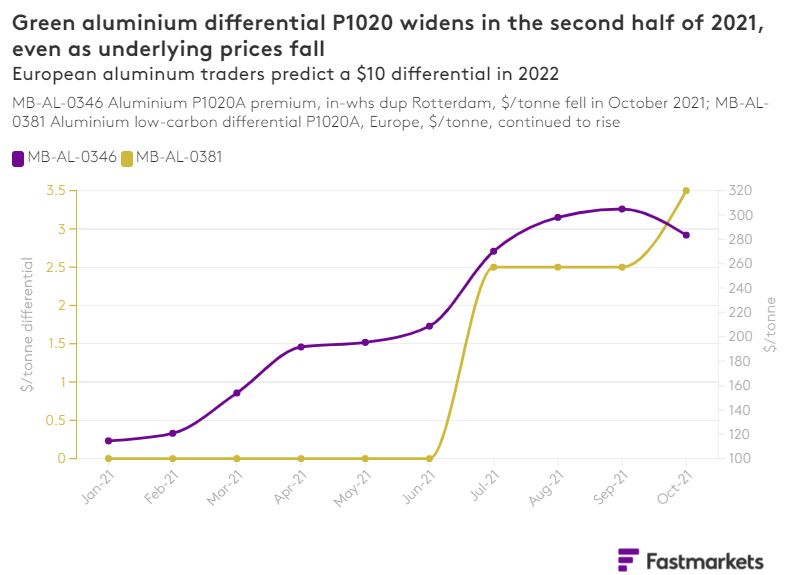

Fastmarkets assessed the aluminium low-carbon differential P1020A, Europe, at $0-10 per tonne, up from $0-7 per tonne in the previous assessment on October 1.

“We would be looking for $10 per tonne minimum right now, and I think that is totally achievable for 2022,” a trader in Europe said. “I think demand will be strong next year, when premiums recover and consumers look at their supply chains. Look at this week – all the talk is about sustainability.”

Market participants further downstream shared this sentiment, especially on deals for 2022.

Fastmarkets assessed the aluminium low-carbon differential, value-added product (VAP), Europe, at $20-30 per tonne on Friday, flat from the month before.

“It’s significantly higher than in the previous year,” one producer said, referring to offers of low-carbon VAP for 2022. “The market can support that number.”

Some offers for next year’s low-carbon aluminium supply have been reported as high as $50 per tonne.

“The product premium is still good, especially for [aluminium] billet and foundry [material],” a second trader in Europe said, “but going into next year we really have to focus on achieving a better percentage for the products. A $30 [per tonne differential] versus a $1,500 [per tonne billet premium in Europe] is not a lot. It needs to be better.”

Sustainability has been a focus for market participants across the supply chain in the past two weeks, especially during COP26.

In the run-up to the conference, executives at producer Norsk Hydro told Fastmarkets that they expected strong demand for low-carbon aluminium and that sales of low-carbon products have increased “significantly” compared with last year.

Rio Tinto announced the implementation of carbon capture and storage at its ISAL smelter, and also announced with Alcoa a scaling-up of their zero-carbon aluminium technology.

Producer Rusal and parent company EN+ have been speaking on panels at the conference, about low-carbon aluminium.

“The aluminium industry needs rapid and radical transformation to keep in step with net-zero goals, requiring breakthrough technologies and large-scale investment,” Yulia Chekunaeva, director of capital markets at EN+, said on Friday.

Trading house Trafigura announced that it would commit to decarbonization of the aluminium and shipping sectors by becoming a founding member of the First Movers Coalition.

Trafigura is committed to working with the coalition to agree to future purchasing commitments for low-carbon aluminium, it said, as well as incentivizing and working with producers and consumers of aluminium to decarbonize the industry. It added that it has also committed to owning and operating six carrier vessels, which will be converted to use low-carbon ammonia as their primary fuel source by 2030, if technically feasible.