Japan’s flash manufacturing purchasing managers index (PMI) climbed to 49.7 in December, from a revised 49 in November, up from 48.3.

The dollar index is at the lowest since April 2018.

Base metals

The three-month base metals prices on the LME were mainly stronger. Nickel bucked the trend with a 1.4% sell-off to $17,410 per tonne, while the rest were up by an average of 0.4%, with copper up $3 per tonne at $7,809.50 per tonne. This was almost a mirror image of the situation yesterday morning, when nickel was up and the rest were down, which highlights the consolidation nature of the market, albeit up in high ground.

Traded volume has been above average with 8,544 lots traded as of 6.44am London time, compared with 6,085 lots at a similar time on Tuesday.

The most-traded base metals contracts on the SHFE were trading in line with the LME with the February nickel contract off 1.4%, while the rest of the complex was up an average of 0.4%, with January copper up by 0.4% at 57,810 yuan ($8,818) per tonne.

Precious metals

Spot gold prices were firmer, up by 0.2% at $1,856.40 per oz, while silver ($24.76 per oz) was up by 1.2% and palladium ($2,342.50 per oz) and platinum ($1,045.90 per oz) were up by 1.2% and 1.1% respectively.

Wider markets

The yield on US 10-year treasuries was recently quoted at 0.9%, up slightly from 0.89% at a similar time on Tuesday.

Asia Pacific equities were stronger across the board this morning: the ASX 200 (+0.72%), the Nikkei (+0.26%), the Hang Seng (+0.81%), the Kospi (+0.54%) and the CSI (+0.18%).

Currencies

The US dollar index has breached the recent lows at 90.42 and was recently quoted at 90.39; the next obvious support level on the chart is the February 2018 low at 88.25.

Most of the other major currencies were holding up in high ground, albeit below recent highs: the euro (1.2168), the Australian dollar (0.7564), the yen (103.46) and sterling (1.3478).

Key data

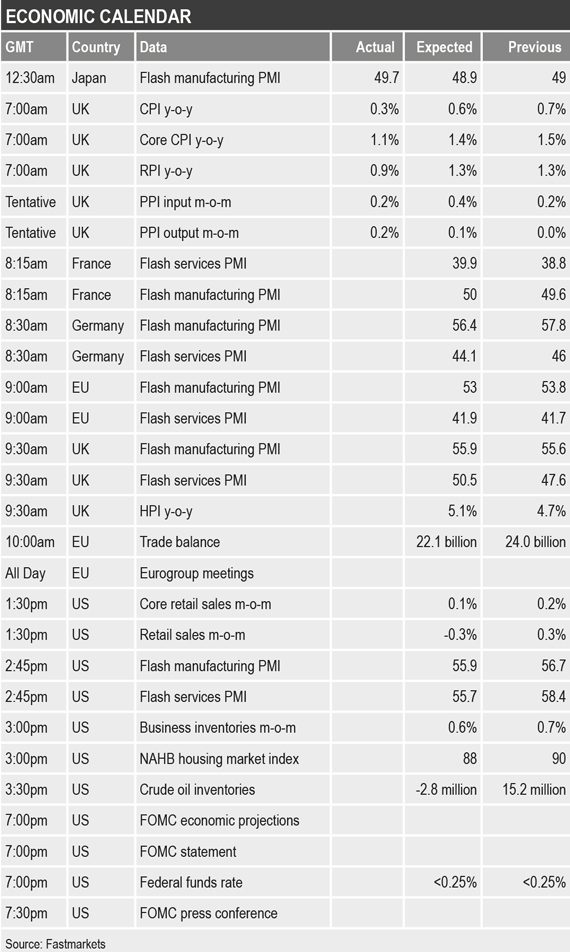

Other key economic data already out on Wednesday showed United Kingdom price data, most of which has climbed less than expected, see table below.

Later there is flash manufacturing and services PMI data out across Europe and the United States. In addition, there is data on UK house prices and Europe’s trade balance.

Additional US data includes retail sales, business inventories, house market index and crude oil inventories, while the Federal Open Market Committee will announce its interest rate decision and economic projections, issue a statement and hold a press conference.

Today’s key themes and views

Once again most of the metals are holding up in high ground and there seems little appetite for profit-taking, suggesting sentiment has faith in the bullish longer-term implications of all the infrastructure spending. But, being up in high ground there is a risk of a correction, especially with holidays and year-end ahead, but overall any dips are expected to be well supported.

Gold’s rebound off the late-November low ran out of steam, but prices have found support and are attempting another rebound. Also, while prices are back above $1,840 per oz, they are looking less vulnerable. But unless sentiment in broader markets deteriorates, we still feel gold may struggle on the upside. For now, we would be bearish gold below $1,840 per oz and bullish above $1,880 per oz.