This year has seen many new circumstances influence the tissue business in a gradually recovering post-pandemic world. On top of soaring raw material prices, logistics problems, such as a lack of containers and escalating freight rates, have multiplied transport costs. More recently, energy supply issues, such as the availability and cost of natural gas, fuel and electricity, have caused headaches for many companies, especially in Europe and China.

| Tissue producers have even been obliged to idle machines and/or mills for good as the rigid nature of tissue product pricing and escalating production and delivery costs have damaged profitability so severely that closure has been a better alternative than continuing to make orders at a loss. |

Measures against climate change are another hot topic, and reducing carbon dioxide emissions is one of the main targets. The European trading system for carbon emission rights has resulted in charges per tonne of carbon dioxide produced rising within a short time from €5 per tonne to €60 per tonne and even more.

High logistics costs could slow foreign trade flows

Will traded volumes decline in the medium term? Who will be the winners and who the losers in these changed business circumstances?

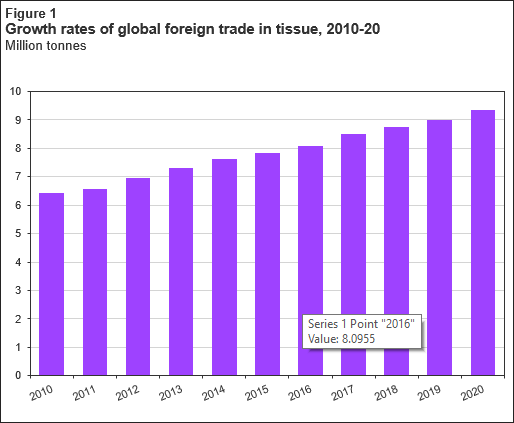

| Global tissue trade shows an average annual growth trend of 3.8% in 2010-20. This is slightly faster than the long-term growth rate of about 3.3% per year of worldwide tissue consumption. |

On average, foreign trade has grown by about 290,000 tonnes per year from 2010 to 2020. Parent roll trade shows even faster growth per year, at almost 5%, with expansion of nearly 10% in some years. Globally, foreign trade in tissue parent rolls and converted products amounted to 9.3 million tonnes, which means that more than one out of every five tonnes of tissue consumed is of foreign origin (trade accounts for 22% of consumption).

Tissue products are mainly shipped from overseas suppliers in standard 40-foot containers on ocean vessels to import harbors and further to either tissue converters (parent rolls) or retailers’ logistic centers. The availability of containers is better in Europe and North America than in Asia, as many more goods are moving from Asia to the big consumer markets in the West than exported from there to Asia.

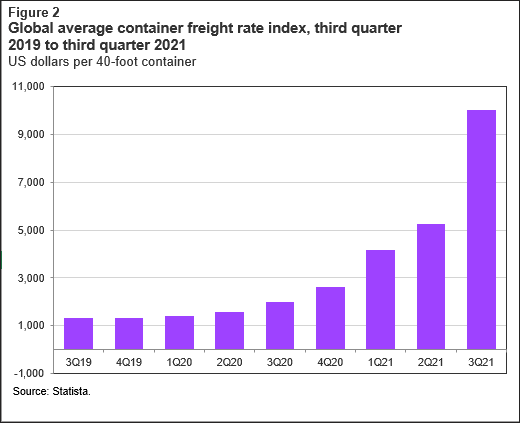

The global container freight rate index for a 40-foot cube, as reported by Statista, has recently skyrocketed. In the second half of 2019, the average rate was rather stable at US$1,325 per container. This price started to move up during 2020 to US$1,415 per container in the first quarter, US$1,560 per container in the second quarter, US$1,985 per container in the third quarter and more than US$2,600 per container in the fourth quarter.

But in 2021, freight rates have soared to US$4,165 per container in the first quarter, and US$5,250 per container in the second quarter. The third quarter average was US$10,000, while the latest available notation from September 2021 approached US$11,000 per container. Tissue products are very bulky and occupy a lot of space in the container. Depending on how the goods are packed – on pallets or cases – and what products are exported – folded poly-packed facial tissue and parent rolls taking less room than household towel rolls – a container could hold 7-14 tonnes of tissue. Pure container costs in September 2021 were 8.5 times higher than in September 2019 and 4.8 times higher than in September 2020. Other items, including harbor fees, handling costs, land transportation, etc. also have to be added to these costs.

Ocean freight rates are increasing tissue costs

It is clear that tissue costs have risen at least US$100 per tonne because of the increase in ocean freights, which does not include escalating manufacturing costs due to high raw material and energy costs. This is pushing prices for overseas imports very high, making them much less unattractive than prior to the pandemic.

After looking at how import and export volumes developed in select major trading countries during the first eight months of this year, results strongly supported expectations that traded volumes of tissue will be lower in 2021 than in 2020. It is unclear if this is due to the hangover effect after a record 2020, the lack and skyrocketing prices of containers, carbon emission charges, or high manufacturing costs. However, it is likely that all of these reasons are contributing to the nosedive in tissue trade volumes.

After examining statistics for the major importers during the first eight months of 2021, import volumes contracted by about 28% in the US, 27% in Australia, 7% in the UK and 4% in Japan. Among the exporting countries, Chinese tissue shipments nosedived by 23%, Indonesian exports by 24% and Italian exports by 10% (seven months only), but Turkish tissue exports gained 2%. It appears that intercontinental trade has suffered more than intraregional trade in the current situation.

High prices can’t last forever, history suggests

Another interesting question is how long freight rates will remain high and container availability remain scarce. Although a quick solution to these problems is not in sight, history has shown that what goes up must come down. If container availability seriously endangers Chinese exports of goods, it is likely that very soon radical measures will be taken and more containers will be built in the country – and the increase in supply will bring the cost per container down. High energy and fuel costs are also causing unrest in many countries, and political decisions for relieving cost pressures may follow.

The measures taken to combat climate change is an obstacle the industry will need to adapt to. Sudden shifts in how to deal with carbon emissions, trade and rights is not expected. The industry has already seen prices for rights multiplying and further increases are planned. This will mean additional cost burdens for tissue shipments and will make large-scale exports less attractive. Tissue companies will need to rethink their business strategies and, as an alternative, build new mills closer to their customers. The ongoing and planned further investments in the United Kingdom are indicating that major changes in the current supply pattern are likely ahead.

Get more insight into the dynamics at play in the forest product market at fastmarkets.com/forestproducts.