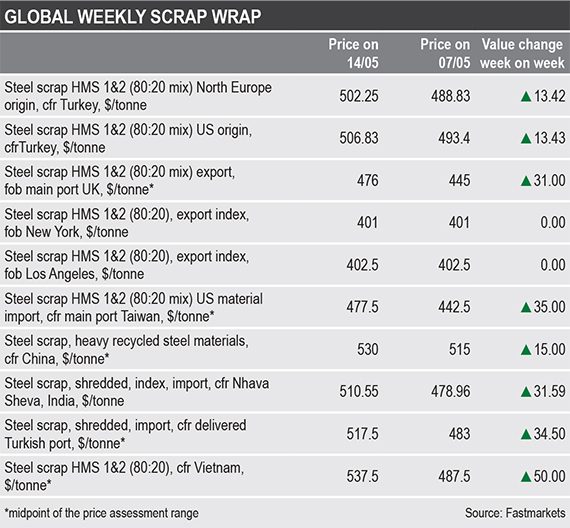

- Turkey secured European scrap at an increase to satisfy surging finished steel demand

- Higher offers failed to tempt US exporters to market

- Bullishness pervaded the Vietnamese market; prices rose following Turkey’s lead

- Chinese buyers lowered or withdrew bids for scrap amid softer steel prices

- A lack of supplier offers moved Taiwanese prices higher

- Indian buyers increased their bids to secure scrap ahead of potential supply issues.

Turkey

Turkey retreated from the global steel scrap export markets for the Eid-al-Fitr religious holiday on Friday after buying a slew of higher-priced European deep-sea scrap cargoes in the preceding days.

European sales of HMS 1&2 (80:20) to the region have now hit $500 per tonne cfr.

Mills in the region were forced to pay more for scrap imports amid surging sales of rebar, which hit $750 per tonne fob this week.

Pricing history

steel scrap HMS 1&2 (80:20 mix), Northern Europe origin, cfr Turkey.

steel scrap HMS 1&2 (80:20), US origin, cfr Turkey.

United States

US sellers were reticent about selling deep-sea cargoes to Turkey for the second week running, opting to focus on domestic business despite a huge increase in export offers, which hit $500 per tonne over the period.

Pricing history

steel scrap HMS 1&2 (80:20), export index, fob New York.

steel scrap shredded scrap, export index, fob New York.

steel scrap, HMS 1&2 (80:20), export index, fob Los Angeles.

Vietnam

Soaring downstream global steel prices and surging domestic and export prices in Turkey fueled bullish sentiment in the Vietnamese steel scrap market, pushing prices higher this week.

Pricing history

steel scrap, HMS 1&2 (80:20), cfr Vietnam.

China

Softer finished steel prices pushed buyer offers down, with some resorting to withdrawing bids while prices plummeted.

Pricing history

steel scrap, heavy recycled steel materials, cfr China.

Taiwan

Strong appetites and limited supplier offers pushed prices higher, though the market remained divided on the future trajectory of prices. Some expected them to depreciate in line with weaker Chinese steel futures, while others expected an increase on the basis of tight supply.

Pricing history

steel scrap, HMS 1&2 (80:20 mix), US material import, cfr main port Taiwan.

India

The Indian scrap market strengthened in the wake of higher Turkish scrap prices, with participants raising their buying prices amid an expectation of production stoppages.

Pricing history

steel scrap, shredded, index, import, cfr Nhava Sheva, India.