Europe, Japan and the US are now suffering manufacturing contraction, but there are early signs that parts of China’s economy are starting to recover.

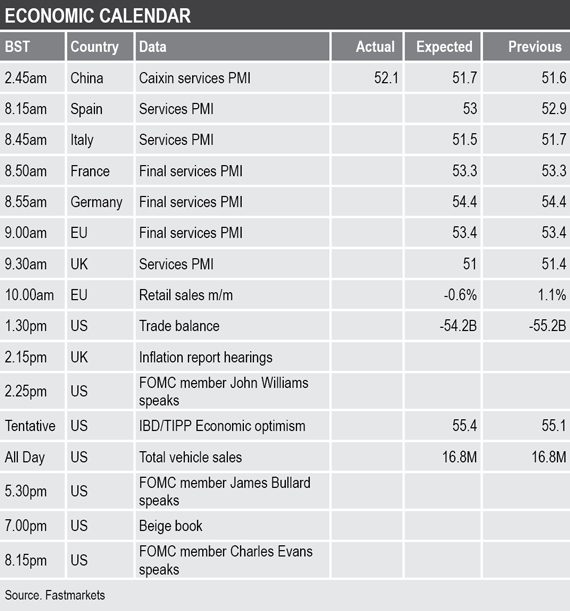

Following a rebound in the Caixin manufacturing purchasing managers’ index (PMI) on Monday, this morning saw the Caixin services PMI climb to 52.1, from 51.6, so perhaps China stimulus measures are starting to bear fruit. Weakness in the US economy may make the US administration more determined to get a trade deal.

- Economic data picks up in China, but slips in the US

- US ISM manufacturing PMI fell to 49.1 from 51.2

- Hong Kong set to withdraw extradition bill

Base metals

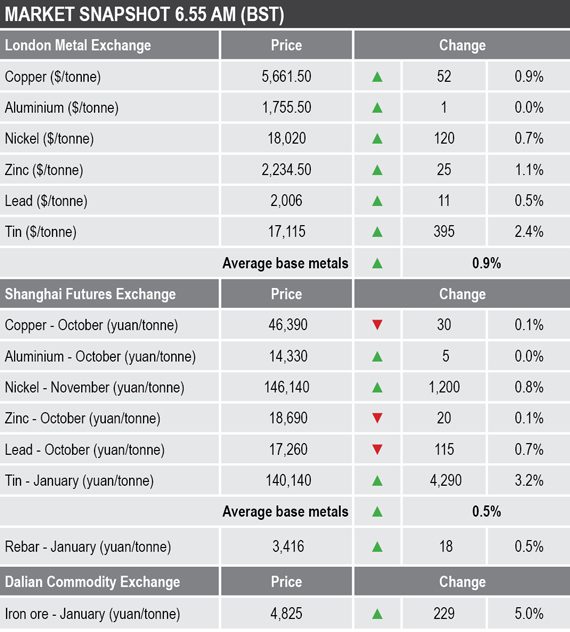

Three-month base metals prices on the London Metal Exchange were positive across the board this morning, Wednesday September 4, with the complex up by an average of 0.9%, with healthy gains in all but aluminium.

Tin prices led the way with a 2.2% rise to $17,115 per tonne, followed by a 1.1% gain in zinc to $2,234.50 per tonne and a 0.9% gain in copper that was recently quoted at $5,661.50 per tonne. Copper prices are rebounding following their drop on Tuesday to $5,518 per tonne, the lowest since May 2017, when prices were rising off the 2016 lows.

In China, the base metals traded on the Shanghai Futures Exchange were mixed; January tin and November nickel led on the upside with gains of 3.2% and 0.8% respectively, while October lead was down by 0.7% and the rest were little changed. October copper was off by 0.1% at 46,390 yuan ($6,461) per tonne.

The spot copper price in Changjiang was down by 0.3% at 46,240-46,330 yuan per tonne and the LME/Shanghai copper arbitrage ratio dipped to 8.2, compared with 8.3 on Tuesday.

Precious metals

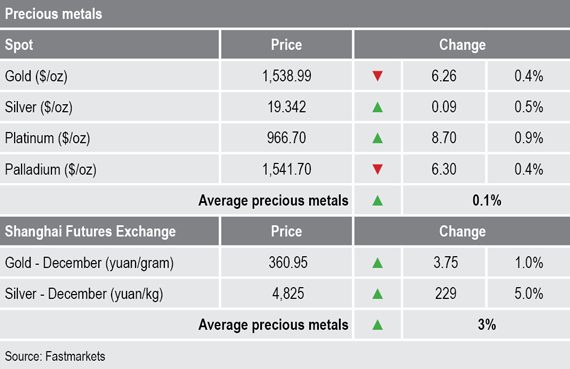

Once again the spot gold price did not stay down for long, highlighting a robust market with the price rebounding to $1,549.70 per oz on Tuesday, but it failed to set new highs and are consolidating again – recently quoted at $1,538.99 per oz. Whether the reduced stress in Hong Kong diminishes some haven demand remains to be seen. Spot silver prices set a fresh multi-year high earlier this morning at $19.59 per oz, with the spot palladium price strong at $1,545 per oz and the spot platinum price was recently quoted at $964 per oz.

Wider markets

The spot Brent crude oil price has been slipping lower and was recently quoted at $58.50 per barrel, compared with $58.57 per barrel at a similar time on Tuesday – the price has become rangebound between $58.30 and $61.48 per barrel.

The yield on benchmark US 10-year treasuries has weakened again, it was recently quoted at 1.4773%, compared with 1.5089% at a similar time on Tuesday. The German 10-year bund yield is firmer at -0.6920%, compared with -0.7090% at a similar time on Tuesday.

The focus in Asian equities is the 3.42% rise in the Hang Seng that is up on back of reports that the extradition bill in Hong Kong is expected to be withdrawn. The rest are mixed: the CSI 300 (+0.65%), the ASX200 (-0.31%), the Kospi (+1.16%), and the Nikkei (+0.12%).

This follows a weaker performance in Western markets on Tuesday: in the US, the Dow Jones Industrial Average closed down by 1.08% at 26,118.02 and in Europe the Euro Stoxx50 closed down by 0.34% at 3,420.74.

Currencies

The dollar index is correcting lower and was recently quoted at 98.84, this after Tuesday’s multi-year peak at 99.38. A pullback in the dollar may well help underpin the metals.

As the dollar slips, the euro (1.0987), sterling (1.2135) and the Australian dollar (0.6780) are rebounding, but the yen (106.19) is flat.

Key data

Today’s economic agenda is busy – as already mentioned the Caixin services PMI beat expectations, later there is services PMI data out across Europe and the United Kingdom, there is data on European Union retail sales and a UK inflation report.

US data includes the trade balance, economic optimism, total vehicle sales and the Beige book. In addition, there are speeches from US Federal Open Market Committee members John Williams, James Bullard and Charles Evans.

Today’s key themes and views

Nickel is in its own boat and the market is likely to take time adjusting to the latest supply disruption news. Tin’s rally seems to be riding nickel’s coattails but not following any particular news, while the others struggle with the uncertainty over the trade situation. Perhaps deteriorating US economic data may make a trade deal more urgent. Any deal could lead to relief rallies and those in turn could lead to restocking and given how long prices have been trending lower the upside risk could be large.

That said, the market has raised its hopes about a trade deal before only to be disappointed so prices may well bump along the bottom until a deal is eventually signed.

While in low ground waiting for a trade deal there will remain the risk that broader markets could undergo a steeper correction and that could see metal prices sink further. As such, this is probably not the time to second-guess the market.