Upward pricing pressure for US old corrugated containers (OCC), new double-lined kraft corrugated cuttings (DLK), and mixed paper showed no signs of slowing down, maintaining yearlong pricing increases that improved US OCC’s average further above its 10-year average to $91/ton in February 2024.

Want to know what’s behind your packaging price? Our cutting-edge index builder tool can provide valuable insights into how market volatility affects packaging costs, allowing you to make informed decisions and negotiate better deals. Learn more.

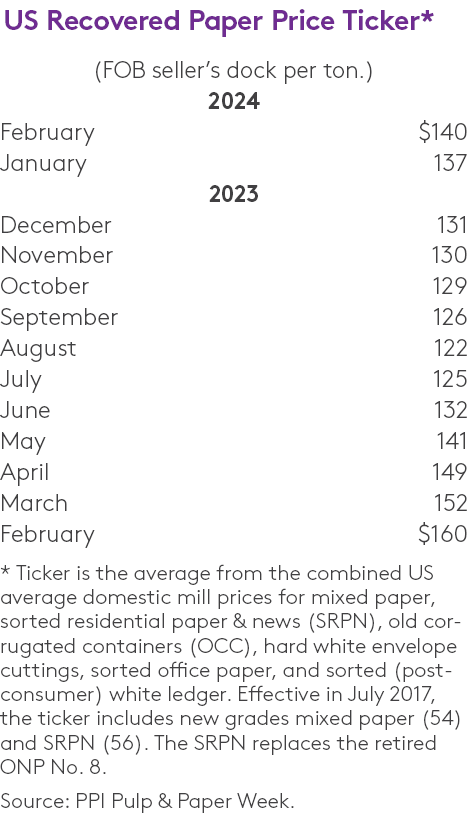

The 10-year average pricing for domestic OCC is $84/ton at the FOB seller’s dock, according to Fastmarkets’ PPI Pulp & Paper Week pricing and data.

The $10-20/ton rises in OCC prices at the FOB seller’s dock for February orders hiked up OCC’s national average this month by $4/ton month-over-month from $87/ton in January. In one year, OCC pricing is up big. Compared with February 2023, when US OCC averaged $33/ton, the $91/ton average this month puts OCC’s average in February 2024 above year-ago average pricing by 176%, or $58/ton.

Seasonal slowdowns in the US recovered fiber generation, exacerbated by winter weather in mid-January, added demand for February tons, causing prices to increase for most domestic grades this month. The frigid temperatures and snowy conditions prevented trucks from moving tons to mills, and forced the temporary shut of some suppliers’ plants and mills’ machines, according to contacts. Further, while mills came out of the holidays with low inventories, contacts in February said the typical post-holiday surge in recovered fiber supplies hardly happened across the US.

Prices for US OCC and DLK progressed for 11 months in a row and improved for a year straight now for mixed paper. Mixed paper averaged $1/ton in February 2023, rising $53/ton in one year to a $54/ton average in February 2024. DLK, at a US average of $110/ton this month, is up 129%, or $62/ton, in one year compared with a US average of $48/ton in February 2023.

Henderson at ‘full production’

At the same time, a new demand existed at the start of 2024 that had yet to materialize by the start of 2023.

This includes five machines with 2.4 million tons/yr of recycled containerboard capacity started up since January: Domtar in Kingsport, TN, ND Paper in Wisconsin at its Biron mill, Cascades in Ashland, VA, Atlantic Packaging in Whitby, ON, and Pratt in Henderson, KY.

Pratt’s Henderson mill, the most recent startup in North America, planned for a “full month of production” in February, contacts said, and stocked up on thousands of tons of OCC and especially mixed paper. Contacts say the PM, once it reaches an appropriate learning curve, would typically run on about two-thirds mixed paper and about one-third OCC furnish.

A major mill contact said domestic containerboard and paper and board mills for February tons were “scrambling for OCC, there’s no doubt about it.”

A supplier said this new demand is directly tied to today’s tight bulk grades market.

“It’s a reflection of how hard it is to get corrugated (with the) 2 million new tons of recycled linerboard capacity,” a supplier said of bulk grades markets in February.

For integrated mills, major mill groups continue to internalize their DLK partly due to short OCC supplies.

“There’s no excess (DLK) right now,” a supplier in the Midwest said.

US actual box shipments hardly increased in the fourth quarter, by 0.4% year-over-year, and full-year actual shipments dropped by 5.0% (compared with actual shipments in 2022), according to Fibre Box Association statistics released on Jan. 26. Asian OCC recovered in the US may also be less today, as China’s exports to the US dropped by 20% last year, and Mexico moved up to become the No. 1 exporter of goods to the US.

Prices up $10-20/ton

OCC prices increased by a range of $10-20/ton at the FOB seller’s dock for February orders, except for the US West Coast, where reduced export prices patted down any domestic pricing rises, according to P&PW’sFeb. 5 pricing survey and market report. In the Pacific Northwest, mills increased their demand for US OCC, yet pricing remained flat at $65-70/ton, buyers and sellers said.

Contacts said the shutter of Sonoco’s Sumner, WA, 42,000-ton capacity uncoated recycled board (URB) mill the first week of February wouldn’t dent the demand-supply condition in this region, as “other PNW mills are more than eager to consume any excess tons,” one contact said.

February pricing rises for OCC put the brown grade’s price in the Northeast region at $95-105/ton, and at $100-110/ton in the Midwest, Southeast, and Southwest regions. In Los Angeles, OCC fell $10/ton to $75-80/ton.

DLK pricing improved along with OCC, increasing DLK in the Northeast to $120-130/ton, and in the Midwest, Southeast, and Southwest to $130-140/ton. In Los Angeles, DLK pricing declined to $85-90/ton, and held unchanged at $80-85/ton month-over-month in the Pacific Northwest.

Supplies of mixed paper remain tight as well. Prices for mixed paper increased by $10-15/ton at the FOB seller’s dock, raising mixed paper’s pricing to $55-60/ton in the Northeast, to $65-70/ton in the Midwest, and to $60-65/ton in the Southeast and Southwest regions. Pricing fell in Los Angeles to $40-45/ton, and in San Francisco to $30-35/ton, while holding steady in the Pacific Northwest at $40-45/ton. Mixed paper’s premium is $20-30/ton in most regions, contacts told P&PW.

“Mixed is strong,” a seller in the Midwest said. “Every mill that can use mixed is looking for it.”

No. 56 sorted residential papers and news (SRPN) prices also added $10-15/ton. Mills said they struggled to find enough No. 56, and “clean” SRPN found homes at higher prices. The Southeast region reported that SRPN was especially hard to find as some suppliers aren’t paying labor to sort out this grade.

SCN up $10/ton

Buying picked up for No. 58 sorted clean news (SCN) for February orders, hiking up SCN’s price this month by $10/ton in most US regions, except for a hold in the Pacific Northwest. Buyers and sellers said insulators had strong demand for SCN.

Some buyers turned away from SCN early last year when prices shot up with demand vs short supplies in mid-2022. The elevated prices caused cost-savvy mill buyers to seek alternative grades, and insulators and molded pulp producers are buying more DLK and boxboard cuttings, as well as some coated groundwood sections (CGS), among others. For mills that shied away from SCN, they confirmed that they are sticking with their new furnish recipes that have replaced SCN for these alternative grades so as to avoid the high-priced SCN.

At a $158/ton US average in February, SCN’s pricing is 17.7%, or $34/ton, below a $192/ton US average in February 2023. SCN prices reached $193/ton US average in July 2022, and held firm at those prices until one year ago when SCN’s pricing declines began, falling by $1/ton to the $192/ton one year ago in February 2023.

Groundwood grades overall faced improved demand against short supplies. Buyers and sellers said softer CGS and old magazine supplies met more buyers in February. The added demand for CGS boosted prices for the second straight month. CGS prices increased by $5/ton in most US regions, increasing the US average to $81/ton, a rise in two months by $8/ton from December’s $73/ton US average.

“Some of that (CGS) does make its way to the molded pulp stream, and some to the insulators,” a supplier contact said.