There are many cross currents flowing through the markets – the US Covid-19 relief package continues to be delayed, a no-deal Brexit is still a high possibility and US initial jobless claims jumped to a three-month high last week.

At the same time, Covid-19 is spreading at an alarming pace in the United States and Europe but vaccines are already being rolled out in the United Kingdom and the US seems likely to follow shortly, and Europe has agreed a €1.8 trillion ($2.2 billion) budget and post-pandemic recovery package.

- Brent crude oil prices are back above $50 per barrel, a level not seen since March

Base metals

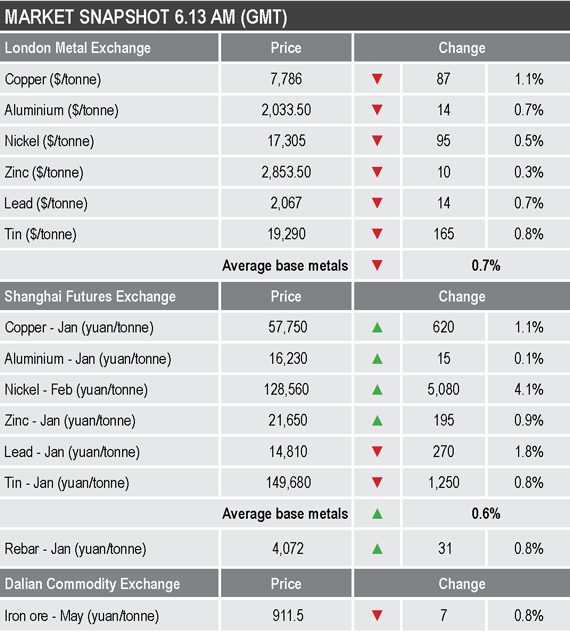

The three-month base metals prices on the LME were down across the board this morning by an average of 0.7%, although earlier in the day all the metals had been in positive territory and at their highs the complex was up by an average of 1%. More recently, copper was down by 1.1% at $7,786 per tonne, having earlier set a fresh high at $7,973.50 per tonne.

Volume traded on the LME has been high with 16,336 lots traded as of 6.13am London time, a more usual volume at a similar time of day is around 5,000-6,000 lots.

The most-traded base metals contracts on the Shanghai Futures Exchange were mixed; the January lead and tin contracts were down by 1.8% and 0.8% respectively, while the rest were up by an average of 1.6%, somewhat skewed by a 4.1% rise in February nickel. The latter’s rise follows a 4.3% increase in the LME nickel price on Thursday. The January copper contract on the SHFE was up by 1.1% at 57,750 yuan ($8,822) per tonne.

Precious metals

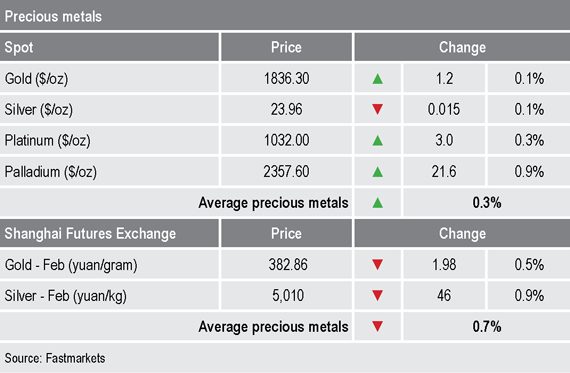

Spot gold prices were slightly firmer this morning, up by 0.1% at $1,836.30 per oz, while silver was down by 0.1% at $23.96 per, but palladium ($2,357.60 per oz) and platinum ($1,032 per oz) were up by 0.9% and 0.3% respectively.

Wider markets

The yield on US 10-year treasuries has eased, it was recently quoted at 0.91%, compared with 0.92% at a similar time on Thursday.

Asia-Pacific equities were mixed this morning: the CSI (-1.11%), the ASX 200 (-0.61%), the Nikkei (-0.39%), the Hang Seng (+0.35%) and the Kospi (+0.86%).

Currencies

The US dollar index was weaker this morning and was recently quoted at 90.64 – the recent low, from December 4, is 90.47.

Most of the other major currencies were strengthening, led by the Australian dollar (0.7567) that is at the highest it has been since June 2018, while the euro (1.2157) is approaching recent highs, the yen (104.01) was firmer, while sterling (1.3321) is weaker.

Key data

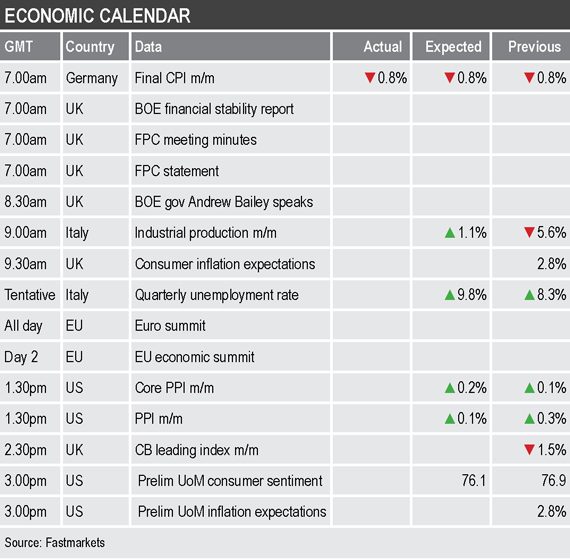

The economic agenda is busy on Friday. Data already out showed German consumer prices fell by 0.8% month on month in November, after a 0.1% rise in October. Later there is data on Italian industrial production and unemployment, UK consumer inflation expectations and leading indicators and US data on producer prices and the University of Michigan readings on consumer sentiment and inflation expectations.

In addition, the Bank of England (BOE) will release a financial stability report, the Financial Policy Committee statement and meeting minutes and BOE Governor Andrew Bailey is scheduled to speak. There is also a European Union economic summit.

Today’s key themes and views

The turnaround in the metals from recent highs to a down day suggests profit-taking ahead of the weekend. We have been saying for some time that we feel prices appear to have run ahead of the fundamentals and that a correction was overdue, but a correction has been elusive. Given overall strong sentiment, strong upward trends, positive medium-term outlooks and an extremely liquid climate, we should get a feel for how bullish sentiment still is, by seeing how far today’s pullback goes.

Gold’s rebound has run out of steam and given the overall positive sentiment in other markets it may struggle to trend higher. The yellow metal failed to get back above $1,900 per oz after it ran out of steam at $1,875 per oz, but has now broken support at $1,840 per oz, so is looking more vulnerable again, especially as this weakness is happening when the dollar is also weak.