- Limited trading activity heard to Turkey again

- US exporters sell to Mexico, India in new deals

- Vietnamese scrap prices down again amid abundant offers

- Chinese scrap prices emerge above Asian competitors

- Taiwan import prices drop again following fresh container sales

- Rare deep-sea bookings undercut containerized prices in India.

Turkey

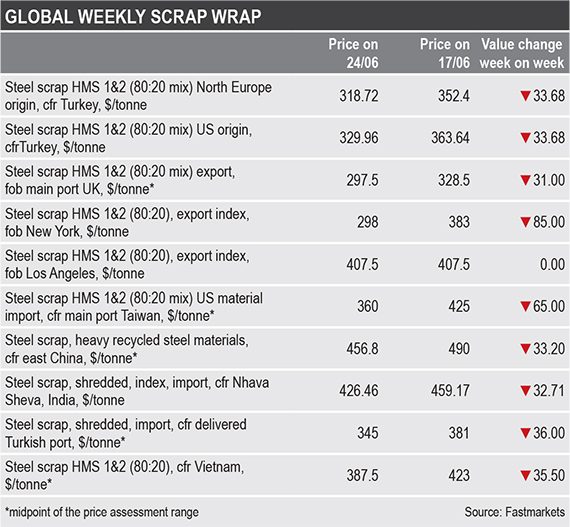

The Turkish steel scrap import market fell again over the past week, following a handful of deals from Europe and the Baltic Sea region, sources told Fastmarkets.

A steelmaker in the Iskenderun region on Friday booked a European cargo of 19,500 tonnes of HMS 1&2 (75:25) and 2,500 tonnes of bonus at an average price of $318 per tonne cfr. The most recent previous transaction was on June 23, when a steel mill in northern Turkey booked a Baltic Sea shipment of HMS 1&2 (90:10) for $335 per tonne cfr.

Weak steel demand overseas led to another drop in Turkish export rebar prices over the week, further softening scrap buy prices in the country, according to market participants.

Pricing history

- Steel scrap HMS 1&2 (80:20 mix), Northern Europe origin, cfr Turkey.

- Steel scrap HMS 1&2 (80:20), US origin, cfr Turkey.

United States

US scrap exporters have been reluctant to strike deals with Turkish importers amid the fall in prices in the Middle Eastern country, so have instead sold bulk cargoes to both India and Mexico over the past week.

Pricing history

- Steel scrap HMS 1&2 (80:20), export index, fob New York.

- Steel scrap, HMS 1&2 (80:20), export index, fob Los Angeles.

Vietnam

Spot import prices of deep-sea scrap into the key market of Vietnam kept falling this week with weaker offer prices heard from both Europe and the US, sources told Fastmarkets.

Pricing history

steel scrap, HMS 1&2 (80:20), cfr Vietnam.

China

Chinese scrap prices have emerged above import levels in most other major Asian markets over the past fortnight, leading to at least one bulk cargo being sold to the country.

Pricing history

- Steel scrap, index, heavy recycled steel materials, cfr north China.

- Steel scrap, index, heavy recycled steel materials, cfr east China,

Taiwan

Buyers in Taiwan secured several US-origin containerized scrap cargoes at $360 per tonne cfr Taiwan on Friday, down sharply from $405-425 per tonne cfr Taiwan late last week, according to sources.

Pricing history

India

Traders expected prices for containerized scrap imports to fall further as a result of cheaper deep-sea bulk bookings from the US and offers from Europe this week.

Pricing history