- Chinese equities rebound this morning after last week’s weakness

- US Senate makes progress on $1 trillion infrastructure bill

- China’s official manufacturing purchasing managers’ index (PMI), released over the weekend, eased to 50.4 in July, from 50.9 in June.

- China’s Caixin manufacturing PMI dropped to 50.3 in July, from 51.3 in June

Base metals

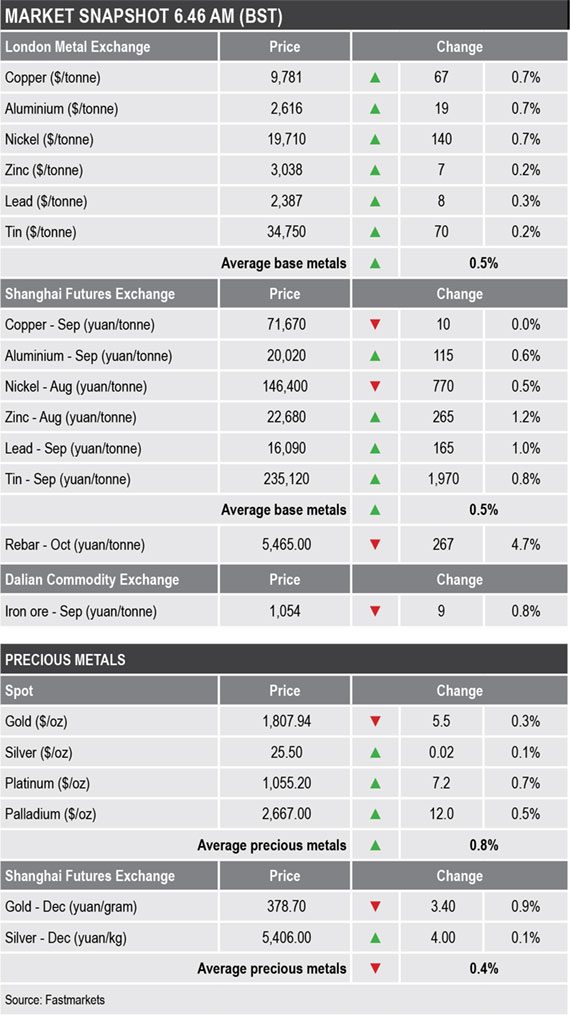

LME three-month base metals prices were up across the board with gains averaging 0.5% – led by 0.7% rises in copper ($9,781 per tonne), aluminium ($2,616 per tonne) and nickel (19,710 per tonne). The rest were up by between 0.2% and 0.3%.

The most-active base metals contracts on the SHFE were mixed; August zinc led on the upside with a 1.2% gain, August nickel led on the downside with a 0.5% loss, copper was little changed at 71,620 yuan ($11,082) per tonne, while the rest were up by an average of 0.8%.

Precious metals

Spot gold prices were down by 0.3% at $1,807.94 per oz, silver was up by 0.1% at $25.50 per oz, while platinum ($1,055.20 per oz) and palladium ($2,667 per oz) were up by 0.7% and 0.5% respectively.

Wider markets

The yield on US 10-year treasuries was at 1.23% this morning, up from Friday’s close at 1.22%.

Asia-Pacific equities were stronger on Monday: the Nikkei (+1.82%), the Kospi (+0.65%), the Hang Seng (+0.92%), the ASX 200 (+1.34%) and the CSI 300 (+2.4%).

Currencies

The US Dollar Index turned lower last week and is consolidating around 92.01, just above Friday’s low of 91.78 and down from the recent peak at 93.19 from July 21.

The major currencies were consolidating this morning, after last week’s stronger moves: the Australian dollar (0.7350), sterling (1.3914), the euro (1.1882) and the Japanese yen (109.66).

Key data

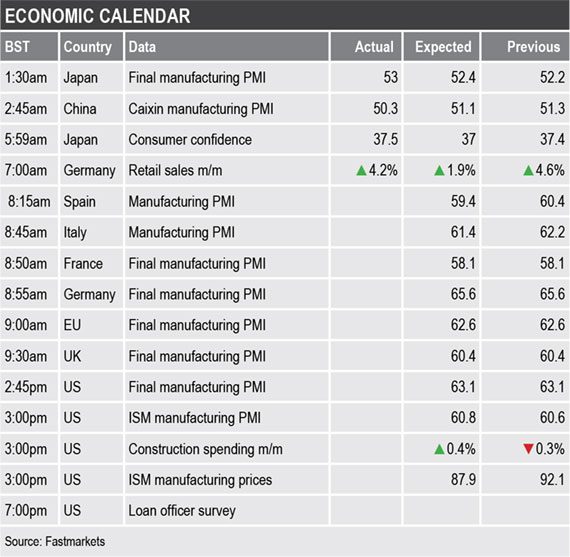

Economic data already out on Monday showed Japan’s final manufacturing PMI climbed to 53 in July, from 52.4 in June, Japan’s consumer confidence climbed to 37.5 in July, from 37.4 in June, and German retail sales climbed by 4.2% month on month in June, after rising 4.6% in May.

Later there manufacturing PMI data out across Europe and in the United States, plus there is US data on construction spending and lending.

Monday’s key themes and views

Most of the base metals are working higher and remain in high ground with aluminium, lead and tin leading the way, but while copper is firm it is still well down from May’s high and this despite news that workers at BHP’s Escondida mine have voted to go on strike. Generally, the fact so far over the summer dips have been well supported and the opportunity to see follow-through weakness has not been taken, suggests sentiment is not bearish – if anything it is starting to look more bullish again.

Gold prices lost upward momentum on Friday, with prices stuck in a sideways range now. With other markets more upbeat and Asian equities rebounding, demand for havens is likely to be weak.