- Asian-Pacific equities generally upbeat, along with pre-market western equity index futures

- US 10-year treasury yields continue to rise, which seems to be underpinning the dollar too

Base metals

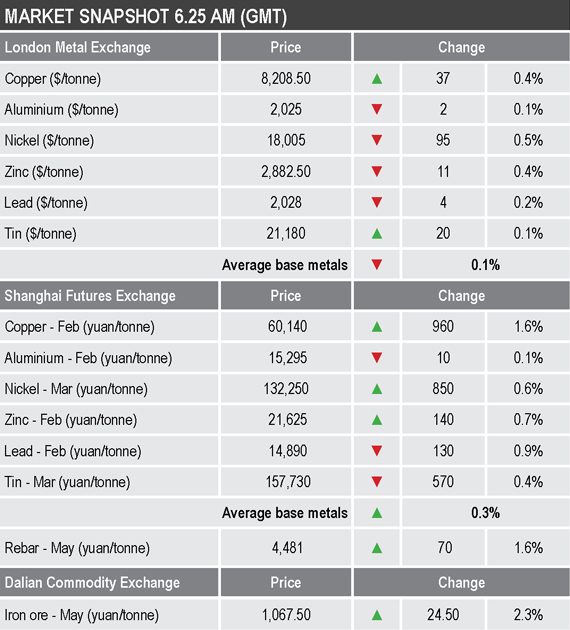

Three-month base metals prices on the London Metal Exchange were mixed with copper ($8,208.50 per tonne) and tin ($21,180 per tonne) up by 0.4% and 0.1% respectively, while the rest of the metals were down by an average of 0.3%, led by a 0.5% fall in nickel ($18,005 per tonne).

The most-traded base metals contracts on the Shanghai Futures Exchange were also split with February aluminium, February lead and March tin down by an average of 0.4%, while March nickel and February zinc were up by 0.6% and 0.7% respectively and February copper was up by 1.6% at 60,140 yuan ($9,296) per tonne.

Precious metals

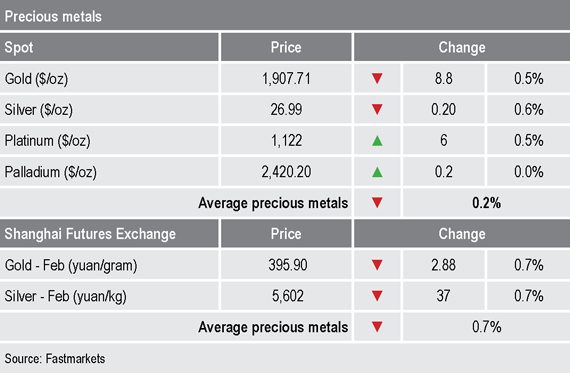

Spot gold ($1,907.71 per oz) and silver ($26.99 per oz) prices were down by 0.5% and 0.6% respectively, while palladium ($2,420.20 per oz) was unchanged and platinum was up by 0.5% at $1,122 per oz.

Wider markets

The yield on US 10-year treasuries was recently quoted at 1.09%, compared with 1.06% at a similar time on Thursday.

Asia Pacific equities were mostly stronger with many at record highs this morning: the ASX 200 (+0.68%), the Nikkei (+2.36%), the Kospi (+3.97%) and the Hang Seng (+1.13%) – the exception was the CSI (-0.54%).

Currencies

Despite the Democratic win in the Senate, the US Dollar Index was firmer this morning and was recently quoted at 89.91, this after a low on Wednesday at 89.62.

The other major currencies have pulled back from recent highs after the dollar has firmed: the euro (1.2250), the Australian dollar (0.7780), sterling (1.3577) and the yen (103.91).

Key data

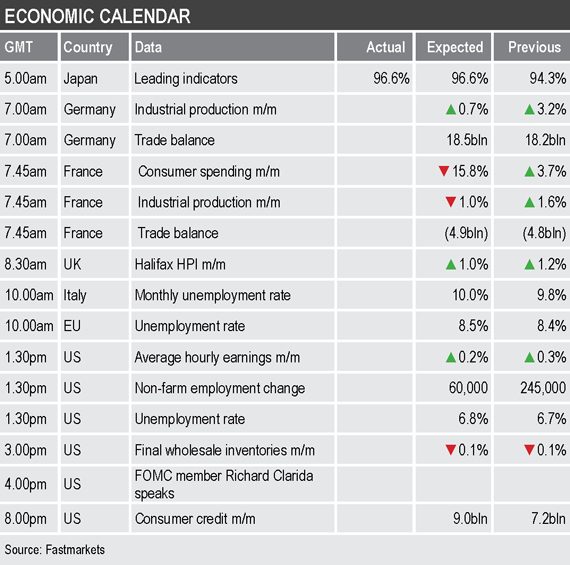

The focal point of Friday’s economic data will be the monthly US employment report. Data out already showed Japan’s leading indicators rose to 96.6% in November from 94.3% in October.

Other key data out later includes German and French industrial production and trade balances, French consumer spending, Italian and EU unemployment rate, with additional US data on wholesale inventories and consumer credit.

In addition, US Federal Open Market Committee (FOMC) member Richard Clarida is scheduled to speak.

Today’s key themes and views

The base metals were off their highs and consolidating this morning, but with the possible exception of aluminium and lead, the trends look strong, while aluminium and lead prices have struggled to get back to the high ground and are looking a bit toppy. While underlying sentiment seems extremely strong you have ask how much more good news can be baked into these price levels, before some profit-taking/consolidation sets in.

As we mentioned on Thursday, while Biden is expected to announce new fiscal stimulus measures, he may well take a firmer stand on trying to rein in the spread of Covid-19, which could lead to more lockdowns and that could hit nearby demand for metals.

With treasury yields, equities and industrial commodities all trending higher and with the stronger yields dragging the dollar up too, it does look as though gold is facing too strong a headwind for now, especially because it has rallied almost $200 per oz over the past six weeks.