- United States 10-year treasury yields continue to trend lower, despite inflationary pressures in the country

Base metals

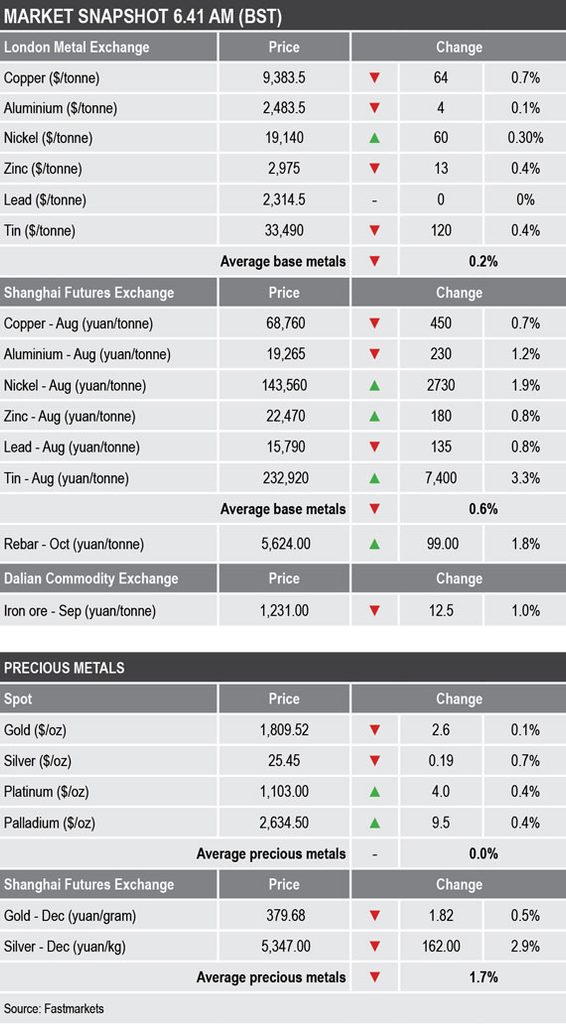

LME three-month base metals prices were mixed this morning, with nickel up by 0.3% at $19,140 per tonne and lead unchanged at $2,314.50 per tonne, while the rest were down by an average of 0.4%, led by a 0.7% fall in copper to $9,383.50 per tonne.

The most-active base metals contracts on the Shanghai Futures Exchange were also mixed and more polarized, with August tin up by 3.3% after tin smelters in China’s Yunnan region received notice to reduce their power usage by 25% following confirmation that more power rationing is being imposed in the region. August nickel was up by 1.9% on the back of concerns that rising Covid-19 cases in Indonesia are prompting partial lockdowns that could affect supplies. August zinc was up by 0.8%, while the August contracts for lead, aluminium and copper were weaker by 0.8%, 1.2% and 0.7% respectively with copper at 68,760 yuan ($10,605) per tonne.

Precious metals

Spot precious metals were mixed with gold down 0.1% to $1,809.50 per oz and silver down 0.7% to $25.45 per oz, while platinum was up 0.4% at $1,103 per oz and palladium up by the same amount at $2,634.50 per oz.

Wider markets

The yield on US 10-year treasuries was recently at 1.29%, having trended lower since July 13 when it climbed to a high of 1.42%. Given the inflation concerns in the US, it is strange the yield is weaker – unless it is showing a pick-up in haven buying?

Asia-Pacific equities were mainly weaker on Monday: the Nikkei (-1.25%), the Kospi (-1%), the Hang Seng (-1.68%) and the ASX 200 (-0.85%), while the CSI 300 (+0.23%) bucked the trend.

Currencies

The US Dollar Index remains near its recent highs and was recently at 92.76, up from July 9’s low of 92.07. The recent high point was 92.85, seen on July 7.

The Australian dollar (0.7380) and sterling (1.3752) were weaker this morning, while the euro (1.1800) and the Japanese yen (109.99) were consolidating.

Key data

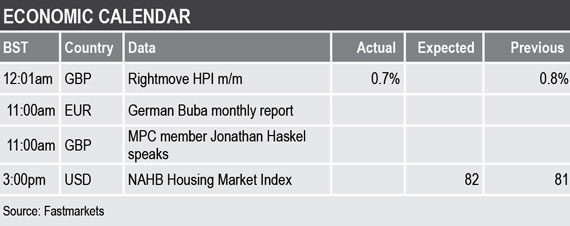

There is no key economic data out on Monday, although there is some UK and US housing data, see table below.

Germany’s Bundesbank will release its monthly report and UK Monetary policy committee member Jonathan Haskel is scheduled to speak.

Monday’s key themes and views

The metals are, for the most part, looking robust and are either holding up in high ground or rallying. The main exception is copper, which is struggling to get much lift and remains vulnerable while it maps out a potential head-and-shoulder pattern. The other metals, however, are looking less vulnerable and with the Delta variant of the coronavirus more likely to affect supply than demand, most should remain supported. As such, it is too early to say whether copper will break lower – it may just be consolidating.

Gold climbed higher last week but has struggled to hold on to gains, which suggests there is not too much haven demand around, despite the weaker US treasury yields. It seems there is some interest in gold as a hedge against inflation, but with equity markets still generally trending higher, the opportunity cost of holding gold remains high.