The combination of poor data summed up by the United States’ Empire State manufacturing index falling to -78.2 in April, from 12.9 as recently as February, and the release of corporate earnings and outlooks are bringing somewhat of a reality check to the recent rebounds in metals and equities markets.

- Asian-Pacific equities were weaker this morning, while pre-market western equity futures were slightly firmer following Wednesday’s weakness.

- Markets are braced for shocking first quarter gross domestic product data from China, scheduled to be released on Friday.

- But ahead of that is today’s US initial jobless claims data.

Base metals

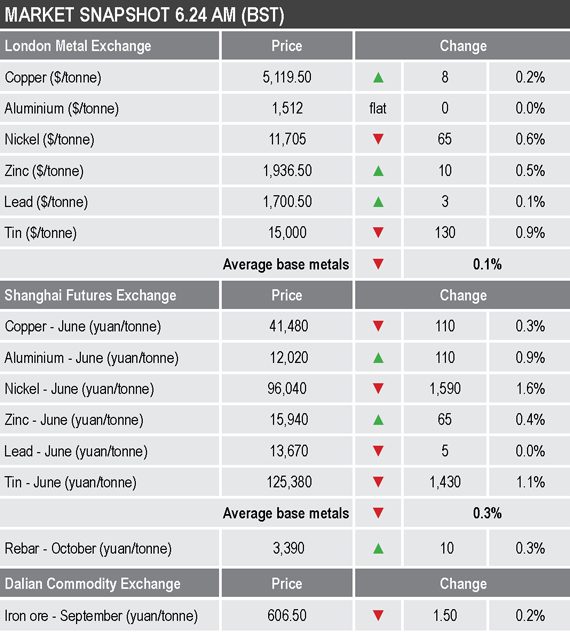

Three-month base metals prices on the London Metal Exchange were mixed this morning while prices consolidated Wednesday’s losses that averaged 0.9%. This morning, nickel and tin led on the downside with losses of 0.6% and 0.9% respectively, while the zinc led on the upside with a 0.5% gain. The rest were between unchanged and up by 0.2%, with copper up 0.2% at $5,119.50 per tonne.

Volume on the LME has returned to below normal levels with 4,401 lots traded by 6.24am London time, compared with an average of 6,750 lots traded at a similar time across last week.

The most-traded base metals contracts on the Shanghai Futures Exchange were also mixed, ranged between June aluminium that was up by 0.9% and June nickel that was down 1.6%. June tin was also weak with a 1.1% loss and June copper was down by 0.3% at 41,480 yuan ($5,882) per tonne. June lead was little changed, while June zinc was up by 0.4%.

Precious metals

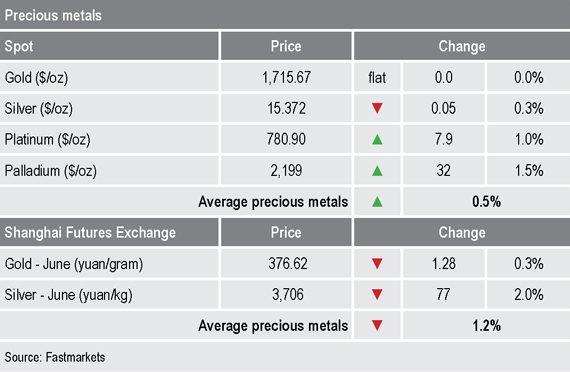

The spot gold price is drifting while it consolidates after its recent push to multi-year highs and was recently quoted at $1,715.67 per oz – this after a high of $1,747.25 per oz on Tuesday.

Silver has following gold’s lead and was recently quoted at $15.37 per oz, putting the gold/silver ratio at 1:111. Platinum ($778 per oz) has now followed gold and silver out of the bullish flag we have been talking about in recent weeks, and palladium ($2,203 per oz) is still trying to break out of its flag.

Wider markets

Tuesday’s risk-on sentiment in the broader markets eased on Wednesday and seems to be on a back footing again this morning judging by the yield on benchmark US 10-year treasuries that has fallen back to 0.63%, compared with 0.73% at a similar time on Wednesday.

Asian-Pacific equities were mainly weaker mixed this morning: the Nikkei (-1.41%), the Hang Seng (-0.7%), the ASX 200 (-0.92%) and the CSI 300 (-0.07%), but the Kospi (+0.05%) was up slightly.

Currencies

The dollar index is rebounding, it was recently quoted at 99.81, compared with 99.01 at a similar time on Wednesday.

With the dollar stronger, the other major currencies we follow are weaker: sterling (1.2484), the euro (1.0888), the yen (107.77) and the Australian dollar (0.6286).

Key data

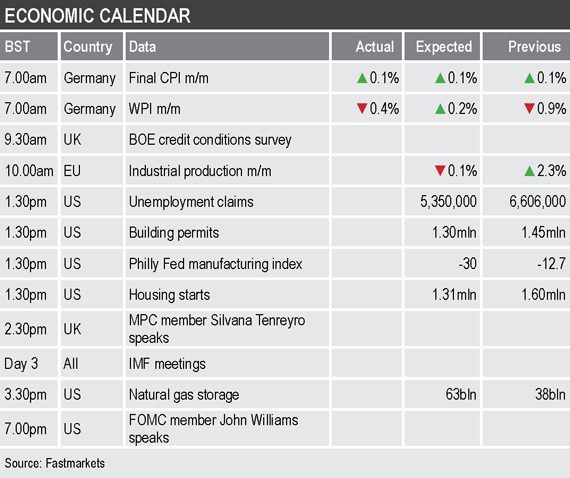

The economic agenda contains important data including Germany’s consumer price index, European Union industrial production and US data on initial jobless claims, housing starts, building permits and the Philly Fed manufacturing index.

In addition, UK Monetary Policy Committee member Silvana Tenreyro and US Federal Open Market Committee member John Williams are speaking and the International Monetary Fund meeting continues.

Today’s key themes and views

The rallies in the base metals may be paused for now, but generally they look well placed to extend gains and you could argue that the likelihood of government infrastructure projects taking off once lockdowns end could mean that is one of the first areas that sees a recovery in demand.

But the metals are unlikely to be immune to set back in equity prices and the risk is that poor data, corporate earnings and guidance could lead to some setbacks in equity indices in the short term.

The grim economic and financial data also needs to be weighed up against any encouraging signs that the Covid-19 virus is being contained in some countries that are in the spotlight – but I bet that the virus situation is still deteriorating in many more countries that are not in the spotlight, which will continue to hit demand as well as supply.

Our view on gold is unchanged: the combination of economic pain, much uncertainty and ultra-loose monetary and fiscal policy, are expected to support demand for gold and other havens.