The latest retreat in equities was partly fueled by the US Centers for Disease Control and Prevention warning Americans to prepare for the spread of the novel coronavirus (2019-nCoV) in the United States, and while the virus spreads deeper into countries outside China.

- US 10-year treasuries yields dropped to a record low of 1.3155% on Tuesday.

- Asian equities were down on Wednesday, US equity indices dropped 3% for a second consecutive day on Tuesday.

- Hong Kong to disperse “helicopter money” with cash handouts of HK$10,000 ($1,284) per permanent resident over the age of 18.

Base metals

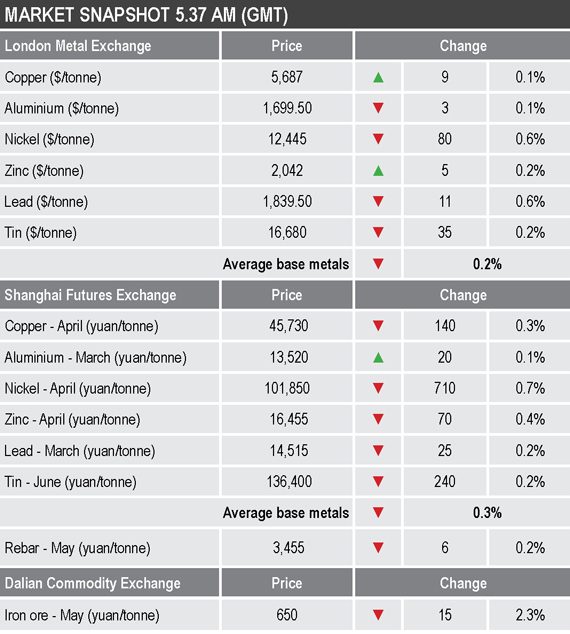

The three-month base metals prices on the London Metal Exchange were mixed this morning, led by 0.6% falls in nickel and lead to $12,445 per tonne and $1,839.50 per tonne respectively. The others lie within a range of down by 0.2% and up by 0.2%, with copper up by 0.1% at $5,687 per tonne.

Trading volume is picking up again this week, with 8,686 lots traded as at 5.37am London time, taking the average so far this week to 9,321 lots for this time of day. This compares with last week’s average of 6,649 lots for this time of day.

The most-traded base metals contracts on the Shanghai Futures Exchange were for the most part weaker on Wednesday, with prices down by an average of 0.3%. The exception was April aluminium that was up by 0.1%, April nickel led on the downside with a 0.7% fall, April zinc was down by 0.4%, with April copper off by 0.3% at 45,730 yuan ($6,495) per tonne, while April lead and June tin were both down by 0.2%.

The spot copper price in Changjiang was down by 0.3% at 45,320-45,400 yuan per tonne, while the LME/Shanghai copper arbitrage ratio was at 8.04, compared with 8.01 on Tuesday.

Precious metals

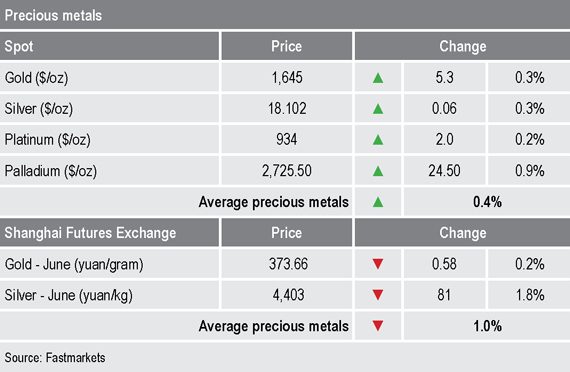

Despite the escalation in fear across financial markets, the rally in gold has faltered, with prices consolidating around $1,640 per oz, down from Monday’s high of $1,689 per oz. Profit-taking and selling to raise funds for margin calls in other markets may well be behind the price retreat – we do not see the retreat as reflecting any reduction in concerns.

Wider markets

Having set a record low on Tuesday at 1.3155%, the yield on benchmark US 10-year treasuries was recently quoted at 1.35%, compared with 1.4% at a similar time on Tuesday.

Asian equities were weaker this morning: Nikkei (-0.79%), China’s CSI 300 (-0.82%), the ASX 200 (-2.31%), the Hang Seng (-0.81%) and the Kospi (-1.28%).

Currencies

Weaker equities and treasury yields – real yields on 10-year Treasury Inflation Protected Securities (TIPS) are now -0.2% – are weighing on the dollar, with the dollar index recently quoted at 99.07, compared with 99.30 at a similar time on Tuesday and a peak on February 20 of 99.91.

The other major currencies we follow are mixed with the Australian dollar (0.6578) weak and the yen (110.35) strengthening, no doubt as Japanese investors repatriate funds in this time of trouble. Sterling (1.2979) and the euro (1.0872) are working sideways to higher while they rebound off recent lows.

Key data

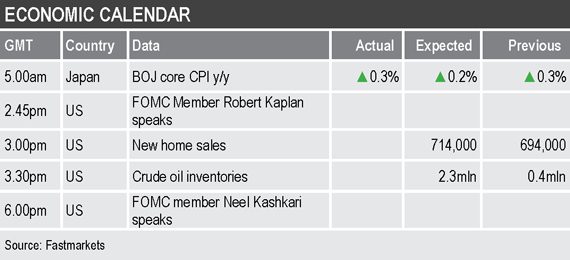

Economic data already out on Wednesday shows Japan’s consumer price index rise by 0.3% in January, unchanged from December’s number. In the US, there is data on new home sales and crude oil inventories.

In addition, US Federal Open Market Committee members Robert Kaplan and Neel Kashkari are speaking.

Today’s key themes and views

Apart from tin, which is managing to hold near rebound highs, the rest of the base metals are on a back footing while they drift lower with the near-term outlook continuing to deteriorate. As the virus spreads outside China, more businesses are likely to face either temporary closure or reduced output, which for manufacturing will mean weaker demand for manufacturing materials.

If the World Health Organisation’s assessment is correct and the epidemic has peaked in China then that is one bit of good news, but the wider spread likely means the global impact will be considerable. As such we expect more downward pressure on the metals.

Gold prices seem to be absorbing profit-taking, given all the uncertainty and nervousness across markets we expect gold will attract further waves of safe-haven buying.