While the flash moment for the nickel market came during Asian trading hours on Tuesday March 8, with the three-month nickel price surging by 111% to a peak of more than $101,000 per tonne and forcing a raft of interventions from the London Metal Exchange, a “concerning” situation had been building in the market for some time.

The bourse stepped in to suspend trading at 8:15am GMT on Tuesday, canceled all trades made from 00:00 on that day and ceased the publication of official prices in an effort to restore order to the market.

But the feeling among market participants was that nickel on the LME by this point was the “definition of disorderly,” they told Fastmarkets.

“A storm has been brewing,” one market source said.

“We have been talking for months about the current squeeze on the market. This stems from the dominant positions of a few players doing most of the volumes,” this source said.

While the continuing situation has increased uncertainty around nickel supply, the squeeze had begun much earlier than that.

The three-month nickel price began the year at $21,040 per tonne on January 4 and has steadily risen since then, reaching $22,235 per tonne on January 31 and $24,225 per tonne on February 28 before rising to $29,130 per tonne on March 4.

“The LME has access to every position held and by whom, so this cannot have come as a shock. The signs were on the wall late last week, when the nickel market was around $28,000 [per tonne] and there were suddenly buyers of $35,000, $38,000 and $40,000 call options, which at the time seemed ridiculously out of the money. However, this has been going on for some time and it was obviously no coincidence and the trap was set,” Kingdom Futures director Malcolm Freeman said.

“It is easy to look back, but the warning signs were there. But the issue is were the people looking at the data capable of, firstly, understanding it and, secondly, being able to react quickly enough?” he asked.

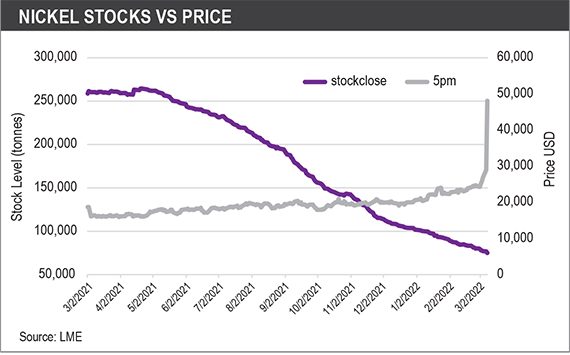

LME stock levels

Stock levels in LME warehouses globally have been declining steadily for close to a year now.

Stocks reached a recent peak of 264,606 tonnes on March 22, 2021, of which 203,778 tonnes was on warrant.

Since then, stock levels have fallen by 71.74% to the current level of 74,778 tonnes, of which 39,330 tonnes is on warrant. This current stock level represents the lowest since 2019.

Off-warrant stocks on the LME also declined, falling by 91.32% to 2,687 tonnes in December – the latest data available – from 30,953 tonnes globally last March.

Throughout this decrease in stocks, significant warrant holding positions have been held by individual parties.

At the point of the peak stock level, one party held 40-49% of warrants. By the start of 2022, two parties held 40-49% of warrants and at the point of the price surge on March 8, two parties held 30-39% of all nickel warrants.

As LME stocks were declining, Fastmarkets’ research team estimates that the global nickel market recorded a deficit of 155,000 tonnes in 2021 following significant disruptions to supply from major mining operations globally.

This tightness is expected to extend into 2022, with Fastmarkets’ research team forecasting a market deficit of 93,000 tonnes.

“Demand has been steady, even through the current high prices,” one trader in Europe told Fastmarkets prior to the price action on March 7-8.

This significant tightness was also reflected in the cash/three-month spread, which has been in persistent backwardation. The cash/three-month spread reached a $720-per-tonne backwardation on March 7, before the LME intervened on March 8.

Russia-Ukraine conflict adds to uncertainty

Russia’s invasion of Ukraine and Western governments’ response with a raft of sanctions has only added to the uncertainty in the market.

“Panic levels across commodity markets have risen alarmingly as the latest escalations in the Russia-Ukraine war have further heightened concerns over supply disruptions,” Fastmarkets’ research analysts said.

There have been growing concerns in the market that if nickel were subject to sanctions, there could be a significant impact on the market, particularly in Europe.

Russia is a key supplier of nickel to the global market, with Fastmarkets’ analysts estimating the country supplies around 6-7% of the global market. But it accounts for an even more significant share of class one products, with 23% of production and 29% of mined nickel sulfide.

Russia’s primary nickel miner, Nornickel, exports 96% of its production, of which 45% is supplied to customers in Europe.

“A conservative estimate would put Russian-origin material at around 50% of the market in Europe,” one trader told Fastmarkets.

With sanctions beginning to disrupt supply chains, and companies reportedly “self-sanctioning” Russian-origin material, nickel premiums in the spot market have begun to increase.

Nickel premiums surged in Europe this week due to the volatility of the price on the LME and growing concerns about the supply situation and Russia.

There were reports of premiums close to $10,000 per tonne on some products while consumers scrambled to secure non-Russian origin material for prompt delivery.

The biggest price increase was seen in the briquette market due to the volatility.

Fastmarkets assessed the nickel briquette premium, in-whs Rotterdam at $700-1,400 per tonne on March 8, nearly four times the $240-300 per tonne on March 1.

Amid this storm of supply tightness, concerns over supply due to the Russian-Ukraine war and a short squeeze, the three-month futures price on the LME more than tripled to its $101,365-per-tonne peak on March 8 from $29,130 per tonne at the close on March 4.

“The biggest worry now is companies and banks looking to finance nickel deals; how are you supposed to operate in this market?” one producer asked.

“The move [by the LME to suspend nickel trading] was, of course, the only course of action; something has gone terribly wrong in the market,” another trader said.

Alice Mason in London contributed to this article.