- US consumer price index (CPI) climbed by 0.9% month on month in June, after a 0.6% rise in May

- US 10-year treasury yields rebound to 1.4%, after a low of 1.25% last week

Base metals

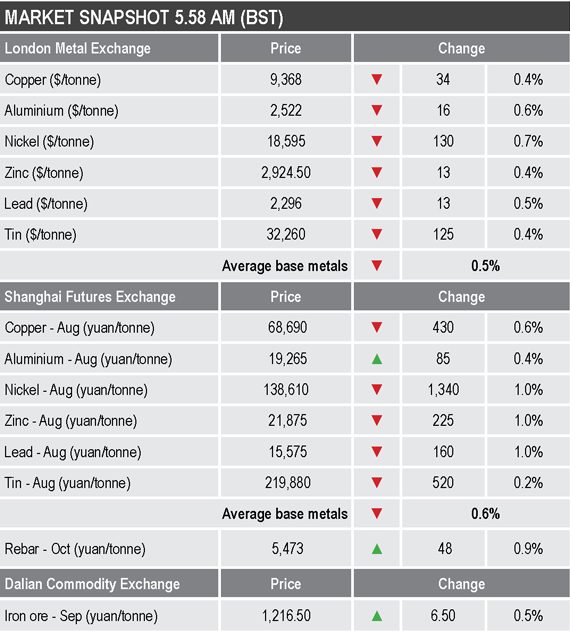

LME three-month base metals prices were down across the board this morning; prices were down by an average of 0.5% and closely bunched with losses ranged between 0.4% and 0.7%. Tin prices did set fresh highs earlier this morning at $32,495 per tonne – the all-time high being $33,600 per tonne from April 2011. Copper was down by 0.4% at $9,368 per tonne.

The most-active base metals contracts on the Shanghai Futures Exchange were for the most part weaker, the exception was August aluminium that was up by 0.4%. The rest were down by an average of 0.8%, with the August contracts of nickel, lead and zinc down by 1%, while August copper was off by 0.6% at 68,690 yuan ($10,617) per tonne.

Precious metals

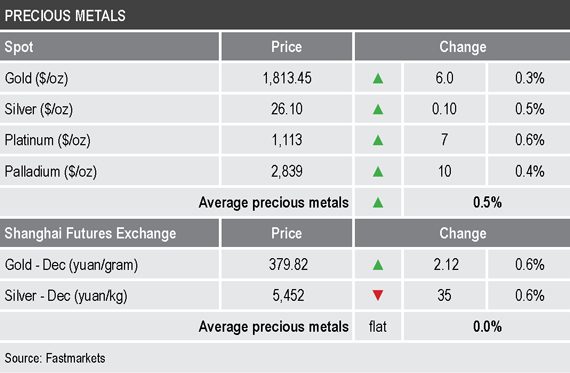

Spot precious metals were up across the board with gains averaging 0.4%; spot gold was up by 0.3% at $1,813.45 per oz.

Wider markets

The yield on US 10-year treasuries was recently at 1.40%, which is down from yesterday’s peak of 1.42%, but up from its recent range either side of 1.30%. The bond market is likely to be nervous today ahead of US Federal Reserve chairman Jerome Powell testifying on the Semi-Annual Monetary Policy report before the US House Financial Services Committee.

Asia-Pacific equities were mainly weaker on Wednesday: the Nikkei (-0.28%), the Kospi (-0.2%), the Hang Seng (-0.59%) and the CSI 300 (-0.59%), while the ASX 200 (+0.42%) bucked the trend.

Currencies

The US Dollar Index remains near its recent highs and was recently at 92.70, up from July 9’s low at 92.07. The recent high was 92.85, seen on July 7.

The euro (1.1789) and the Japanese yen (110.51) are consolidating after recent weakness, while the Australian dollar (0.7460) and sterling (1.3825) are consolidating within recent ranges.

Key data

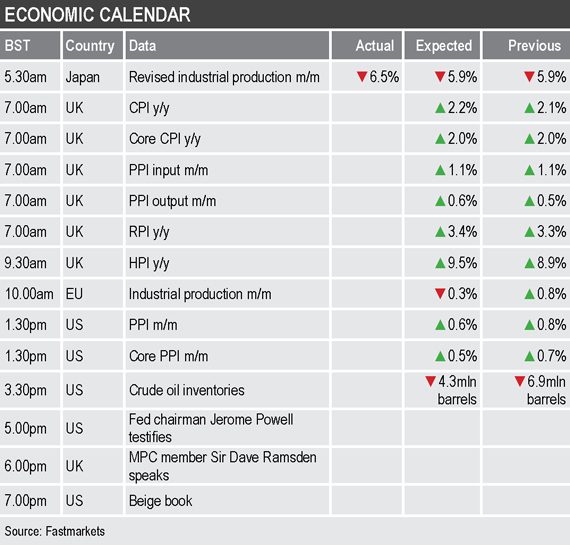

Key economic data already out on Wednesday showed Japan’s revised industrial production fell 6.5% in May, the earlier reading showed a 5.9% fall.

Later there is United Kingdom data consumer (CPI), producer (PPI) retail (RPI) and house (HPI) prices, EU industrial production, US PPI, the Beige Book and crude oil inventories.

In addition, UK Monetary Policy Committee member David Ramsden is scheduled to speak.

Wednesday key themes and views

The metals are consolidating and for the most part look rangebound; copper is struggling to get much lift and remains vulnerable while it maps out a potential head-and-shoulder pattern and zinc is also looking vulnerable, while lead, aluminium and nickel look stronger, and tin is extending gains. It is too early to say whether copper will break lower – it may just be consolidating. With the summer lull upon us, the markets may well remain capped, but tightness and the continuing risk that the spread of the Delta variant of Covid-19 could cause problems for mine supplies and logistics, may well keep prices underpinned.

Gold’s July rebound has run into some resistance – will gold react to increased inflation pressures, or will a stronger dollar and stronger treasury yields create headwinds?