- The release of flash purchasing managers’ index (PMI) data on Friday will provide further insight into the state of global manufacturing.

- With gold prices weaker and US 10-year treasury yields firmer, havens are in less demand.

Base metals

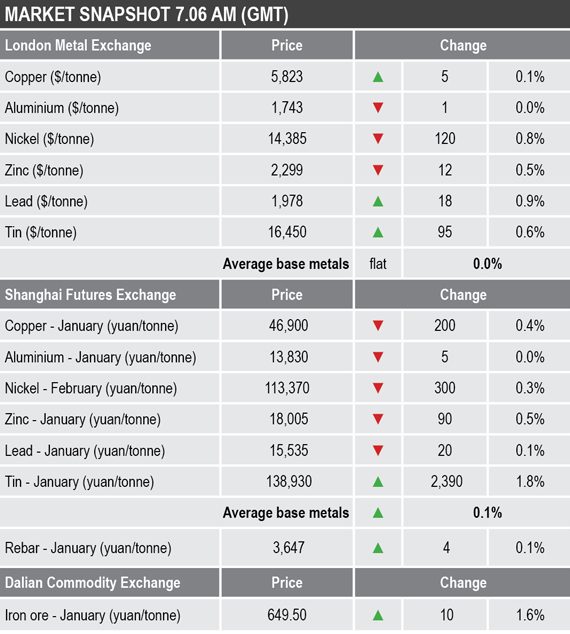

Three-month base metals prices on the London Metal Exchange were mixed this morning. Nickel and zinc prices led on the downside with losses of 0.8% and 0.9% respectively, while lead and tin were up by 0.9% and 0.6% respectively. Copper and aluminium were little changed, with copper up by 0.1% at $5,823 per tonne.

Traded volume has been below average with 3,573 lots traded as at 6.09am London time.

In China, the most-traded base metals contracts on the Shanghai Futures Exchange were also mixed; January tin was up by 1.8%, January lead and aluminium were little changed, while January copper, February nickel and January zinc were down by an average of 0.4%, with copper at 46,900 yuan ($6,667) per tonne.

The spot copper price in Changjiang was down by 0.3% at 46,900-46,950 yuan per tonne and the LME/Shanghai copper arbitrage ratio was recently at 8.05, compared with 8.07 at a similar time on Thursday.

Precious metals

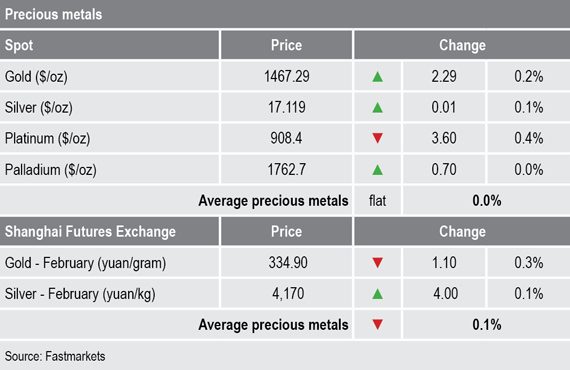

The precious metals are consolidating after recent rebounds – it is unclear whether the recent rallies were just countertrend moves, which may have formed bearish flags on the charts. Spot gold prices were up by 0.2% at $1,467.29 per oz, but down from $1,470.90 at a similar time on Thursday.

Wider markets

The yield on benchmark US 10-year treasuries has firmed and was recently quoted at 1.7693%, compared with around 1.7369% at a similar time on Thursday morning. The German 10-year bund yield was also firmer and was recently quoted at -0.3300%, compared with -0.3740% at a similar time on Thursday.

Asian equities were for the most part firmer this morning: the Nikkei (+0.32%), the Kospi (+0.26%), the Hang Seng (+0.24%) and the ASX 200 (+0.55%) – the exception was China’s CSI 300 (-1.03%).

This follows a weaker performance in Western markets on Thursday, where in the US, the Dow Jones Industrial Average closed down by 0.20% at 27,766.29, and in Europe, where the Euro Stoxx50 closed off by 0.11% at 3,679.66.

Currencies

The dollar index has been consolidating in recent days and was recently quoted at 97.91, this after some choppy trading since early November that has seen it rise from a low of 97.16 on November 4 to 98.45 on November 13.

Other major currencies we follow are also consolidating: the euro (1.1069) and sterling (1.2920) have been climbing, while the Australian dollar (0.6785) and the yen (108.60.

The yuan, at 7.0363, is little changed from Thursday, but the fact it is weaker than it was earlier on in the month highlights the deterioration in the outlook for trade talks, we think.

Key data

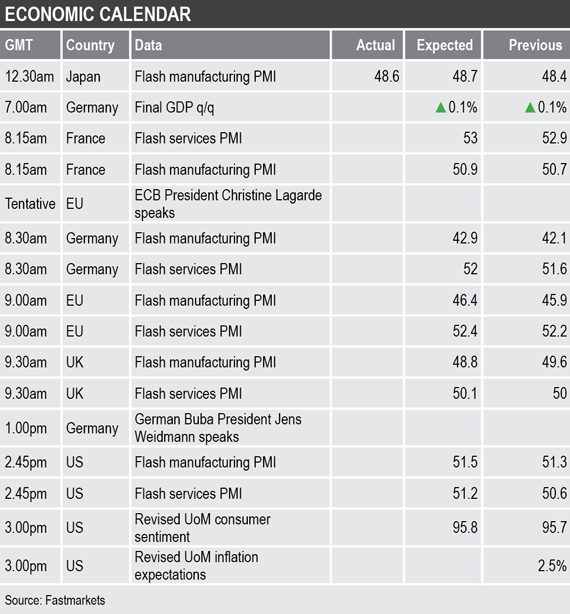

Data out already on Friday showed Japan’s flash manufacturing PMI edge up to 48.6, from 48.4. With flash manufacturing and services PMI out across Europe and the US later, we should get an update on the state of the global economy. There is also data out on German final gross domestic product and US data on consumer sentiment and inflation expectations from the University of Michigan.

In addition, European Central Bank President Christine Lagarde and German Bundesbank President Jens Weidmann are speaking at the European Banking Congress in Frankfurt, Germany.

Today’s key themes and views

It is more of the same in the markets while the trade news continues to alternate between positive and negative, which clouds the outlook. Concerns that the trade war could escalated further before a deal is reached are keeping prices on a back foot.

Overall, the further prices sink, the more powerful a rebound there could be if an actual deal is agreed as that is likely to lead to some restocking along the supply chain, which could give apparent demand a much-needed boost.

Gold prices, along with other haven assets, had been firmer in recent days on the back of fresh uncertainty over the direction of trade talks, but the fact prices have slipped and Asian equities are mainly positive this morning, suggests traders are not so concerned as they were earlier in the week. As such, we expect more consolidation.