The Dow Jones Industrial Average in pre-market trading on Friday February 28, is indicated at 25,190, which means it is down by 14.9% from the January high, while at their individual lows in recent weeks, the base metals prices have been down by an average of 13.4% from their January highs.

- The Asian equity indices we follow are down between 2.7% and 4.5% this morning.

- Gold prices are falling too, probably as profits are taken to raise cash for margin calls.

- Japanese yen and United States treasuries take the lead in being safe-haven assets of choice.

Base metals

The three-month base metals prices on the London Metal Exchange were weaker across the board by an average of 0.9% this morning, led by a 1.5% drop in zinc to $1,994.50 per tonne. This was followed by 1.2% falls in nickel and copper to $12,235 per tonne and $5,586.50 per tonne respectively. Aluminium, at $1,674 per tonne, was off by 1%, while lead was down by 0.5% at $1,807 per tonne and tin was off by 0.1% to $16,310 per tonne.

Trading volume is picking up again this week, with 12,6502 lots traded as at 5.37am London time, this compares with last week’s average of 6,649 lots for this time of day.

The most-traded base metals contracts on the Shanghai Futures Exchange were also down across the board by an average of 1.8%, led by a 2.9% drop in April zinc. April copper, was down by 1.6% at 44,810 yuan ($6,386) per tonne.

The spot copper price in Changjiang was down by 1.2% at 44,450-44,810 yuan per tonne, while the LME/Shanghai copper arbitrage ratio was at 8.02, compared with 8.04 on Wednesday.

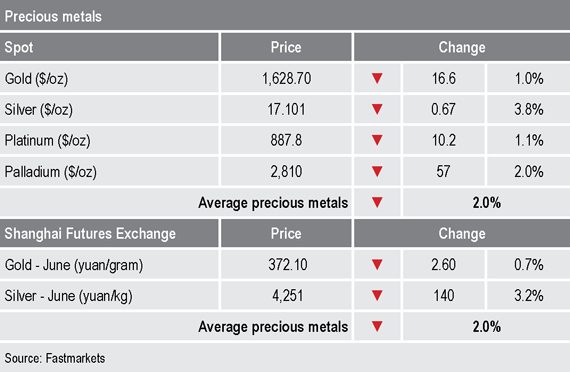

Precious metals

Despite the escalation in fear across financial markets, the rally in gold has faltered, with prices off by 1% this morning at $1,628.70 per oz, down from Monday’s high of $1,689 per oz. Profit-taking and selling to raise funds for margin calls in other markets may well be behind the price retreat.

Wider markets

The yield on benchmark US 10-year treasuries was recently quoted at 1.23%, compared with 1.49% at a similar time on February 21.

Asian equities were weaker this morning: Nikkei (-3.67%), China’s CSI 300 (-3.11%), the ASX 200 (-3.25%), the Hang Seng (-2.74%) and the Kospi (-3.3%).

Currencies

Weaker equities and treasury yields – real yields on 10-year Treasury Inflation Protected Securities (TIPS) are now -0.23% – are weighing on the dollar, with the dollar index recently quoted at 98.34, compared a peak on February 20 of 99.91.

The other major currencies we follow are polarized with the euro (1.1003) and yen (108.87) strengthening, while sterling (1.2881) is drifting lower and the Australian dollar (0.6519) is weakening, in line with it being a commodity currency.

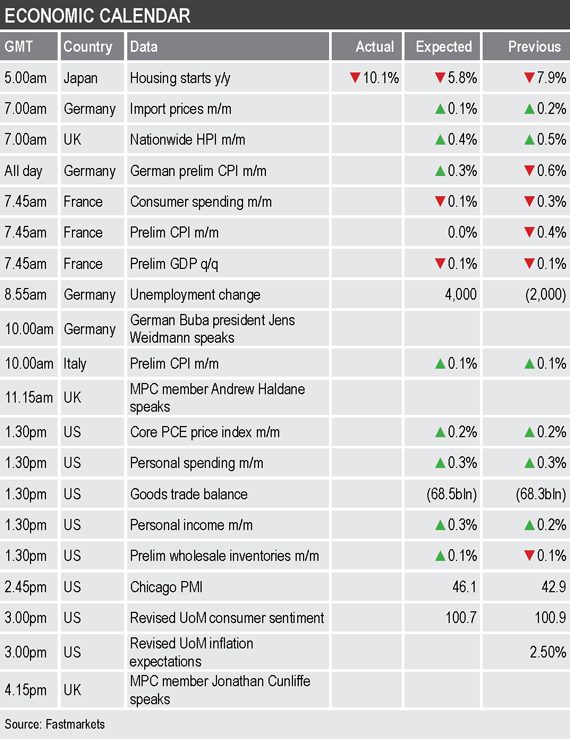

Key data

Today is a bumper day for economic data – see table below – but with the markets now gripped with fear and deleveraging, and with past data now likely to have little bearing on future data, the data may well be largely ignored.

Central bank speakers include German Bundesbank president Jens Weidmann and United Kingdom Monetary Policy Committee members Andrew Haldane and Jonathan Cunliffe.

Today’s key themes and views

With equity indices in falling-knife mode all markets are going to be extremely nervous, but so far the metals on the LME, although weaker, are not in free-fall. The question is whether deleveraging in the metals follows. The fact this crisis has happened after a long drawn-out period of low confidence due to the prolonged US-China trade war probably means the metals supply chain is fairly lean so there may not be too much destocking to do, but there is little doubt that demand will be weak, so stocks are likely to rise and put pressure on prices, unless producers rein in production.

Gold prices seem to be absorbing profit-taking, given all the uncertainty and nervousness across markets we expect gold will attract further waves of safe-haven buying, especially as the opportunity cost of holding gold is falling given negative US TIPS, a weakening dollar and falling equity prices.