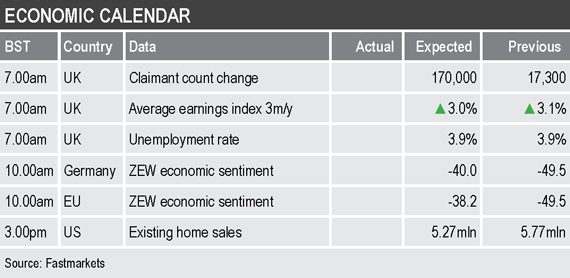

Key data

Today’s economic data is mainly focused on Europe with employment and earnings data from the United Kingdom, economic sentiment data from Germany and the European Union from the Zentrum fur Europaische Wirtschaftsforschung (ZEW) institute. There is also US data on existing home sales.

Today’s key themes and views

With the monetary easing and fiscal stimulus announcements tailing off, the markets may have to face reality for a while and question whether the rebounds off the March lows have been justified.

While China’s industry and manufacturing may have returned to work, domestic demand seems to be recovering at a slow pace and with demand for its exports low, just how fast can it ramp-up output? At the same time, with Europe and the US in a transition phase with some areas allowing some businesses to reopen, while in other areas lockdowns are being extended, at best demand recovery is going to be very weak.

The danger is the supply side of the market recovers before the demand side and that leads to the build-up of inventories.

Perhaps metals producers should take note of what has happened to oil – the market may punish it if it overproduces, or at least floods the market with metal.

Gold prices have experienced some profit-taking, but our overall view on gold is unchanged: the combination of economic pain, much uncertainty and ultra-loose monetary and fiscal policy, are expected to support demand for gold and other havens and we expect dips to be bought into.

There may be risk of further distress selling to raise money for margin calls is equities sell-off again, but overall in these very uncertain times gold may offer relatively security, especially as the opportunity cost of holding gold is low.