- Battery-grade lithium hydroxide prices in both domestic Chinese and seaborne Asian markets were underpinned by robust demand.

- Battery-grade lithium carbonate price in China was flat, although concerns persisted over increased supply.

- Europe, US spot lithium complex underpinned by tight availability, shipping delays.

The battery-grade lithium hydroxide price in the seaborne Asian market resumed its upward trajectory after two weeks’ stability since mid-May.

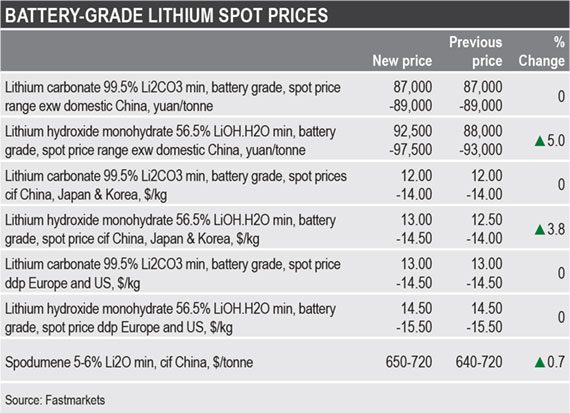

Fastmarkets’ weekly price assessment for lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price cif China, Japan & Korea rose to $13.00-14.50 per kg on Thursday, up by 3.77% from $12.50-14 per kg one week ago.

Global lithium hydroxide supply remains tight with upstream feedstock tightness hurting China’s ambitions for lithium chemical operation ramp-ups.

Fastmarkets’ assessment for spodumene min 6% Li2O, cif China edged higher to $650-720 per tonne on May 26, up by 0.74% from $640-720 per tonne one month ago.

On top of that, market participants hold an optimistic demand outlook for nickel-cobalt-manganese (NCM) lithium-ion batteries, especially those for nickel-rich types that feed on lithium hydroxide and they believe China’s demand strength has also been a critical driver.

China continued to lead the momentum for lithium hydroxide prices in Asia, with security of units remained a problem for some consumers.

Fastmarkets’ weekly assessment for the lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery grade, spot price range, exw domestic China nudged higher to 92,500-97,500 yuan ($14,446-15,227) per tonne on June 3, up by 4.97% from 88,000-93,000 yuan per tonne previously.

“All leading cathode materials producers in China are operating at full capacities,” a consumer told Fastmarkets. “Robust demand from the electric vehicle [EV] battery sector has continued to filter to the upstream value chain.”

NCM 811 (Ni:Co:Mn:8:1:1) cathode production in China is expected to increase to 30% this year from 20% last year, according to Vicky Zhao, senior analyst of Fastmarkets’ battery raw materials research team.

“For the majority of consumers like us, security of lithium hydroxide is the priority,” the same consumer said. “It is not about prices anymore.”

Lithium carbonate prices in Asia remained unchanged, however, and some market participants are still wary of a short-term correction due to the seasonal increase in production in Qinghai province in China.

Fastmarkets’ weekly price assessment for lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price, cif China, Japan and Korea was flat at $12-14 per kg on June 3. The corresponding assessment in the domestic Chinese market was unchanged week on week at 87,000-89,000 yuan per tonne on the same day.

“Seasonal increase of operations in Qinghai province is easing the previous supply tightness of lithium carbonate in China over the winter,” a trader said. “That is resulting in a widening gap between lithium hydroxide and carbonate for now.”

The output for technical-grade lithium carbonate produced from brine in salt lake areas, such as Qinghai province, is higher in the summer as opposed to winter when salt lakes are frozen.

Battery-grade lithium hydroxide in China was traded at a premium of 7,000 yuan per tonne over the equivalent grade of lithium carbonate on June 3, while both chemical prices were almost at parity on May 20, according to Fastmarkets’ data.

Europe, US spot lithium complex underpinned

Prices in Europe and the United States continued to be supported by tight availability of technical-grade compounds and exacerbated by logistics disruption due to a lack of container space availability, sources said.

“It is really challenging in logistics right now with the misplacement of containers affecting shipments… We are facing delays but in our particular case we are not that much affected as we have inventories abroad,” a lithium producer active in Europe and Asia said.

“This has created some opportunities in the market for us and it has benefited the spot market as people are trying to react to this reality and trying to secure material. However, lithium prices went up for fundamental reasons rather than this transitory impact,” the same producer said.

Fastmarkets’ weekly assessment of the lithium carbonate, 99% Li2CO3 min, technical and industrial grades, spot price, ddp Europe and US was $12.50-14.00 per kg on June 3, up around 1.9% week on week from $12.50-13.50 per kg on May 27 and posting a fourth consecutive weekly increase.

On the other hand, the battery-grade compounds remained steady in Europe over the past week following previous increases.

Fastmarkets’ latest assessment of the lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price, ddp Europe and US was $13.00-14.50 per kg on Thursday, unchanged for two consecutive weeks but up by 3.8% from $12.50-14.00 per kg on May 20.

Learn more about Fastmarkets’ lithium pricing methodology here and read the latest lithium price spotlight here.