This article is an extract from a special report, “The future of China pulp futures”. Get your copy of the 22-page report here.

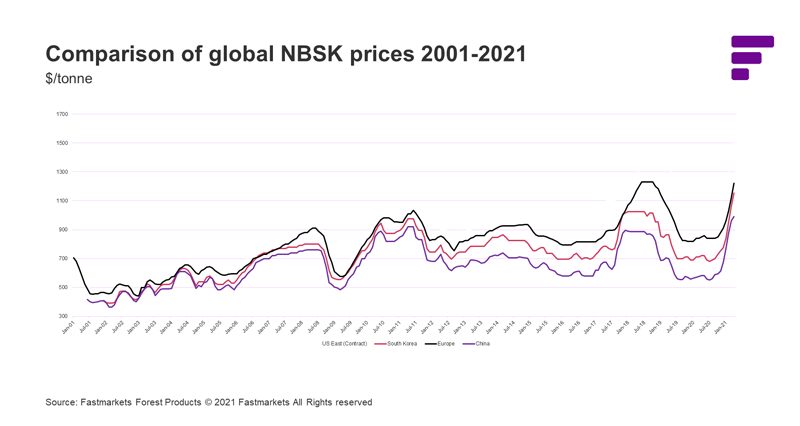

- Key factors in the seemingly continual rise in prices over the past two decades are commodity price inflation and discount inflation for all markets outside of China net prices.

- Annual price volatility currently stands at around 20%, which is comparable with Brent crude and copper.

- The latest rally, which started in late November 2020, is one of the fastest and steepest the pulp market has ever seen.

- China, which accounts for around 38% of market pulp consumption, was the main driver behind the recent rally.

- RISI NBSK cif China assessments are at the highest level in their 20-year history. Prices have risen by nearly 70% year on year to above $,1000 per tonne.

- Other regions are now playing catch-up. North American NBSK prices are also now at record highs and Europe’s are very close.

- There are many fundamental reasons for the surge in prices: demand has picked up from pandemic lows; unexpected downtimes and shipping constraints have hampered supply; stock levels are tighter than in 2020; and there has been a general rally in commodities prices since the start of the year.

What role did futures trading play in the 2021 price rally? The China pulp market experienced one of its fastest and steepest rallies ever in the first few months of 2021, surpassing even that seen in the second half of 2017. This has had a knock-on effect on pulp prices around the globe, with Europe and the US also seeing unprecedented price hikes.

Both supply-side and demand-side fundamentals were strong going into 2021, but soaring futures prices on the Shanghai Futures Exchange drove prices up further and faster than expected. They created additional buying interest from traders, who could afford to pay higher prices in the local import and resale markets as they could sell on the exchange and still make a sizable profit.

High price volatility makes planning difficult

High price volatility creates a challenge for companies when it comes to managing their margins and costs. This is true for both buyers and sellers of pulp.

Pulp futures are here to stay

The incredible success of the SHFE softwood pulp contract has proven the use case for futures in the pulp market. Moving forward, this contract and new offshore contracts focused on industrial players will become an increasingly important part of the global market pulp landscape.

Learn more about pulp prices, the global pulp market and China pulp futures in our special 22-page report, The future of China pulp futures.

What’s inside this report?

- Global pulp market trends and price drivers in 2021 by David Fortin, vice president, International Fiber, Fastmarkets Forest Products

- Understanding SHFE and its impact on physical markets by Nick Chang, managing editor Asia, Fastmarkets Forest Products

- An introduction to NOREXECO’s new China Pulp Futures by Anita Skjong, director market, NOREXECO – The Pulp and Paper Exchange

And much more