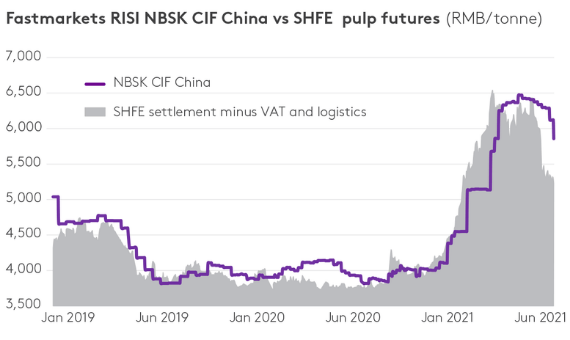

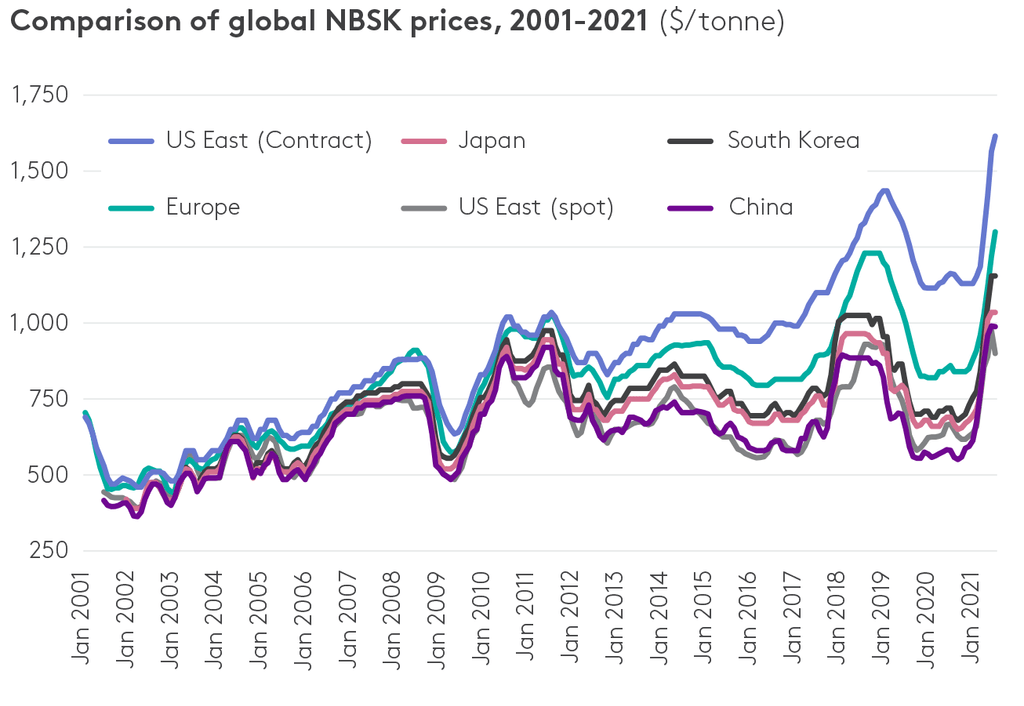

The most recent pulp price rally has been the fastest, steepest the pulp market has ever seen, with NBSK rising by almost 70% in just 6 months. Recently, prices in China have started to roll over. Could this be the start of an equally dramatic fall in prices?

Take a deeper dive with our special 22-page report, The future of China pulp futures. Get your copy here

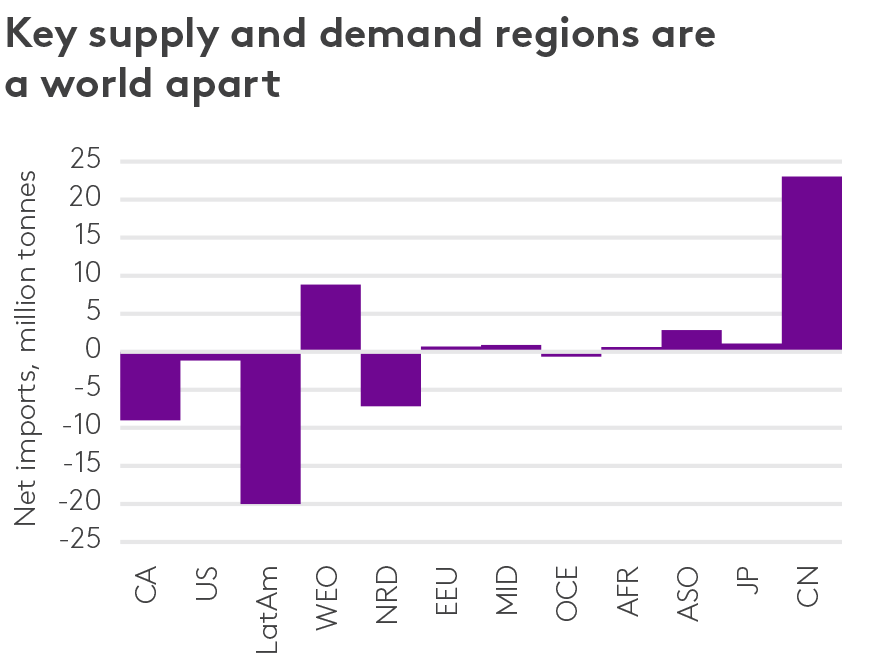

China, which accounts for around 38% of market pulp consumption, was the main driver behind the recent rally.

China, which accounts for around 38% of market pulp consumption, was the main driver behind the recent rally.

Other regions are now playing catch-up. North American NBSK prices are also now at record highs and Europe’s are very close.

There were many fundamental reasons for the surge in prices: demand picked up from pandemic lows; unexpected downtimes and shipping constraints hampered supply; stock levels were tighter than in 2020; and there was general a rally in commodities prices since the start of the year.

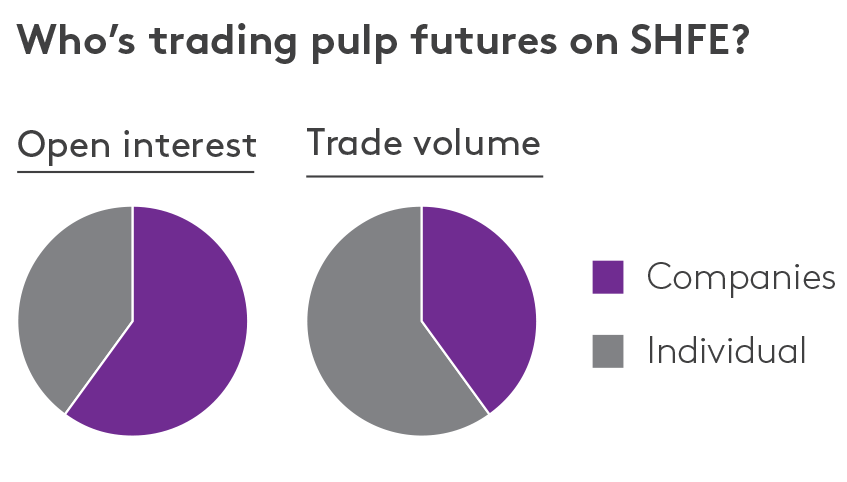

Prices in China are now retreating from record highs. Seasonally weak paper and board demand has combined with oversupply to pull paper and board prices lower. This has resulted in deteriorating margins, and along with China’s commitment to combat speculative pressure in commodity markets has placed strong downward pressure on pulp prices.

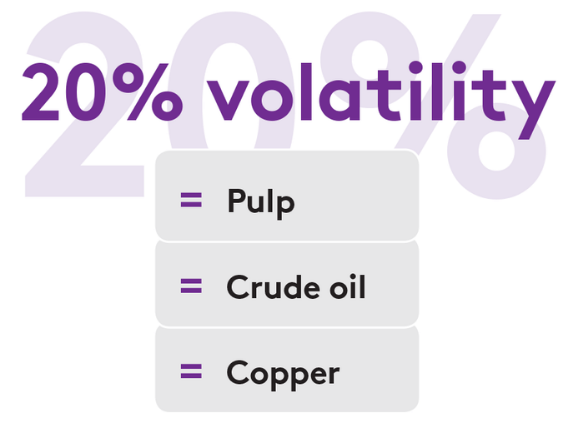

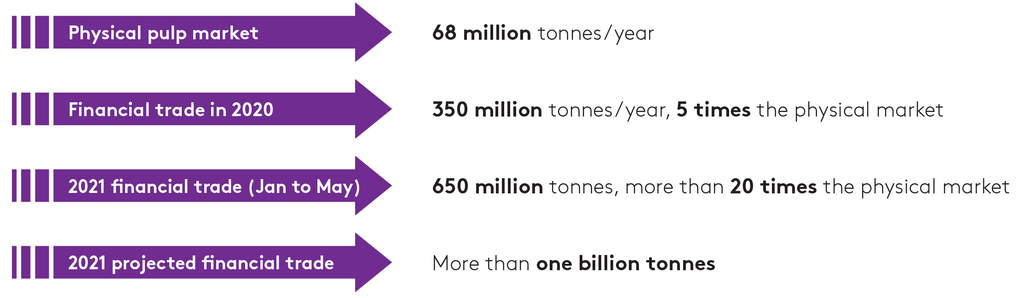

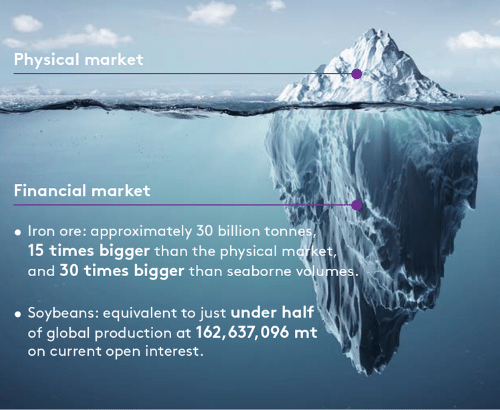

How does pulp compare to other top traded commodities?

Take a deeper dive with our special 22-page report, The future of China pulp futures.

What’s inside?

- Global pulp market trends and price drivers in 2021 by Dave Fortin, vice president, Global Fiber, Fastmarkets Forest Products

- Understanding SHFE and its impact on the physical markets by Nick Chang, managing editor Asia, Fastmarkets forest Products

- An introduction to NOREXECO’s new China Pulp Futures by Anita Skjong, director market, NOREXECO – The Pulp and Paper Exchange

- And much more