- The US Dollar Index remains on a back foot

- US 10-year treasury yields were weaker than they were at the start of the weak

Base metals

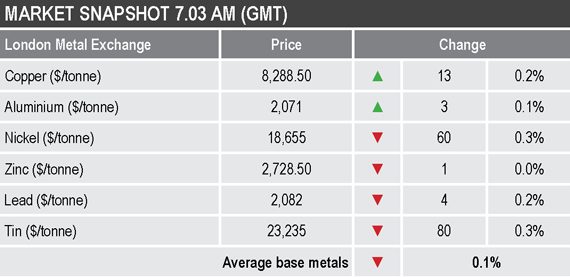

The three-month base metals prices on the LME were mixed this morning but generally consolidating recent gains and in high ground, with zinc and to a lesser extent lead, still some way below recent highs. Copper ($8,288.50 per tonne) was up by 0.2% and aluminium ($2,071 per tonne) was up by 0.1%, zinc was little changed at $2,728.50 per tonne, while the rest were down by around 0.3% – see table below for more details.

Volume has been very low, not surprising with Chinese markets closed, with 1,269 lots traded as at 7.03am London time, compared with a more normal level of around 6,500 lots at similar time of day.

Precious metals

Platinum continues to be the precious metal in the spotlight; it is up by 1.8% at $1,257.20 per oz compared with the previous day’s close and is up by 16.8% since the start of the month. Silver was up by 0.7% this morning at $27.19 per oz, gold was little changed at $1,842.64 per oz and palladium was off by 0.3% at $2,357.20 per oz.

Wider markets

The yield on US 10-year treasuries has edged lower and was recently quoted at 1.14% this morning, down from 1.2% at the start of the weak.

Asian-Pacific equities were mostly closed this morning, of those we follow only the ASX 200 (-0.1%) was open.

Currencies

The US Dollar Index is on a back foot and recently quoted at 90.37, down from its recent high at 91.60 from February 5.

The other major currencies were holding on to recent gains this morning: the euro (1.2126), the yen (104.58), the Australian dollar (0.7745) and sterling (1.3841).

Key data

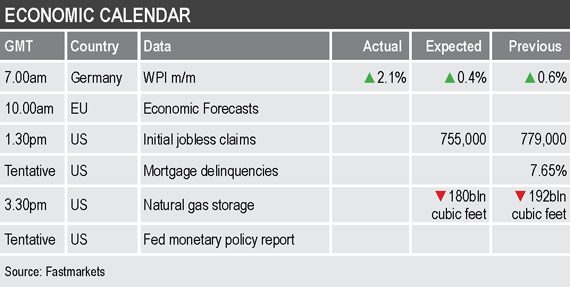

Data already out on Thursday showed German wholesale prices jumped by 2.1% month on month in January, after a 0.6% rise in December.

Out later, there is US data on initial jobless claims, mortgage delinquencies and natural gas storage.

In addition, the European Union will release its economic forecast and the US Federal Reserve will release a monetary policy report.

Today’s key themes and views

The metals continue to look strong but key will be whether they can hold on to the gains, or build on them, with China on holiday. Based on the charts, it looks like most of the metals have broken out to the upside of sideways-to-downward continuation patterns that have lasted varying lengths of time. But with lower liquidity we should expect increased volatility until Chinese participants return to the market.

Gold prices have been rebounding within their sideways-to-down channel, silver and palladium prices are working higher, while platinum is going from strength to strength and is at levels not seen since 2015.