The US ferrous scrap market is experiencing a banner year, marked by the longest upcycle that it had experienced in quite some time with both domestic and international demand levels being strong – especially when compared with a year ago. And with the surge of new US electric arc furnace (EAF) capacity coming online over the next several years, there is optimism that the market will continue to have strength.

“But even though the market has been strong, there continues to be a number of challenges,” including supply chain interruptions and transportation and logistics and labor issues, Joseph Pickard, chief economist and director of commodities for the Institute of Scrap Recycling Industries (ISRI) pointed out.

At the same time, the US ferrous scrap market is going through some fundamental changes, Greg Dixon, chief executive officer of Smart Recycling Management, noted, including the acquisition of several scrap assets – both by larger recycling companies and steel mills looking to secure supply, as well as moves by mills to change their blend of steelmaking inputs. “Because of this, the US scrap industry looks different than it did several years ago – even before the Covid-19 pandemic – and will look even different a few years from now,” he said.

Domestic market

This year it is the domestic steel market that has had the most dominant impact upon US ferrous steel consumption as, according to Frank Goulding, SA Recycling’s Southeast ferrous marketing manager, it has been quite strong virtually for the entire year, except early in the first quarter. Meanwhile, even though US ferrous scrap exports have also been very good overall, they have been somewhat mixed, including an approximate three-month slump in shipments to Turkey, which since – over the past month or so – have started to turn back up.

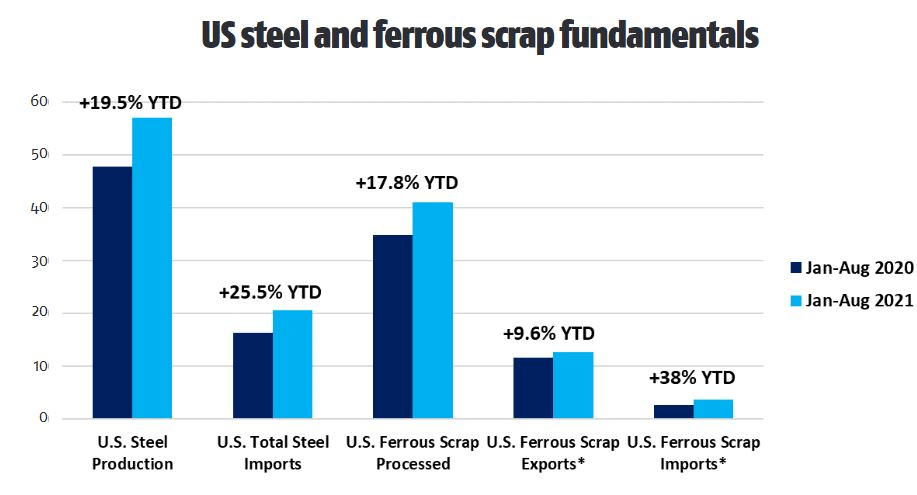

Based upon trends during the first eight months, Christopher Plummer, managing director of Metal Strategies Inc., forecasts that US scrap use by domestic steel mills (EAF and BOFs combined) will be 67.2 million short tons, which would be up by 21.7% compared with 55.2 million tons last year, and even 0.4% higher than the 66.9 million tons that the mills used in 2019 – prior to the pandemic. By comparison, Plummer forecasts that US scrap exports will be up by 12.8% year on year and up by 7.5% from 2019 volumes.

The main driver – at least for the year-on-year increase – has been the recovery in the demand for steel products, which, while not yet completely back to pre-pandemic levels, are coming very close, according to Philip Gibbs, an equity research analyst with KeyBanc Capital Markets, who said that it is also helping that the domestic mills’ scrap inventories had gone very low so they are now needing to replenish their stocks.

Over the past year, US steel mill operating rates had been steadily rising until they started to show some signs of levelling off in recent weeks, peaking at about 85% in mid-October. That, Alexander Kershaw, a senior analyst for Fastmarkets MB, observed, is up from about 50% capacity utilization last year. “And while integrated mills had slowed production, the EAFs (which tend to use much more scrap in their mix than BOFs) have been quicker to return to normal levels or to even go higher,” he said.

While Plummer agrees that the lion’s share of US crude steel output is coming from EAF steelmaking at present, which currently accounts for about 71% of all domestically produced steel, that is not to say that the increase in the US mills’ scrap consumption this year is exclusively coming from that sector.

“The basic oxygen furnace is often overlooked as a user of scrap,” Lourenco Goncalves, Cleveland-Cliffs’ chairman, president and chief executive officer, said during his company’s recent earnings conference call.

He said that Cliffs plans to use more prime scrap (as well as the hot-briquetted iron (HBI) it produces) to stretch the amount of hot metal the company produces without having to build new production capacity. This, he said, is one of the reasons that Cliffs is acquiring Ferrous Processing & Trading Co. (FPT).

ISRI’s Pickard said that, as a rule of thumb, scrap accounts for 90% of the raw material inputs used in EAFs and 15-25% in blast-furnace-based steelmaking.

The ratio also depends on what volumes of alternative iron units are used, such as pig iron, direct reduced iron (DRI) and hot-briquetted iron (HBI), in a given steel plant.

Pickard pointed out that not only has scrap demand been following steel demand upwards as virtually all steel end-use markets – including manufacturing, construction and energy markets – recover from their pandemic lows, but all the EAF mill production capacity additions set to come online over the next few years are expected to result in a similar, massive ramp-up in scrap demand, given that scrap is the EAFs’ major raw material input.

Securing scrap supply

Some new EAF steelmaking capacity has already started to come online, including the doubling of the output at Big River

Steel and the start-up of several rebar and merchant-bar micromills. Plummer said that from last year through 2024, over 20 million tons per year of new, low-cost EAF steelmaking capacity – mostly sheet, but also plate and long-product capacity – will be coming online, further squeezing the already tight US scrap market.

“As a result, US mills have been and will continue to do what they can to secure as much scrap as possible, including acquiring more scrap assets,” Kershaw said.

Even though steelmakers with scrap processing divisions, such as Nucor and Steel Dynamics (SDI), currently have more scrap than they use internally, an important question is where that scrap is located, Plummer point out, maintaining that, for example, SDI recognized early on that in order to feed the new mill being built in Sinton, Texas, they would need to provide scrap supply from sources closer to that site by acquiring scrap companies in Texas and Mexico.

Similarly, Nucor recently announced that it was acquiring two new scrap companies – Grossman Iron and Steel and Garden Street Iron & Metal.

The consolidation of the US scrap industry, however, is not just vertical, but also horizontal, Pickard said, with certain larger scrap processors buying certain smaller operations. “SA Recycling is a great example of that,” Goulding said, noting that it has acquired several companies over the past 18 months, including buying PSC Metals, Southern Recycling LLC, Pirkle Inc. and Metro Alloys Inc. since August. It is not alone in making such moves.

For example, Schnitzer Steel recently acquired Columbus Recycling and Goulding noted that there are several other smaller scrap companies that are “actively on the market.”

Opinions diverge as to whether there is good reason for concerns about the potential for insufficient scrap being available to meet increasing demand. “I don’t think that the steel mills would either build a new plant or expand an existing one without having a strategic plan on how they could source the needed raw materials,” Don Martin, Alter Trading Corp.’s senior vice president for ferrous sales and marketing, said, although he acknowledged that there is a limit to how much scrap is being generated.

Traditionally, obsolete, or industrial, scrap has been the lifeblood of most scrap consumption, especially for steel used in the construction sector, Will May, a senior economist for IHS Market, noted. And Martin said that the current high price of scrap has promoted a lot of demolition jobs. “We are seeing a lot of obsolete scrap coming in,” he said. “Although we don’t know how long that will last given that once those jobs are done they are done.”

Kershaw pointed out that the new US domestic steelmaking capacity is expected to particularly increase demand for busheling and other prime scrap, which has been tight with certain supply chain issues, such as the global shortage of microchips used in automobiles and some other consumer products, affecting the generation of such scrap.

While some of the supply chain issues are starting gradually to improve and there are some signs that steel inventories are beginning to recover, May noted that the generation of prime scrap is not something that can be ramped up or down that easily because it is tied to manufacturing activity. Therefore, he said, it is uncertain whether the needs of the new EAF capacity – much of which is targeting the automotive and other high-quality end-use markets traditionally supplied by integrated mills – can be met by the available prime scrap supply.

“Overall, there will be enough steel raw materials to meet the increased demand – if not prime scrap, then shredded scrap mixed with alternative iron units,” KeyBanc’s Gibbs said. “Which way mills go is based upon an equation that they need to figure out,” based upon the limited supply pool of prime scrap, the availability of other iron units and the price spreads between prime and obsolete scrap, which are currently quite wide, although, according to May, they have recently started to narrow.

He said that this, as well as the fact that merchant pig iron imports have been rising significantly this year, could be an indication of mills’ interest in using alternative iron units and a potential, if only short-term, easing of demand for prime scrap.

But that is not expected to be the case longer term, Gibbs said, given that new EAF mills will demand a higher grade of material. Also, Dixon said that integrated producers are looking to do some “fancy melting”, using more prime scrap to make their blast furnaces more competitive.

International demand

Demand for ferrous scrap is high beyond the US domestic market. Plummer projects that US ferrous scrap exports will move up by 12.8% to their highest level since 2013, following a 4.6% decline last year.

This reflects a recent increase in US exports to Turkey, which is a large importer of ferrous scrap, including about 25% of US scrap exports.

Fastmarkets reported that Turkey had booked 10 cargoes from the US East Coast just in October, after exports had been weaker – albeit marked by its usual month-by-month volatility – earlier this year. Pickard said that year-to-date through August US ferrous scrap exports to Turkey were actually down 25%, even though Turkish steel production was up by 16.7% over the same timeframe, attributing that difference to volatility in the US dollar and Turkish lira exchange rates and logistics issues, resulting in Turkish steelmakers choosing to buy scrap from other locations.

Meanwhile, overall US exports were up 9% year to date, with shipments up 107% to Vietnam and 93% to Mexico. In addition, May said that more US scrap is being exported to some new markets such as India, Pakistan and Taiwan, with the current high steel prices making them willing to buy scrap from further away. Pickard also noted that US ferrous scrap exports to China increased 215% year to date through August, although remaining at very low volumes given how little was exported there last year. He said that with China now being more concerned about its environment, it is looking to increase the use of EAFs and expects consumption of ferrous scrap to climb to 230 million tonnes a year by 2025, but it does not yet have that that much scrap capacity domestically. At present, China is being very selective about the grades it imports, Kershaw said, although that could change over time as the nation’s EAF steelmaking capacity increases. Gibbs said that as China harvests the reservoir of all the steel it has consumed over the past decade, the country could become a net exporter of scrap.

Plummer said that with China’s scrap stockpile likely to grow every year, it is possible that eventually it will have a surplus of obsolete scrap bigger than anywhere else in the world.

An important question is whether the increased US domestic demand for shredded and other obsolete scrap will limit the amount available for export.

“We haven’t seen scrap availability getting that tight yet,” Dixon said, “But we could be on the cusp of that. At some point in time the question of scrap availability will get interesting.”

While this year has been a very positive one for the US ferrous scrap market and scrap companies, with the recovery in demand, higher prices and better flows, Kershaw said that next year, helped by the new EAF steelmaking capacity starting to come online, should be even better, with scrap prices expected to stay quite high at the same time as there is a tightening in the spreads between prime and obsolete scrap and improved prime scrap supply.

This was first published in the November/December 2021 issue of Metal Market Magazine.