- Asian Pacific equities were mixed this morning, but major European equity indices were down while they tracked Wednesday’s weakness in US markets

- Gold prices also weaker

Base metals

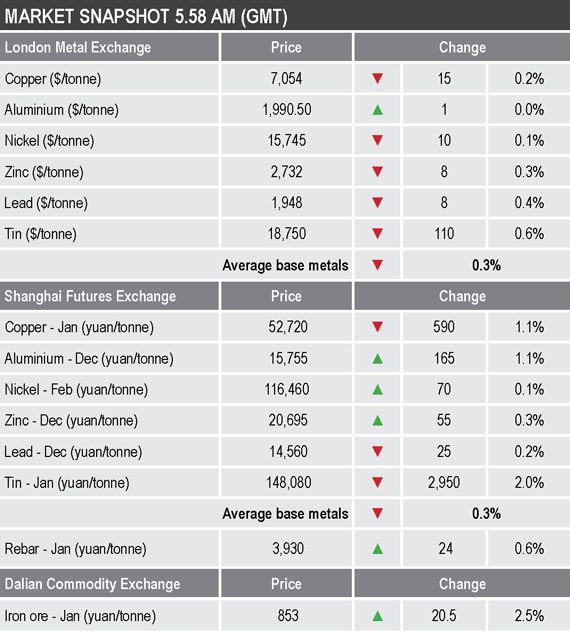

Three-month base metals prices on the London Metal Exchange were mainly weaker, the exception was aluminium that was little changed at $1,990.50 per tonne, while the rest were down by an average of 0.3%, led by a 0.6% fall in tin ($18,750 per tonne), while copper was off by 0.2% at $7,054 per tonne.

The most-traded base metals contracts on the Shanghai Futures Exchange were more polarized with the December aluminium contract up by 1.1%, with February nickel and December zinc up by 0.1% and 0.3% respectively. The rest were weaker, led by a 2% fall in January tin, with December lead down by 0.2% and January copper down by 1.1% at 52,720 yuan ($8,039) per tonne.

Precious metals

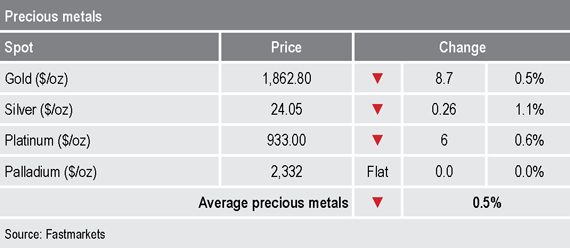

Spot gold prices were down by 0.5% at $1,862.80 per oz, silver was down by 1.1% at $24.05 per oz and platinum was down by 0.6% at $933 per oz, while palladium was unchanged at $2,332 per oz.

Wider markets

The yield on US 10-year treasuries has edged higher, it was recently quoted at 0.86%, this after 0.84% at a similar time on Wednesday.

Asia-Pacific equities were mixed this morning: the ASX 200 (+0.23%), the Kospi (+0.07%), the CSI (+0.65%), the Hang Seng (-0.49%) and the Nikkei (-0.36%).

Currencies

The US dollar index is holding in low ground and was recently quoted at 92.45, this after 92.36 at a similar time on Wednesday – support is between 92.13 and 91.73.

While the dollar is consolidating so are most of the other major currencies: the euro (1.1849), sterling (1.3236) and the Australian dollar (0.7290), while the yen (103.86) is stronger.

Key data

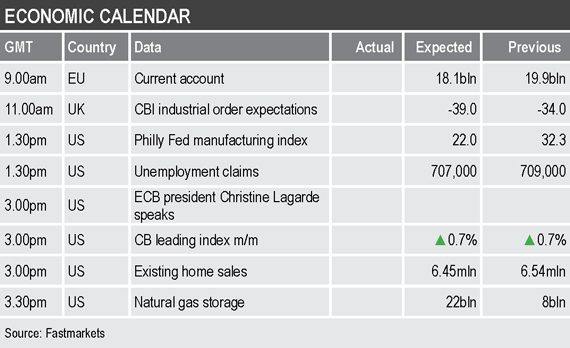

Thursday’s economic agenda contains data on the EU current account, UK industrial order expectations from the Confederation of British Industry and US releases that include the Philly Fed manufacturing index, initial jobless claims, leading indicators, existing home sales and natural gas storage.

In addition, European Central Bank President Christine Lagarde is speaking.

Today’s key themes and views

While the overall upward trends in the base metals continue there does seem to be some hesitation in major equity indices and that we think reflects concern that there will be more near-term economic pain from second-wave lockdowns, before the vaccines can take effect. If equity markets suffer, then that may well spill over into the metals. This is especially so because we are concerned prices may have run ahead of the fundamentals.

Gold is looking vulnerable; prices are back in the sideways-to-down channel that started off the August highs and are not getting much support from the weaker dollar and the strength in other commodities.