- Chinese manufacturing PMI climbed to 52.1 in November, up from 51.4 in October

- Chinese non-manufacturing PMI climbed to 56.41 in November, up from 56.2 in October

Base metals

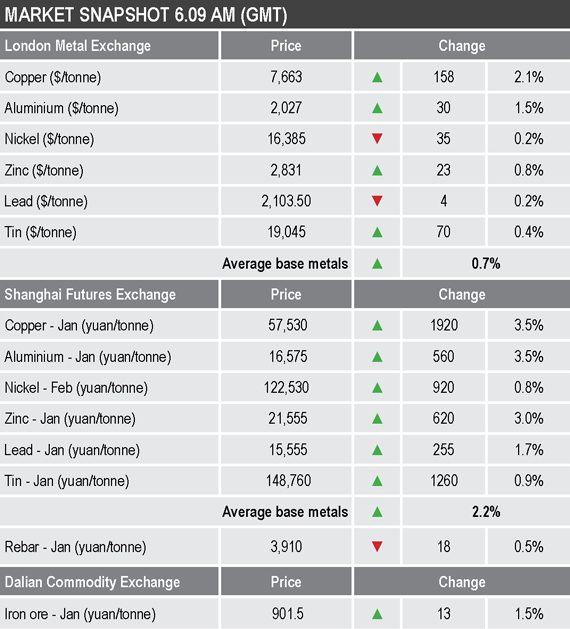

The three-month base metals prices on the London Metal Exchange were mixed, with nickel ($16,385 per tonne) and lead ($2,831 per tonne) prices off by 0.2%, while the rest were up by an average of 1.2% – led by a 2.1% rise in copper ($7,773 per tonne).

Volumes traded on the LME have been extremely high with 18,171 lots traded as of 6.09am London time, with 10,639 lots of copper traded, this compared with more a normal total level of around 6,000 lots at a similar time of day.

The most-traded base metals contracts on the Shanghai Futures Exchange were up across the board this morning, up by an average of 2.2%, with January copper and aluminium leading the way with gains of 3.5%, with the former recently quoted at 57,530 yuan ($8,746) per tonne.

Precious metals

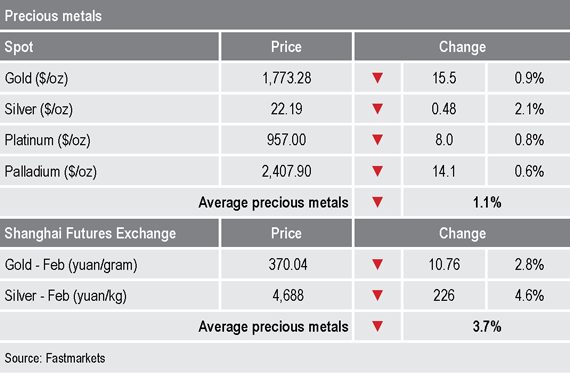

Spot gold prices were trending lower this morning, down by 0.9% at $1,773.28 per oz, with spot silver down by 2.1% at $22.19 per oz. Platinum ($957 per oz) and palladium ($2,407.90 per oz) were down by 0.8% and 0.6% respectively.

Wider markets

The yield on US 10-year treasuries has slipped, it was recently quoted at 0.83%, down from 0.86% at a similar time on Friday.

Asia-Pacific equities were down across the board this morning: the CSI (-0.22%), the Nikkei (-0.79%), the Hang Seng (-1.77%), the Kospi (-1.6%) and the ASX 200 (-1.23%).

Currencies

The US dollar index continues to trend lower; it was recently at 91.75, but was earlier as low as 91.65, thereby support at 91.73, the low from September 1, was breached.

The other major currencies were firmer, in high ground, but below recent highs: the euro (1.1965), the Australian dollar (0.7379), sterling (1.3341 and the yen (103.97).

Key data

In addition to China’s PMI data, as highlighted above, data already out showed Japan’s housing starts declined by 8.3% year on year in October, after a 9.9% decline in September. Data out later includes German, Spanish and Italian consumer prices (CPI) and the United Kingdom’s M4 money supply, mortgage approvals and net lending to individuals.

US data includes Chicago PMI and pending home sales.

In addition, there is an Organization of Petroleum Exporting Countries (OPEC) meeting, a Eurogroup meeting and European Central Bank President Christine Lagarde and UK Monetary Policy Committee member Silvana Tenreyro are scheduled to speak.

Today’s key themes and views

All the base metals on the LME, with the exception of tin, set fresh highs for the year earlier this morning and all the SHFE base metals were showing strong gains too, all of which highlights the strength of sentiment. Early strength does seem to be attracting some selling judging by the overhead tails on today’s candlestick charts, but while momentum is so strong there is little point standing in its way.

Given the strength of sentiment, the positive medium-term outlook and an extremely liquid climate rallies could extend well beyond where value lies. Needless to say we think prices have run ahead of the fundamentals.

Given the bullishness in other markets and strong sentiment, it is not surprising gold has been under pressure. There are still valid longer-term reasons to be bullish for gold, but in the short term the correction may still have further to run.