- Inflation concerns remain elevated, US treasury yields and gold firmer

- United States Federal Reserve officials stick to their view that inflationary pressures will be transitory

- Monday’s data out of China showed some slowing in the economy, but overall it remains strong

Base metals

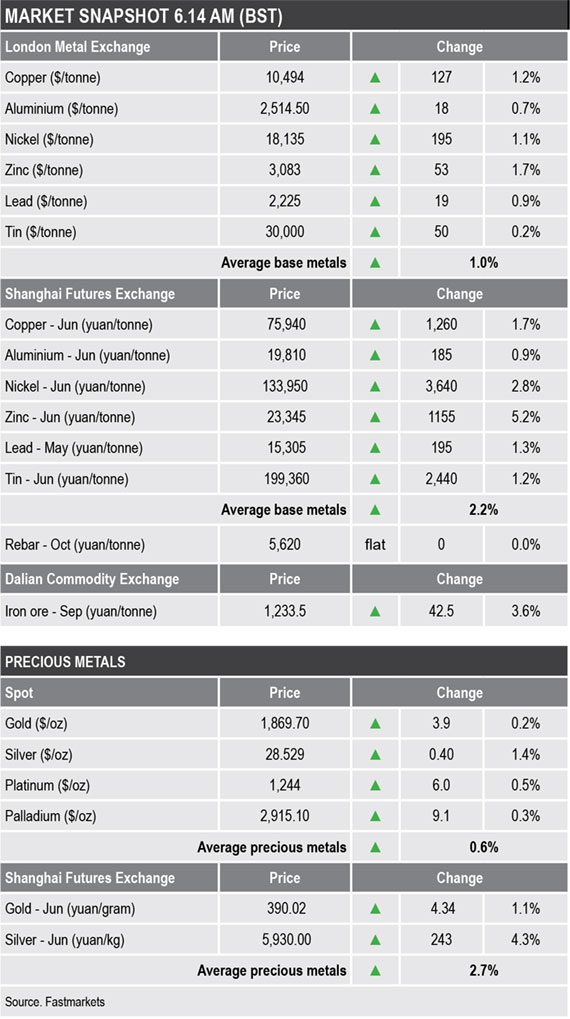

LME three-month base metals prices were up by an average of 1% this morning, led by a 1.7% rise in zinc ($3,083 per tonne), which has been setting new multi-year highs. Copper was up by 1.2% at $10,494 per tonne.

The most-active SHFE base metals contracts were up by an average of 2.2%, led by a 5.2% rise in June zinc, with June nickel up by 2.8% and copper up by 1.7% at 75,940 yuan ($11,791) per tonne.

Precious metals

Precious metals were also up across the board led by a 1.4% rise in silver ($28.53 per oz), with platinum ($1,244 per oz), palladium ($2,915 per oz) and gold ($1,869.70 per oz) up by 0.5%, 0.3% and 0.2% respectively.

Wider markets

The yield on US 10-year treasuries was recently quoted at 1.64%, down from 1.65% at a similar time on Monday.

Asia-Pacific equities were mainly firmer on Tuesday: the ASX 200 (+0.65%), the Nikkei (+2.25%), the Kospi (+1.26%) and the Hang Seng (+1.23%), the exception was the CSI 300 (-0.13%)

Currencies

The US Dollar Index is weakening again and was recently at 90.06, the recent low was 89.98 from May 11, the lows before that were at 89.68 and 89.21 from February and January respectively.

With the dollar weaker, the other major currencies were firmer: the euro (1.2171), sterling (1.4170), the Australian dollar (0.7792) and the yen (109.11).

Key data

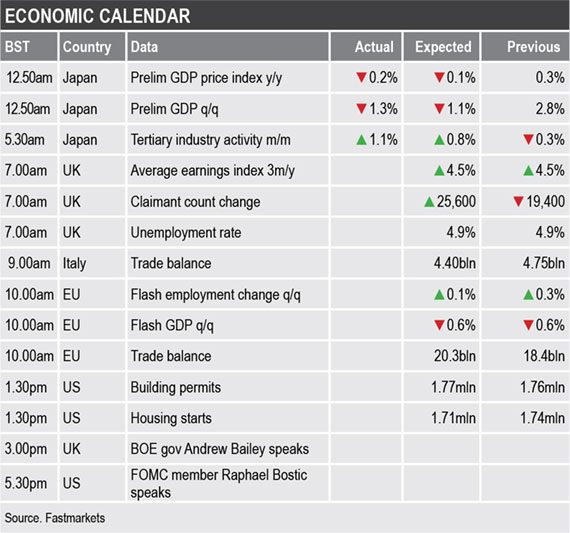

Tuesday’s economic agenda is busy; key data already out showed Japan’s preliminary gross domestic product (GDP) for the first quarter fell by 1.3%, compared with the fourth quarter, while tertiary industrial activity climbed 1.1% in March, compared with a 0.3% fall in February. Later there is data on the employment situation in the United Kingdom and European Union, EU GDP and there is US data on housing starts and building permits.

In addition, Bank of England Governor Andrew Bailey and US Federal Open Market Committee member Raphael Bostic are scheduled to speak.

Today’s key themes and views

The fact last week’s price weakness did not last long and attracted bargain-hunting implies underlying sentiment remains robust. The price pullback provided an excuse for profit-taking but there was limited follow-through selling. These limited pullbacks are very reminiscent of other structural bull runs that we saw in the mid-2000’s super-cycle. But, there is little room for complacency especially if China has its foot on the brake and further waves of the pandemic are starting up in places that have up until now largely had the virus under control, such as Singapore and Taiwan.

Gold’s rally is extending, given there is a lot of stress in the system with overbought asset prices, inflationary fears and concern that the Federal Reserve may be falling behind the curve, perhaps more investors are taking money off the table to put into havens.