By William Adams, head of commodity markets research

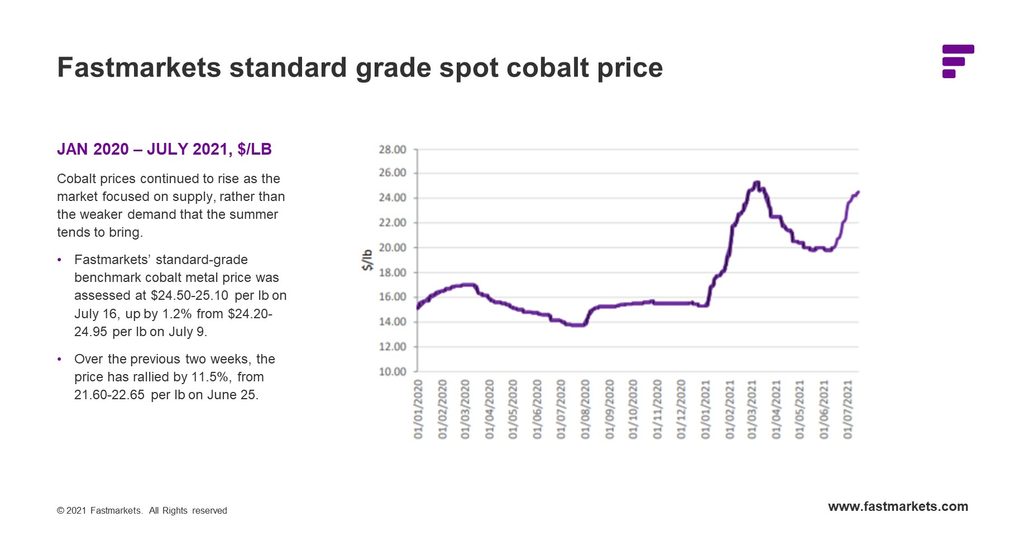

Cobalt prices have continued to rise through July 2021. While earlier buying was thought to be driven by institutional investors, concerns about supply have taken over as the main driver. All eyes in the cobalt market are now on southern Africa and the triple threat of civil unrest, Covid-19 and supply curbs.

1. What if civil unrest in South Africa continues?

South Africa, a major transportation route for cobalt mined in the Democratic Republic of the Congo (DRC), has seen widespread civil unrest in recent weeks. The violence was sparked by the jailing of former South African president Jacob Zuma. Zuma handed himself in to police on Thursday July 8, to begin serving a 15-month sentence, which was handed down in absentia after his refusal to appear in front of a corruption inquiry.

Glencore has described rioting in South Africa as a “force majeure event” in a letter to customers about cobalt and a number of other ores, alloys and metals exported from the country, although this is not a declaration of force majeure. In a notice to customers on Wednesday July 14, seen by Fastmarkets, the trader-miner warned that ongoing violence in South Africa could potentially prevent them from fulfilling contracts with customers.

Glencore’s warning highlights the potential for supply disruptions due to civil unrest.

2. What if a third wave of Covid-19 hits hard?

The Delta variant is on the rise in Africa, fueling a third wave and causing serious illness in young people. The spread of the Delta variant has been described as “unlike anything we have seen so far”, by the World Health Organization’s Africa director, Dr. Matshidiso Moeti.

This adds to the concerns that the third wave of the coronavirus and in particular the Delta variant may impact cobalt mining. While earlier waves of Covid-19 had little impact on mining in the DRC, the Delta variant could be different.

If we see anything like the impact of Covid-19 on South America’s base metals mines in summer 2020, the cobalt industry could be in for a bumpy ride.

3. What if DRC authorities curb supply?

Another factor that could be bullish for the price is if the DRC authorities step in, as is their intention, to buy the cobalt ores produced by artisanal and small-scale miners (ASM). The Entreprise Generale Du Cobalt (EGC) was set up to ensure a responsible sourcing standard, to regulate ASM mining and to buy ASM produced cobalt. Key will be whether the EGC tries to influence prices by holding back material from the market.

At these price levels, we would imagine the state would be more interested in getting the revenue. For now, we do not expect this to get in the way of supply, although bureaucracy may well cause some delays.

Cobalt market responds to volatility

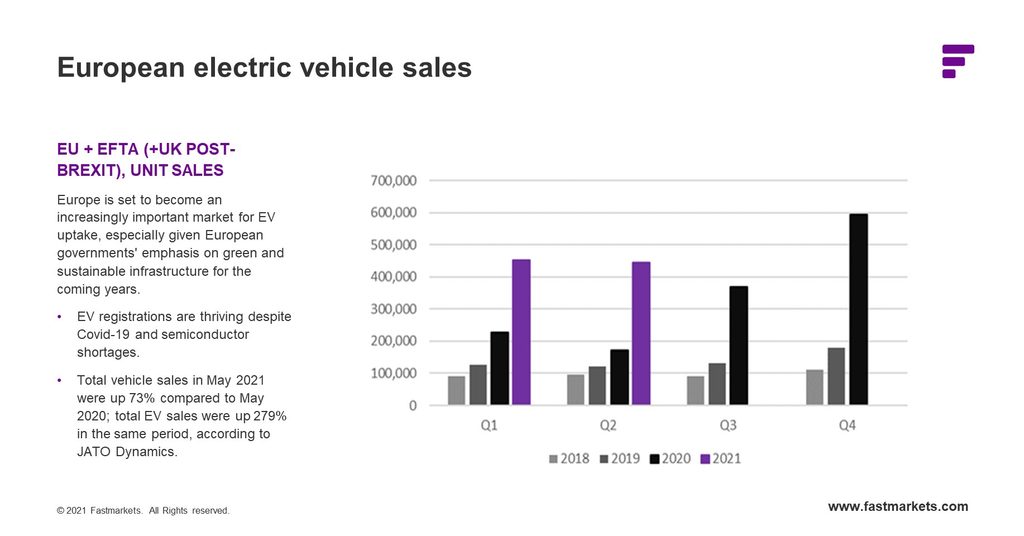

Some cobalt customers are destocking rather than chase the market higher. Following strong NEV data out of China that showed 1.2 million plug-in electric vehicles (EVs) sold in the first half of the year, EU’s EV registrations have also held up well considering the semiconductor shortage. Battery-only EVs (BEV) registrations totaled 210,298 cars and plug-in hybrid (PHEV) totaled 235,730 cars, these were well above 2020 levels, but either side of first-quarter levels, which were 202,410 BEVs and 250,491 PHEVs respectively. For the first half of the year, plug-in EV registrations totaled just short of 900,000 vehicles, see chart. Given Europe’s preference for NCM batteries, the robust numbers bode well for cobalt demand growth.

What’s our forecast for cobalt prices in 2021?

Our base case was for prices to be quiet and only slightly firmer over the summer, but we did say the risk probably lies to the upside should mining, or logistics, be disrupted more by another wave of Covid-19 in southern Africa.

The market is stronger than we expected, but having raised our forecast last week we think we are on target again. Our third quarter forecast is for prices to average $25 per lb; so far, they have averaged $23.94 per lb.

This article is a short extract from our weekly battery raw materials forecast, with news, analysis and price forecasts for lithium, cobalt, graphite, nickel and manganese. It also tracks projects and their impact on future supply. Learn more.