Risk-off sentiment eased slightly as Chinese property giant Evergrande said it would pay some of the interest on its bonds, due Thursday, but the market is also on tenterhooks as it waits for signals from the United States Federal Reserve later today at the conclusion of its two-day meeting.

- Aluminium and tin prices look the strongest hits in the base metals complex, driven by supply disruptions.

- Volumes have been considerably higher than usual on Wednesday morning, with 17,900 lots traded as of 6.20 am London time, compared with a normal level of around 6,000 lots at a similar time.

Base metals

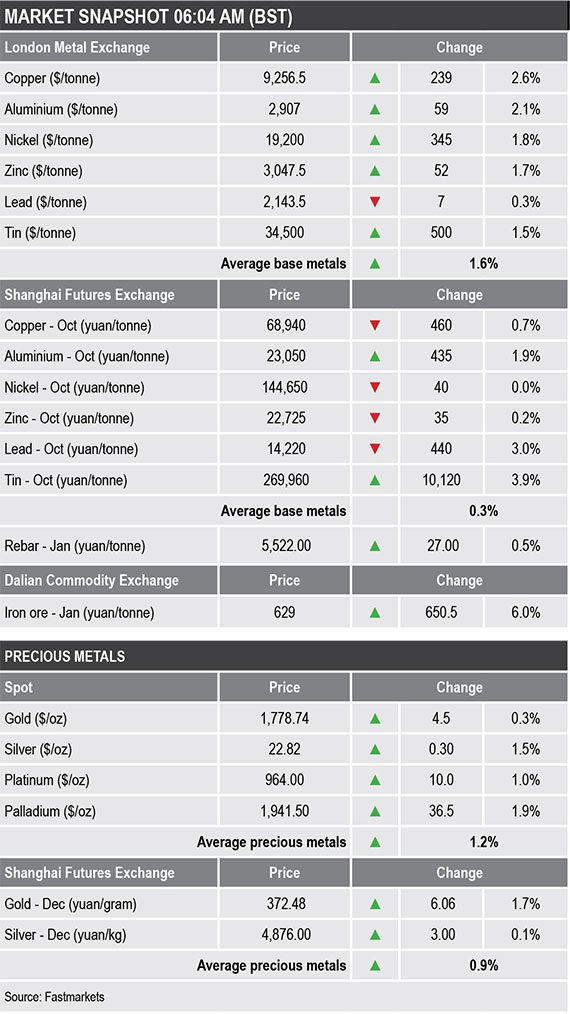

Three-month base metals prices on the LME were mainly firmer this morning, lead was the exception with a 0.3% decline to $2,143.50 per tonne, while the rest were up by an average of 1.9%, led by a 2.6% gain in copper to $9,256.50 per tonne. Bargain hunters once again seem to have taken advantage of the recent price weakness.

The most-active base metals contracts on the Shanghai Futures Exchange were mixed on its reopening after a two-day break, with four metals weaker. The exceptions were October aluminium and October tin, which were up by 1.9% and 3.9% respectively, while the rest were weaker, led by a 3% fall in October lead and a 0.9% drop in October copper that was at 68,940 yuan ($10,655) per tonne. October nickel and zinc were only down slightly.

Precious metals

The precious metals were firmer across the board, up by an average of 1.2%, but the industrial precious metals were leading the way. Spot gold was up by just 0.3% at $1,778.74 per oz.

Wider markets

The yield on United States 10-year treasuries has edged higher and was recently at 1.33%, up from 1.32% on Tuesday.

Asia-Pacific equities were mixed on Wednesday morning: the Nikkei (-0.55%), the Hang Seng (+0.51%), the CSI 300 (-0.68%), the Kospi (closed) and the ASX 200 (+0.37%).

Currencies

The US Dollar Index was edging higher again on Wednesday morning and was recently at 93.28, this compared with 93.18 at a similar time on Tuesday.

With the dollar stronger, the other major currencies were weaker: sterling (1.3647), the euro (1.1719), the Australian dollar (0.7250) and the Japanese yen (109.54).

Key data

Wednesday’s economic agenda contains data on existing home sales and crude oil inventories in the US, but the main focus will be on the data and messages that the Federal Open Market Committee releases this evening.

Wednesday’s key themes and views

We said on September 21 that “overall, we still feel the ‘buy-the-dip’ mentality will prevail” and that is what we seem to have seen so far this morning.

So once again the markets had the opportunity to sell-off more but the appetite does not seem to be there, so the path of least resistance remains sideways-to-up.

A rising tide lifts all boats and that has been the case with gold, prices, which have rebounded along with the rest of the metals despite the stronger dollar. But gold may get jittery again this afternoon, ahead of the Federal Reserve announcements.