Equities and bond markets will no doubt react positively to easier monetary policy, but the metals are unlikely to be hoodwinked by such developments

- US administration gives Huawei a 90-day reprieve from sanction.

- Markets looking for Germany to announce stimulus measures.

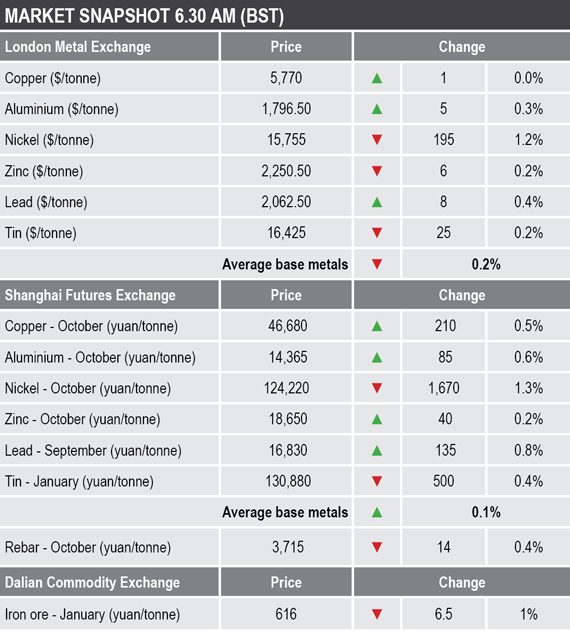

Base metals

On the London Metal Exchange, three-month base metals prices were mixed on the morning of Tuesday August 20. The main mover was nickel where its price was off by 1.2% at $15,755 per tonne, aluminium and lead were up by 0.3% and 0.4% respectively, while zinc and tin were both down by 0.2%. Copper was little changed at $5,770 per tonne, up by $1 per tonne from Monday’s close.

In China, base metals prices on the Shanghai Futures Exchange were for the most part firmer, the exceptions were October nickel and January tin that were down by 1.3% and 0.4% respectively. The other most-traded contracts, October copper, aluminium, zinc and September lead were up by between 0.2% and 0.8%, with copper up by 0.5% at 46,680 yuan ($6,622) per tonne.

Spot copper prices in Changjiang were up by 0.4% at 46,560-46,680 yuan per tonne and the LME/Shanghai copper arbitrage ratio was recently at 8.09, compared with 8.05 at a similar time on Monday.

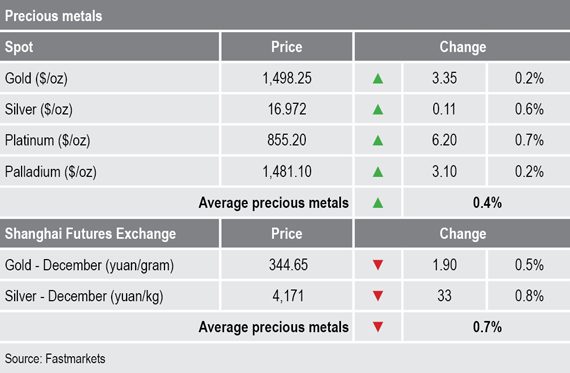

Precious metals

Spot gold prices were firmer at $1,498.25 per oz, compared with Monday’s close at $1,494.90 per oz, while silver prices were up by 0.6%, platinum prices were up by 0.7% and palladium prices were up by 0.2%.

On the SHFE, the December gold and silver contracts were down by 0.5% and 0.8% respectively.

Wider markets

The spot Brent crude oil price is firmer, up by 0.37% at $59.94 per barrel – its recent range being $55.86 to $61.48 per barrel.

The yield on benchmark US 10-year treasuries has edged higher, it was recently quoted at 1.5874% having been at 1.5808% at a similar time on Monday. The German 10-year bund yield is also firmer at -0.6590%, compared with -0.6690% at a similar time on Monday.

In equities, Asian indices were mostly stronger on Tuesday: Nikkei (+0.55%), Hang Seng (+1.12%), Kospi (+1.05%) and the ASX200 (+1.2%), but the CSI 300 was down by 0.25%.

This follows a stronger performance in Western markets on Monday that were underpinned by stimulus hopes: in the United States, the Dow Jones Industrial Average closed up by 0.96% at 26,135.79 and in Europe the Euro Stoxx50 closed up by 1.2% at 3,369.19.

Currencies

The dollar index is edging higher and was recently quoted at 98.36 – the recent range being 97.21-98.94. The yen (106.47) has eased from recent strength at 105.05, the euro (1.1078) is weakening again, as is sterling (1.2111) and the Australian dollar (0.6783) is consolidating.

The yuan remains weaken and was recently at 7.0636, and most emerging currencies we follow remain on a back footing, which is a sign of nervousness.

Key data

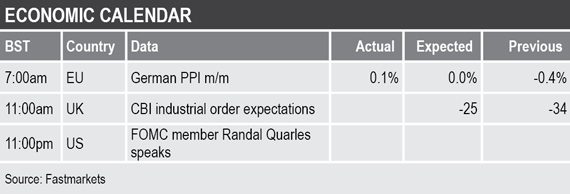

On the economic agenda for Tuesday, there was data on the German producer price index (PPI) that climbed 0.1% in July, this after a 0.4% fall in June. Data out later includes order expectations from the Confederation of British Industry (CBI) and a speech by US Federal Open Market Committee member Randal Quarles.

Today’s key themes and views

Nickel prices appear to be correcting after the strong June-to-August gains, we should get a feel for how robust demand is by seeing how well the dip is supported. Given the subdued performance in other metals and nickel’s tendency to run ahead of fundamentals, we would not be surprised to see nickel prices correct meaningfully. Lead is holding up well too, while the rest are weak, especially tin. While supply is relatively tight in many of the metals, it seems that the poor demand outlook dominates sentiment.

Gold prices are consolidating, but they are only down by 2.4% from the August 13 high at $1,535 per oz. Given the stress from geopolitical issues, world trade and global economic growth, gold is likely to remain sought-after. Key to how robust the bull market in gold will be how well the dip is supported.