- Bullish sentiment and high offer prices push China’s battery-grade lithium carbonate assessment up again.

- China’s industrial-grade lithium carbonate prices also moved up on tight supply.

- Asian battery-grade lithium spot market remained rangebound but with a negative bias, particularly for hydroxide.

- Europe and US lithium hydroxide market dipped on bearish demand sentiment.

Bullish offers from Chinese battery-grade lithium carbonate producers continued to drive the upward price momentum in the domestic market. Producers cited tight spot supply and a positive outlook as reasons for their high offers.

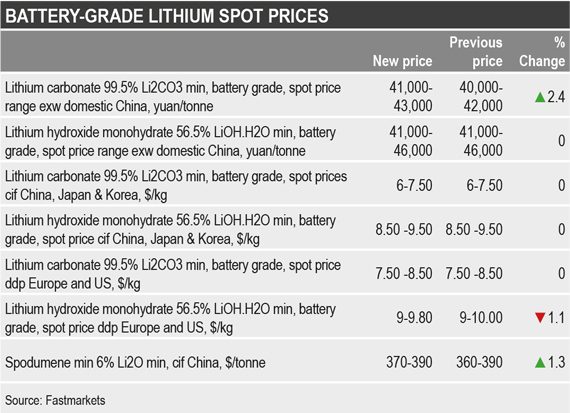

Fastmarkets’ weekly assessment for the lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price range exw domestic China was 41,000-43,000 yuan ($6,232-6,536) per tonne on Thursday, up from 40,000-42,000 yuan per tonne in the previous week.

“We still see continuous demand from the downstream sector, and I think lithium prices will be higher next year as its raw material spodumene supply is expected to become a little tight which might keep pushing lithium prices higher,” a producer said.

The monthly spodumene min 6% Li2O, cif China assessment moved up to $370-390 per tonne on Wednesday November 25 from $360-390 per tonne in October. Market participants said cheaper materials were hard to acquire and higher offers of above $400 per tonne were becoming more prevalent in November following rising lithium carbonate prices and bullish sentiment for next year alongside increased customers inquires. Most deals within this month were still below $400 per tonne.

Meanwhile, buyers said they were finding it increasingly difficult to acquire material below the new range.

“This week it is harder to acquire cheaper materials on spot market; I purchased small quantities of materials from our supplier at prices of 43,000 yuan per tonne, and I heard some deals at even higher at 44,000 yuan per tonne. But I have not seen many deals at 45,000 yuan per tonne so far,” a buyer told Fastmarkets.

“I can still receive offer of 43,000 yuan per tonne for battery-grade lithium carbonate from some suppliers, and I think current mainstream prices are in the range of 41,000-43,000 yuan per tonne. I haven’t made new purchase this week as still having materials on hand,” a second buyer told Fastmarkets.

China’s technical and industrial grade lithium carbonate market also edge up further this year due to tight supply, and most offer prices stayed high at around 38,000-40,000 yuan per tonne this week.

Fastmarkets assessed the Chinese technical and industrial grade lithium carbonate spot price at 36,000-37,000 yuan per tonne on Thursday. The weekly assessment has risen from 35,000-36,000 yuan per tonne on November 19.

In contrast to carbonate, the battery-grade lithium hydroxide market held at the current range due to slow downstream buying activities this week.

Fastmarkets’ lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery grade, spot price range exw domestic China stood at 41,000-46,000 yuan per tonne on Thursday, unchanged from the previous week.

Pressure in Asian seaborne hydroxide

The cif China, Japan and Korea battery-grade lithium spot markets were flat week on week with thin spot activities. But the battery-grade hydroxide participants reported increasing pressure from buyers attempting to press down prices due to a softer domestic Chinese price.

Fastmarkets assessed the lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price cif China, Japan and Korea at $6-7.50 per kg on Thursday, unchanged since mid-September.

The lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery grade, spot price, cif China, Japan and Korea stood at $8.50-9.50 per kg on Thursday, also static since mid-September.

“Some customers are trying to push down the seaborne hydroxide prices to a level that is closer to China’s domestic price, and this brings more pressure on hydroxide in seaborne Asia than on carbonate,” a second Asia-based producer said.

Weaker global sentiment weighs in Europe, US

The Europe, US battery-grade lithium hydroxide spot price moved down by 1.1% over the past seven days amid weaker global sentiment, with sources agreeing that spot prices around $10 per kg are hardly achievable across the lithium complex in the current demand-supply picture.

The remaining lithium spot assessments in Europe and the US remained unchanged in the week to November 26, with sources agreeing on current pricing levels.

Fastmarkets assessed the lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price ddp Europe and US on Thursday at $9-9.80 per kg, down $0.20 per kg or 1.1% on the top end from $9-10 per kg a week ago, a level it held for the previous six weeks.

Elsewhere, the carbonate technical and battery-grade lithium spot markets remained unchanged although sources agreed that upward price pressure stemming from the more active Chinese spot market will likely filter through in the near term.

Fastmarkets assessed the lithium carbonate 99.5% Li2CO3 min, battery grade, spot price ddp Europe and US at $7.50-8.50 per kg on Thursday, unchanged for seven consecutive weeks after narrowing down from $7.50-8.80 per kg at the beginning of October.

Fastmarkets assessed the lithium carbonate 99% Li2CO3 min, technical and industrial grades, spot price ddp Europe and US at $5.80-7 per kg on Thursday, unchanged for 11 consecutive sessions.

“Material [lithium carbonate technical grade] sourced from China is appreciating for Europe delivery, the trend is upward,” a source active in the upstream market told Fastmarkets.

“Prices [for technical-grade lithium carbonate] cif Europe from China are increasing by around $100 per tonne due to increased freight costs and higher offers from producers. We received an offer cif Europe at $6,250 per tonne but big consumers are trying to close contracts with non-Chinese producers at prices lower than that,” a distributor active in Europe told Fastmarkets.

Learn more about Fastmarkets’ lithium pricing methodology here and read the latest lithium price spotlight here.

Fastmarkets’ trade log for battery-grade lithium carbonate in China for November includes all trades, bids and offers reported to Fastmarkets.

All lithium carbonate, hydroxide and spodumene prices are available in our Battery Raw Materials Market Tracker. Get a sample of the report here.