The potential headwinds – political tensions between the United States and China, a no-deal Brexit and the continuing out of control spread of the virus, are for now taking a backseat.

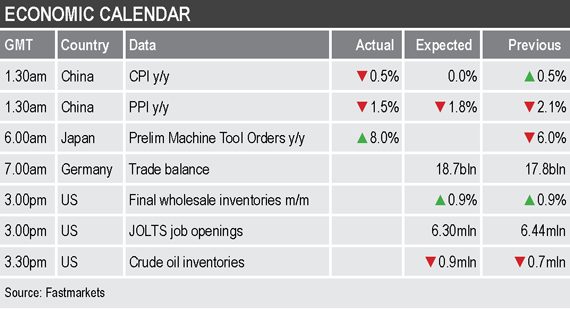

- China’s consumer price index fell by 0.5% year on year in November – the first fall since 2009, the fall coming amid a drop in food prices

- China’s producer price index fell by 1.5% in November from a year earlier, this after a 2.1% fall in October

Base metals

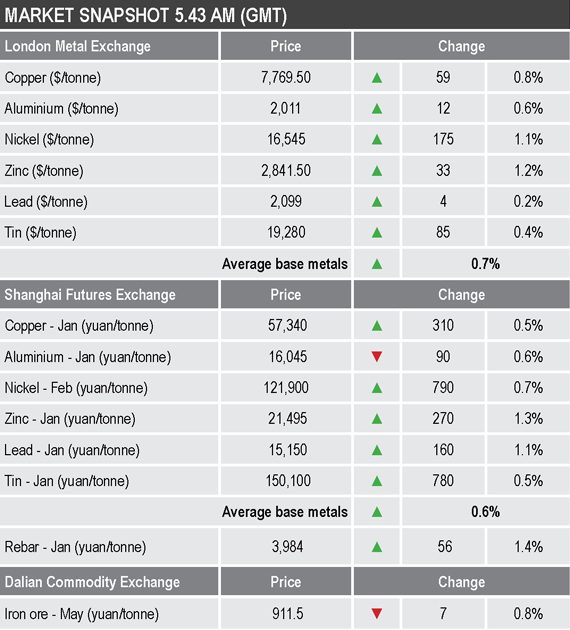

The three-month base metals prices on the LME were up across the board this morning with prices up by an average of 0.7%, led by a 1.2% rise in zinc to $2,841.50 per tonne, while nickel was up 1.1% at $16,545 per tonne. Copper was up by 0.8% at $7,769.50 per tonne.

The most-traded base metals contracts on the Shanghai Futures Exchange were mostly positive, the exception was January aluminium that was down 0.6%, while the rest were up by an average of 0.8%, led by a 1.3% rise in January zinc. January copper was up by 0.5% at 57,340 yuan ($8,773 per tonne).

Precious metals

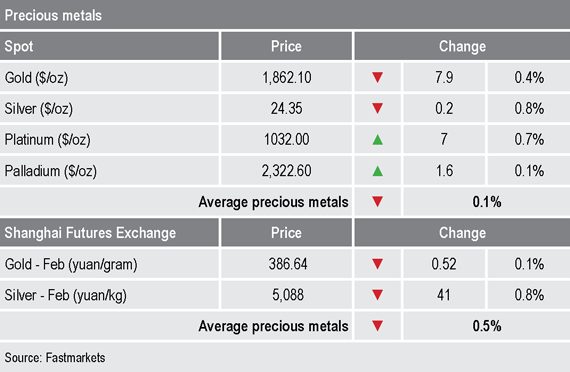

Spot gold prices were slightly weaker this morning, down by 0.4% at $1,862.10 per oz, while silver was down by 0.8% at $24.35 per oz and palladium ($2,322.60 per oz) and platinum ($1,032 per oz) were up by 0.7% and 0.1% respectively.

Wider markets

The yield on US 10-year treasuries has consolidated recent gains, it was recently quoted at 0.94%, compared with 0.93% at a similar time on Tuesday.

Asia-Pacific equities were mixed this morning: the CSI (-0.52%), the ASX 200 (+0.61%), the Nikkei (+1.33%), the Hang Seng (+0.89%) and the Kospi (+2.02%).

Currencies

The US dollar index was consolidating this morning in low ground and was recently quoted at 90.75, down from 90.83 at a similar time on Tuesday.

Most of the other major currencies were off recent highs, but firm as in the case of the euro (1.2141), the Australian dollar (0.7447) and sterling (1.3385), while the yen (104.19) was slightly weaker.

Key data

In addition to the Chinese price data mentioned above, Japan’s preliminary machine tool orders climbed by 8% month on month in November, the first rise since September 2018.

Data out later includes data on Germany’s trade balance and US data on job openings and crude oil and wholesale inventories.

Today’s key themes and views

The metals remain upbeat, backed by strong sentiment, positive medium-term outlooks and an extremely liquid climate. While prices appear to have run ahead of the fundamentals, there seems no appetite for a correction.

Gold’s rebound has run out of steam this morning. Given the positive sentiment in other markets gold may struggle to trend higher, so we wait to see if it can hold on to these gains. A move above $1,900 per oz would look constructive, a move back below $1,840 per oz less so.