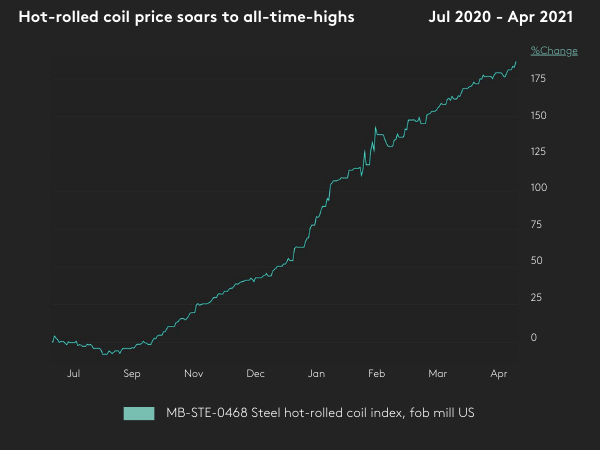

Flat steel prices in the United States continue to soar to all-time highs. Signs of recovery first hit the US steel market during the third quarter of 2020 following an earlier slump in physical activity stemming from the Covid-19 pandemic.

Recovering demand from the automotive and construction sectors overrode supply availability, unbalancing the market and keeping prices high.

With domestic supply remaining tight and buyers continuing to be wary of imports, it is unlikely that the situation will ease in the short term. When will the market hit its peak?

Find out more about pricing and availability of US flat steels.

New coil capacity may shrink record highs

Fastmarkets’ daily steel hot-rolled coil index began its rally in August 2020 and reached an all-time high of $70.53 per hundredweight ($1,410.60 per short ton) on Wednesday April 21. But could this be about to change with the promise of new capacity flooding the US flat steel market?

The prospect of more than 5 million tons of additional flat-rolled steel production starting up in the US by the end of this year has convinced some market participants that the current run of all-time-high prices could come to an end by autumn.

New electric-arc furnaces (EAFs) due in the second half of 2021 – plus the restart of older capacity and the anticipated arrival of more imported steel by June – will likely disrupt the pricing rally.

On top of the new steelmaking capacity coming online this year, another 6 million tons could be added to mill projects by 2023.

New projects on the horizon

Now wholly owned by US Steel, Big River Steel started up its second EAF in Arkansas in November 2020. Steel Dynamics Inc (SDI) will start its coating and paint lines in Sinton, Texas, in the second quarter of 2021 en route to a complete start-up of its new steel mill later in the year.

An expansion at the Nucor Gallatin sheet mill in Kentucky is scheduled to go into production in the second half of this year.

While SDI has said it intends to aim some of its Sinton volumes at the nearby Mexico market, competition is about to get more crowded south of the border too. Ternium plans to start up a new hot-rolling mill in Mexico in July, and ArcelorMittal is opening a new hot-strip mill in Mexico this year.

“This flat-roll market will not last,” one steel trader said. “There is going to be a flood of material by the fall. These mills can’t control it.”

With an onslaught of supply expected later this year, what could too much material do to the market, and could demand keep up?

Consumer behavior to curb steel demand

Prices at US sheet mills started trending upward last August. After the pandemic triggered business closures in the spring, steelmakers idled some production ahead of anticipated economic stagnation, lower steel demand and operational hazards.

The unexpected result was a flurry of orders for automobiles and construction materials as many Americans migrated out of urban centers. During the pandemic, the changing habits of Americans provided a boost to domestic steel suppliers that is likely to fade.

People were spending more on home improvements, new appliances and recreational vehicles because they could not partake in everyday activities such as going to the movies.

If vaccinations do their job and the pandemic subsides, Americans will likely revert to old habits – spending their incomes on vacations, dining out and concerts – potentially curbing domestic steel demand in the near term.

We may be reaching the end of pent-up demand and backlogs at original equipment manufacturers. As new capacity comes online, activity should start to level out.

A genuine concern for many industry participants is a potential market crash reminiscent of 2008, because a steep decline in inventory values can threaten companies’ profitability.

Still, some mill sources are less concerned this time due to strong downstream demand, Section 232 import curbs, better overall discipline regarding production levels and less debt risk in the industry than preceded the 2008-09 shock.

Trade flows boost consumption

Following the reopening of China’s ferrous scrap import market, Asian trade flows could support steel prices this year. With China likely to boost its scrap buying around the same time that the new US EAF capacity starts to ramp up, scrap prices will likely stay high, affecting steel output.

If scrap prices remain higher, mini-mills will need to be more disciplined throughout the production process to maintain their margins.

There is also the prospect that Congress will pass President Joe Biden’s $2-trillion infrastructure investment plan. This deal could provide a shot in the arm for the industry – although any developments are not likely to arrive in time to counterbalance the steel oversupply scenario expected later this year.

Lastly, the possibility that the president may end the Section 232 import tariff put in place by his predecessor could make it easier to form profitable trade relationships. Some 54% of senior-level steel industry executives believe this will happen within the next two years, according to a recent survey carried out by Headwall Partners.

Grace Asenov and Dom Yanchunas contributed to this report.