Fastmarkets conducted a survey of market participants in the battery supply chain – mainly battery materials producers – to assess which battery metals pose the biggest challenge in terms of securing feedstock materials.

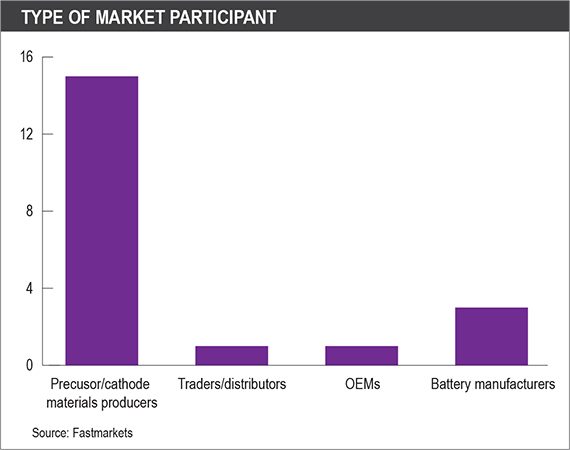

Fastmarkets received responses from 20 market participants, among whom 15 were battery cathode or precursor materials producers. Three of the survey participants were traders or distributors who have an interest in at least two of the battery metals. The remaining two respondents were an original equipment manufacturer (OEM) and a battery manufacturer.

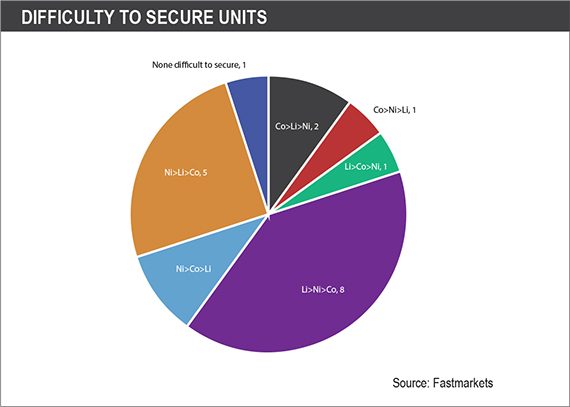

Eight respondents ranked lithium as the battery metal most difficult to secure in the second half of 2021, followed by nickel and cobalt. Five respondents ranked nickel as the most difficult to secure, followed by lithium, then cobalt. The battery supply chain has broadly prioritized securing lithium and nickel in the next few months, with nine votes going to lithium and seven to nickel. Only three survey participants considered cobalt to be their priority.

“We think lithium will be the tightest of the battery raw materials in the second half of 2021 and the first half of 2022,” Will Adams, the head of Fastmarkets’ battery raw materials research team said. “Nickel is likely to be second tightest, but that should be alleviated as new supply ramps up later in the year.”

“For cobalt, the market seems fairly balanced now, save for the logistical bottlenecks in South Africa, but availability should improve as shipping congestions ease,” Adams added. “However, the market is likely to remain fairly tight until Glencore’s Mutanda mine restarts, which we expect to ramp up in 2022-2023.”

Limited number of qualified producers, tight spodumene availability caps lithium supply

Concerns over the supply of lithium have increased since early this year in response to the booming electric vehicle (EV) market, with national and regional policies and incentives aiming to accelerate the adoption of electric mobility in the aftermath of the Covid-19 pandemic.

The rapidly surging demand for lithium, especially battery-grade lithium hydroxide – the feedstock used to produce nickel-rich, nickel-cobalt-manganese (NCM) lithium-ion batteries – is challenged by the limited number of qualified lithium producers in the EV battery manufacturers’ supply chain.

Fastmarkets’ assessment of the lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price range exw domestic China rose to 100,000-110,000 yuan ($15,440-16,984) per tonne on Thursday August 5, widening upward by 2,000 yuan per tonne from 100,000-108,000 yuan per tonne a week earlier. The price has risen by 141% from the start of 2021, the biggest leap among all key battery raw materials so far this year.

Nickel-rich NCM batteries, such as NCM 811 (Ni:Co:Mn: 8:1:1) and NCM 622 batteries usually generate higher energy densities than NCM 523 batteries and lithium iron phosphate (LFP) batteries, a type of battery that doesn’t require nickel or cobalt. With higher energy densities, nickel-rich NCM batteries can provide EVs with a longer driving distance per charge.

Given their sophisticated know-how for nickel-rich NCM-battery production and high standards for the quality of lithium hydroxide, global battery manufacturers and their upstream cathode materials suppliers require lithium producers to be accredited before they are accepted into the sourcing chain. Therefore, it will take lithium producers at least six months, or in some cases several years, to begin supplying their chemical products to leading battery manufacturers, market sources said.

The slow qualification process has become one of the major drivers in the mismatch of lithium supply and EV battery demand. So far this year, demand for EV batteries has grown faster than expected. Most large economies have identified transport electrification as one of the quickest and most efficient ways to stimulate economic recovery in the aftermath of the Covid pandemic, market participants told Fastmarkets.

But as a cathode materials producer in China pointed out, “The lithium supply constraints are more about the limited number of lithium producers that are qualified to supply certain EV battery manufacturers.”

“The lithium market is in short supply, but if tier 2 and tier 3 lithium producers were widely qualified across the li-ion supply chain, we would probably see the current market closer to a supply-demand balance,” a battery metal broker source said. “That said, we believe that the market will be in short supply at least until Q1 of 2022.”

“The supply of lithium is tight at the moment, as the expansions in South America have taken longer to come on stream,” Adams said. “And even though this new capacity will shortly be ramped up, it will still take six to eighteen months for the material to be qualified.”

The majority of cathode materials producers in China also acknowledged that the current bottleneck of lithium supply is due to the structural mismatch of lithium salts supply and downstream demand from cathode materials manufacturing. Ramping up lithium salts supply is restricted by the supply constraints of spodumene, a mainstream feedstock used by Chinese lithium producers.

Fastmarkets’ monthly assessment for spodumene 6% Li2O min, cif China rose to $880-950 per tonne on July 28, up by $190-200 per tonne from $690-750 per tonne one month earlier. The price has more than doubled since January 2021.

Several spodumene operations that were idled in 2019 and 2020 have been slow to restart so far this year, Adams pointed out.

Alita Resources’ Bald Hill mine was halted, in August 2019. Albermarle and Mineral Resources put their jointly owned Wodgina mine on care and maintenance in November 2019, and Altura Mining went into administration in October 2020.

“Only [Altura’s Pilgangoora project, which was renamed Ngungaju project] was scheduled to restart, with Wodgina only likely to restart when processing capacity has either been built or bought,” Adams said.

The global lithium market is estimated to reach a deficit of 12,000 tonnes of lithium carbonate in 2022, compared with a surplus of 3,000 tonnes in 2021, according to the Fastmarkets battery raw materials research team. In 2020, the global lithium market was at a surplus of 54,000 tonnes.

“Lithium supply will remain tight until expansions and restarts at SQM, Albermarle, Livent and Pilbara become commercially available as 2022 and 2023 unfold,” Adams said.

Tight nickel supply in Q3; uncertainties in Q4

The shortage of nickel sulfate and mixed hydroxide precipitate (MHP), which Chinese producers use as feedstock, will persist in the third quarter. The tightness might be eased when the new nickel projects from Indonesia are on stream in the fourth quarter, market participants said.

But they also noted that a variety of variables might cause uncertainty as to how much nickel can be added to the supply chain in the fourth quarter and whether it is enough to fill the gap between supply and demand.

Fastmarkets assessed the price of nickel sulfate min 21%, max 22.5%, cobalt 10ppm max, exw China at 37,000-38,000 yuan per tonne on August 6, unchanged from July 23 when it set a fresh all-time high.

Leading NCM cathode materials producers in China have generally operated at full capacity so far this year, according to market participants. But they also noted that the strong demand for nickel-rich NCM batteries has been tempered by the supply constraints of nickel sulfate.

The supply of nickel sulfate and MHP failed to show any increment this year after New Caledonia’s Usine du Sud (formerly VNC) project was suspended in December 2020 due to social unrest as well as pandemic-related disruptions in both MHP and nickel sulfate operations.

In the second half of 2021, a resurgence of Covid-19 infections across China plus flooding in Henan Province and Typhoon In-fa, which hit eastern China in late July, had various negative effects on the nickel sulfate operations in the country, market sources said.

Despite these set-backs, a number of new and ramped-up nickel supplies are expected in the fourth quarter.

Global production of nickel intermediates, including MHP and nickel matte, will likely rise incrementally to 131,000 tonnes by the fourth quarter of 2021 and to 168,000 tonnes by the last quarter of 2022, according to Fastmarkets’ base metal research team. In Indonesia alone, annual production of these nickel feedstocks will likely go from zero in 2020 to about 40,000 tonnes in 2021 and potentially to 226,000 tonnes in 2022.

Chinese nickel miner-producer Lygend said it would reach full capacity in Phase 1 at about 36,000 tonnes in the second half of 2021 now that its production of MHP has commenced in Indonesia as of May. Tsingshan’s nickel matte production in Indonesia will also commence in the last quarter of this year. The company said it would also adjust its output of nickel matte and nickel pig iron (NPI) based on market demand and prices.

That said, the anticipated fourth-quarter battery-oriented nickel supply from Indonesia is still vulnerable to pandemic disruptions and a strong stainless steel market, market participants said.

“The recent domestic stainless steel market is really bullish,” a precursor material producer in China said. “Therefore, Tsingshan might allocate the production of NPI and nickel matte based on the profit margin of two products, which in return will bring more uncertainties to the battery raw materials supply.”

“The stainless steel market still dominates the nickel market, so we have to consider the increasing consumption from there and how that will impact the nickel supply to the battery supply chain,” a second cathode materials producer in China said.

Fastmarkets assessed the price of nickel pig iron, high-grade NPI content 10-15%, spot, ddp China at 1,400-1,430 yuan per nickel unit on July 30, its highest level since June 2014. The price did drop slightly on August 6 when it was assessed at 1,390-1,430 yuan per tonne.

Elsewhere in the supply chain, some nickel sulfate producers have eyed nickel briquette as an alternative feedstock. It isn’t likely to materially ease the mismatch of nickel supply and demand, however, given the existing and potential options for dissolving nickel briquette as another means of sourcing the material, market participants said.

“Currently the capacity for turning nickel metals into nickel sulfate [makes it] hard to satisfy the robust demand from the EV market,” the second cathode materials producer in China said.

“Given the shortage of MHP/mixed sulphide precipitate (MSP), the faster drawdown in nickel stocks will be a worry for the battery market as the pool of briquette in London Metal Exchange (LME) warehouses acts as a potential source of feedstock for nickel sulfate,” Adams said.

LME nickel stocks were at 205,452 tonnes on August 10, down by 22.32% from 264,474 tonnes on April 20 when the exchange inventories started to fall swiftly.

“Fastmarkets expects the nickel market to be in a supply/demand deficit both this year and next,” Adams said.

Softer LCO demand offsets intermittent cobalt supply disruptions

In the survey, market participants were comparatively less concerned about cobalt supplies, despite the intermittent supply disruptions since late last year due to the logistics bottleneck.

Fastmarkets’ cobalt hydroxide payable indicator, min 30% Co, cif China, was at 88-90% of its standard-grade cobalt price (low-end) on August 11. The payables have been mostly rangebound at this level since May. Yet the force majeure at South African ports, triggered by violence and looting in the country in mid-July, barely incited any price response in the upstream raw material, which is typically mined in the Democratic Republic of Congo and shipped to China out of South Africa.

Downstream consumers broadly cited the weak demand for cobalt in the lithium cobalt oxide (LCO) battery sector since the second quarter of this year as largely offsetting the sporadic spot cobalt feedstock supply constraints.

The performance of LCO batteries, which are mostly used in consumer electronics products, is a crucial barometer for the cobalt market in China. The sector accounts for about 50% of the total cobalt consumption in the country, according to market participants.

Cobalt demand from the LCO battery supply chain has dropped, however, most notably since the start of the second quarter amid semi-conductor chip shortages and resurgent Covid-19 outbreaks in India, one of the world’s biggest consumer electronics manufacturers.

Smartphone shipments in India fell by 13% in the second quarter of 2021 as compared with the prior quarter, according to Canalys. The research institute also noted that global smartphone shipments dropped by 9% month on month in the second quarter, with China – the largest smartphone consumer – showing a 17% quarterly drop.

LCO battery manufacturers in China barely placed any new orders for LCO cathode materials, according to market participants, who expected the weak sentiment to persist in the third quarter and into the fourth.

“Cobalt demand from the LCO battery sector almost halved in the third quarter,” a third cathode materials producer in China said. “There are still many uncertainties regarding whether demand will improve in the fourth quarter.”

“Demand from the consumer electronics sector for LCO batteries has shown no turnaround, and the sluggish situation might last till the end of 2021, which will keep reducing demand for cobalt,” a fourth cathode materials producer in China said.

“The move to ‘work-from-home,’ that came about as companies reinvented how they worked with Covid-19 restrictions, boosted demand for consumer electronics last year,” Adams said, adding that it is not surprising that consumer electronics sales are now weaker. “The semiconductor shortage will also be negatively affecting the production of electronics, and therefore demand for lithium-ion batteries,” he said.

Fastmarkets’ price assessment for cobalt tetroxide 72.6% Co min, delivered China was 290,000-300,000 yuan per tonne on August 11, down 16.90% from this year’s high at 350,000-360,000 yuan per tonne in early March. Cobalt tetroxide is the key raw material in producing LCO batteries.

An increased preference for LFP batteries in EVs since last year has also weakened cobalt demand.

“Cobalt supply will not be that tight in the second half of 2021 compared with other battery raw materials, such as lithium and nickel,” a fifth cathode materials producer in China said. “With the increasing market share of LFP batteries, cobalt demand will be affected.”

Output of LFP batteries in China totaled 37.7 gigawatt hours (GWh) in the first six months of 2021, accounting for 50.5% of total battery production, according to data released by China Association of Automobile Manufacturers (CAAM) in early July.

Fastmarkets’ assessment of the price of cobalt sulfate 20.5% Co basis, exw China stood at 78,000-80,000 yuan per tonne on August 11, down by 17.06% from this year’s high of 94,000-96,500 yuan per tonne on February 26.